The NAIC’s Capital Markets Bureau monitors developments in the capital markets globally and analyzes their

potential impact on the investment portfolios of U.S. insurance companies. Please see the Capital Markets Bureau

website at INDEX.

Leveraged Bank Loans Primer

Analyst: Jennifer Johnson

Executive Summary

What Are Leveraged Bank Loans?

FitchRatings

1

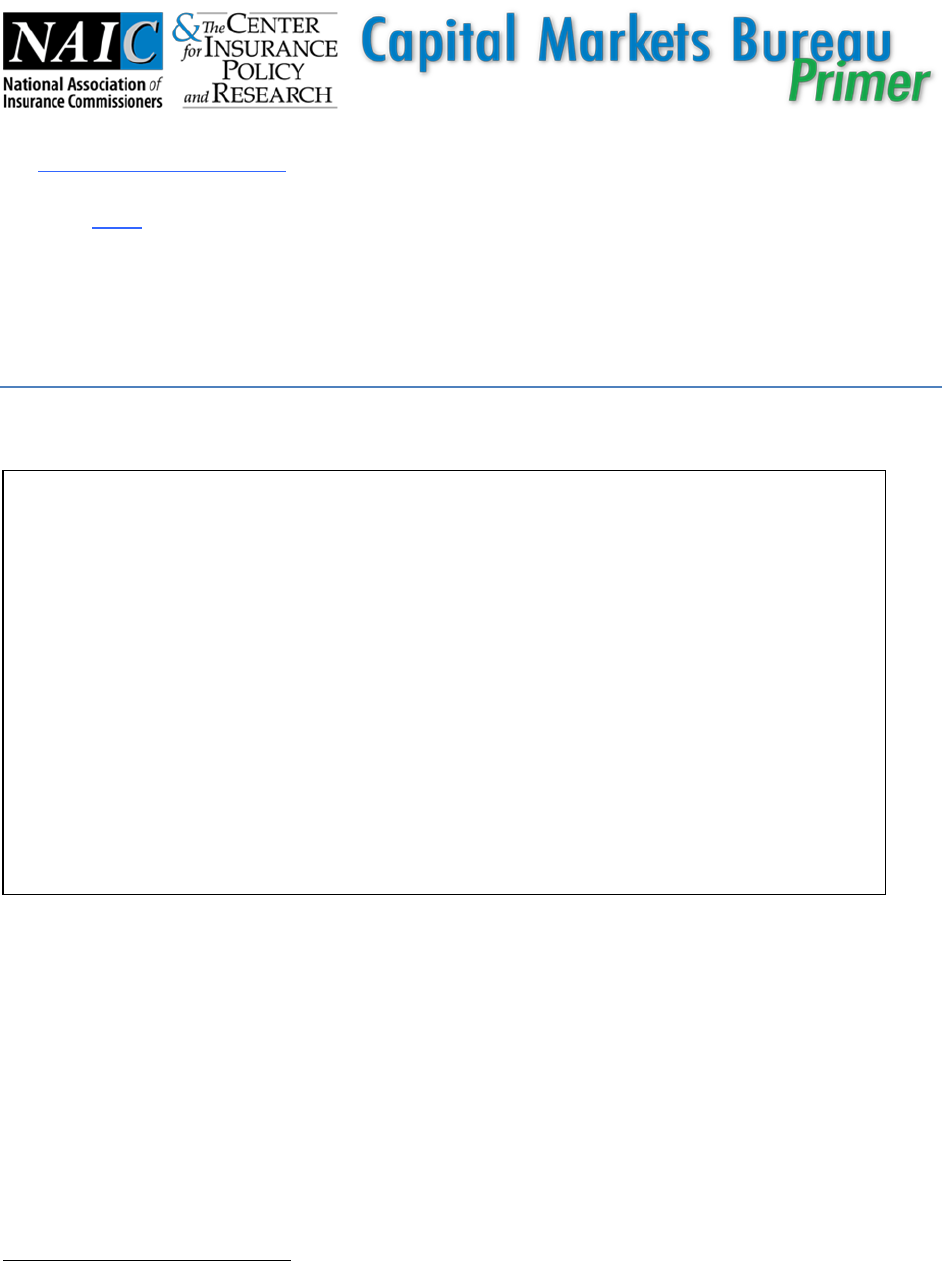

defines a leveraged bank loan as “a commercial loan to a high-yield company provided by a group of

lenders”; they are typically senior secured debt (secured by company, or borrower, assets) and are at the top of a

company’s capital structure (see Chart 1). Leveraged bank loans are often floating rate and priced at a spread over

a referenced rate. They are generally issued with maturities of seven to eight years but can be prepaid sooner.

There are different views as to why they are termed “leveraged”: one is because of the below investment grade

credit quality, another is because they are used to fund leveraged buyouts or refinance debt. BSLs are the largest

segment of the leveraged bank loan market, and they are the predominant loan type included in CLO portfolios.

1

FitchRatings, The 2018 Annual Manual U.S. Leveraged Finance Primer, May 2018.

Leveraged bank loans are lent to companies with high-yield credit quality (rated below

investment grade) by a group of lenders. Within a company’s capital structure, leveraged bank

loans rank the highest in terms of payment priority and are considered senior secured credit.

Pricing leveraged bank loans is typically set as a spread based off a reference rate, such as

prime or the London Interbank Offer Rate (LIBOR).

Broadly syndicated loans (BSLs) are the largest portion of the leveraged bank loan market; they

are syndicated by originating banks to investors. BSLs can be in the form of pro rata loans or

institutional bank loans.

Investors in institutional bank loans include collateralized loan obligations (CLOs), mutual funds

and insurance companies.

In addition to BSLs, middle market loans—generally, loans to companies with less than or equal

to $500 million in gross revenues and less than or equal to $50 million in earnings before

interest, taxes, depreciation and amortization (EBITDA)—are a subset of the leveraged loan

market. Middle market loans are generally smaller in size than BSLs.

2

Leveraged bank loans are originated with covenants, which are restrictions on what the borrower can and cannot

do relative to the loan terms, throughout the life of the loan. These include financial, or maintenance, covenants

that require the borrower to maintain certain financial measures. An example of a financial covenant is the debt

service coverage ratio, whereby the borrower is required to maintain sufficient funds to cover all debt payments.

Leveraged bank loans also have positive/affirmative covenants (indicating what actions the borrower must take to

remain compliant with the loan terms) and negative covenants (restricting or limiting what the borrower can do to

remain compliant with loan terms). An example of a positive/affirmative covenant is paying interest on the

leveraged bank loan; an example of a negative covenant is limiting new debt issuance.

Chart 1:

Basic Background on Leveraged Bank Loans

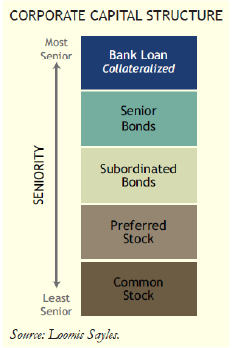

Leveraged bank loans are comprised of institutional bank loans and pro-rata loans (the latter of which include

revolving credit facilities that allow borrowers to draw down funds, repay them and draw down again) as shown in

Chart 2. Investors in pro-rata loans are primarily banks and other financing companies. Investors in institutional

loans (which, for the most part, are term loans) include CLOs, mutual funds and insurance companies. According to

FitchRatings, the institutional leveraged bank loan market has experienced record growth in recent years, totaling

more than $1.1 trillion outstanding across more than 1,600 issuers at year-end 2017—reaching record highs.

3

Chart 2: U.S. Leveraged Loan Issuance

Source: Thomson Reuters LPC, Leveraged Loans Monthly, August 2018.

According to FitchRatings, the leveraged bank loan market has doubled in size since 2012. Investor interest in

leveraged bank loans has been fueled by expectations of continued interest rate hikes by the Federal Reserve, as

increasing interest rates tend to elevate investor interest in floating rate investments, such as leveraged bank

loans. CLOs are the largest investor of leveraged bank loans, according to Leveraged Commentary & Data (LCD), an

S&P Global Market Intelligence offering.

2

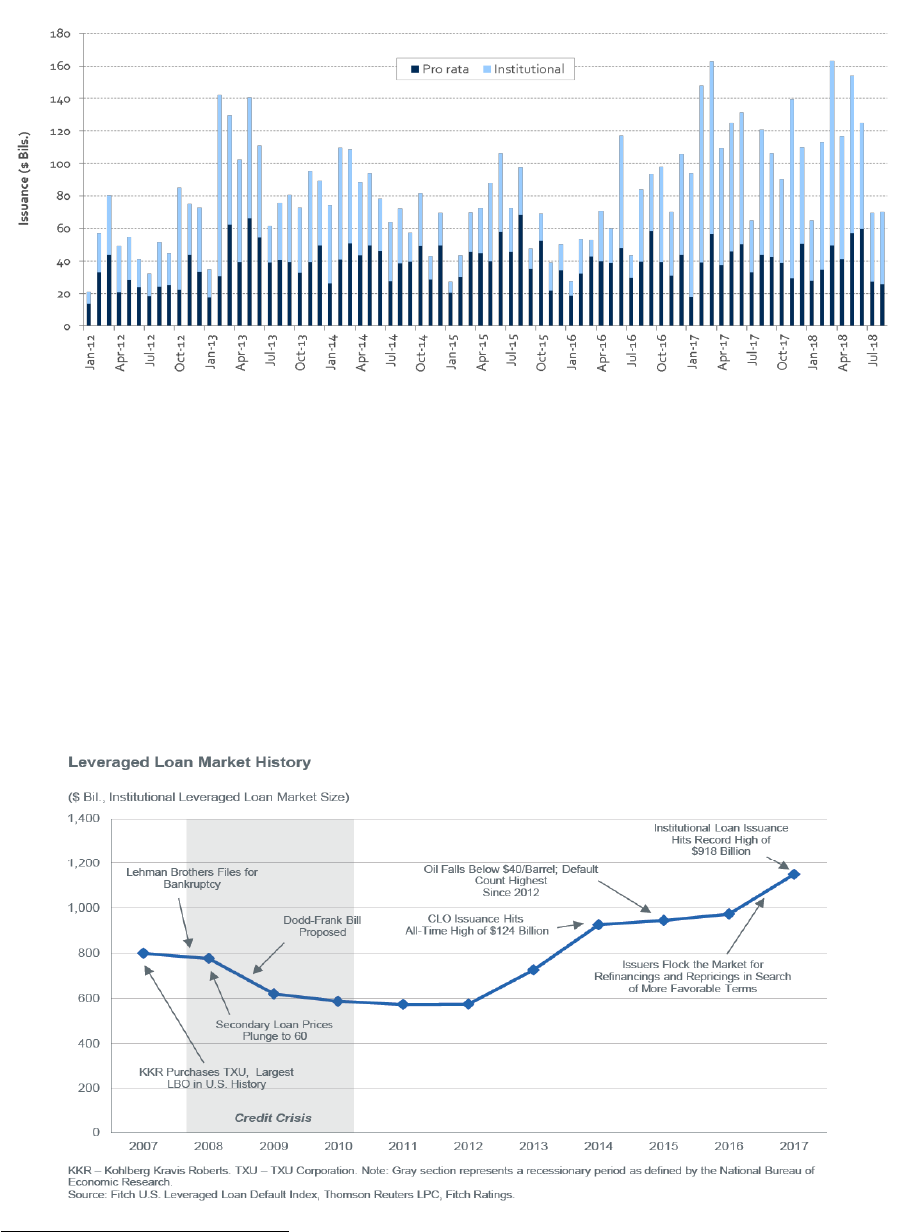

Chart 3 shows how the leveraged bank loan market has grown and been impacted by capital markets events since

the financial crisis. In particular, record growth occurred following the financial crisis due to increased investor

demand as a result of the search for yield.

Chart 3: Market History

2

S&P Global Ratings, U.S. CLO Update, Q3 2018.

4

Leveraged Bank Loan Pricing

The yield on leveraged bank loans is floating rate based on a referenced rate such as prime or the LIBOR; in

particular, the three-month LIBOR. The spread takes into account the bank loan’s credit quality, liquidity and

market technicals (such as supply and demand). The reference rates to which loans are priced change periodically;

that is, they can be reset daily (as is the case with prime), monthly or yearly, for example. Loans that are

considered to be smaller in size in terms of execution (i.e., $200 million or less), are usually priced at a premium

(higher than) to larger loans.

3

And, as the Federal Reserve has been increasing the fed funds rate (or the rate at

which depository institutions lend to each other), leveraged loans have become a more attractive investment

because their yield increases as interest rates rise.

Leveraged Bank Loans vs. High-Yield Bonds

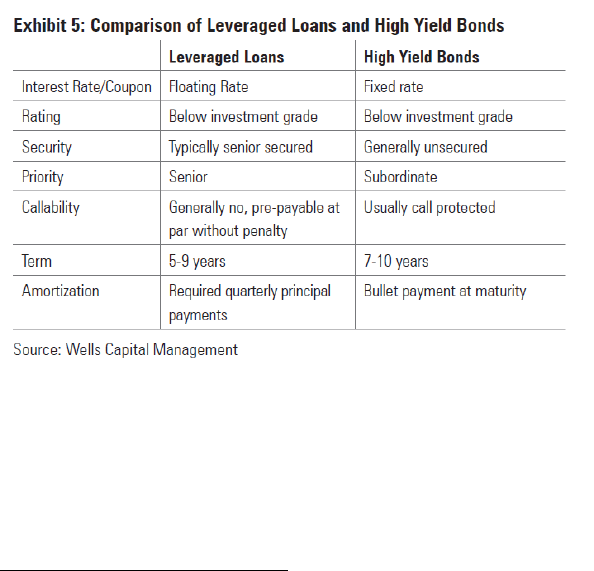

Credit spreads on leveraged bank loans are usually larger than investment grade bonds but smaller than high-yield

bonds, as “[t]he greater yield versus investment grade reflects greater perceived credit risk of bank loans, while

the slightly lower yield relative to high-yield is the result of bank loans’ higher position in the capital structure.”

4

There are other significant differences between leveraged bank loans and high-yield bonds, some of which are

shown in Table 1 below.

Table 1:

In addition, because of differences in characteristics and terms, leveraged bank loans tend to have lower default

rates than high-yield bonds, and due, in part, to their senior position within a company’s capital structure along

with protection from covenants, they have higher recovery rates.

5

3

S&P Global Ratings, LCD Loan Market Primer, 2017.

4

Loomis Sayles, Bank Loans: Looking Beyond Interest Rate Expectations,” September 2012.

5

Wells Capital Management, Bank Loan Market Overview: Opportunities for Diversification, Risk Reduction, and

Return Enhancement, August 2013.

5

Primary vs. Secondary Markets

Leveraged bank loans may be sold in the primary (new issuance) or secondary markets, typically to banks and

other institutional investors, such as insurance companies. The secondary market is where financial instruments

trade after they have been initially issued and sold, and are no longer considered new issues. Secondary market

leveraged bank loan sales typically occur through dealers at large banks. Leveraged bank loans are actively traded

on the secondary market.

Types of Leveraged Bank Loans

Common traits among leveraged bank loans include that these loans are rated BB+ or lower, they are floating rate

based off a referenced rate, they are secured and they are structured by a group of banks referred to as a

“syndicate.” Leveraged bank loans are also key components for corporate finance, mergers and acquisitions and

leveraged buyout (LBO) activity. A few of the common types of leveraged bank loans in the market are discussed

below; they are also the predominant types of loans that are included as collateral for CLOs.

Covenant-Lite (“Cov-Lite”)

Cov-lite generally refers to loans with loose financial maintenance covenants; that is, borrowers are not required

to maintain certain financial performance measures throughout the life of the loan. There are also variations of

cov-lite whereby covenants are loosely set or are only triggered for a certain portion of the loan. The financial

covenants are intended to provide an “early-warning” mechanism to lenders of a potentially deteriorating credit

situation. FitchRatings research cites that the emergence of cov-lite loans in late 2012 (since the financial crisis), is

due to the evolution of the investor base and increased sophistication of the lending market. According to

FitchRatings, cov-lite loans have comprised the majority of newly issued leveraged loans, and they have become

the norm in the institutional leveraged market. Cov-lite loans are typically used for leveraged buyouts and other

large, sophisticated loan transactions and are typically issued in the form of term loans. In 2017, cov-lite loan

issuance reached a peak of $742 billion, the majority of which (17%) were in the technology industry.

Second-Lien Loans

Second-lien loans are “second-in-line” for any post-bankruptcy recoveries, after first-lien loans; that is, claims are

junior to those of first-lien. Second-lien loans are typically highly leveraged and low in credit quality (single B to

CCC rating categories) and, therefore, considered risker than first-lien loans. Second-lien loans are more attractive

than first-lien from a yield perspective. In addition, appetite for second-lien loans increases when a search for

higher yield occurs, such as in a continued low interest rate environment. The attractiveness of second-lien loans

moves in tandem with market volatility and investors’ risk appetite. They are typically issued as a term loans.

CLO portfolios may contain a limited amount of second-lien loans as specified in the transaction’s investment

guidelines. According to FitchRatings research, new issuance of second-lien loans reached a peak of $39.2 billion

peak in 2007.

Middle Market Loans

While the definition may vary slightly acorss different sources, middle market loans are generally made to

companies with less than, or equal to, $500 million in gross revenues and less than, or equal to, $50 million in

6

EBITDA.

6

Middle market loans are a subset of the leveraged bank loan market. FitchRatings research identifies a

few lenders of middle market loans to include CLOs, business development companies (BDCs), alternative asset

managers, credit oppportunity funds and regional banks. Middle market loans are generally less than $500 million

in size.

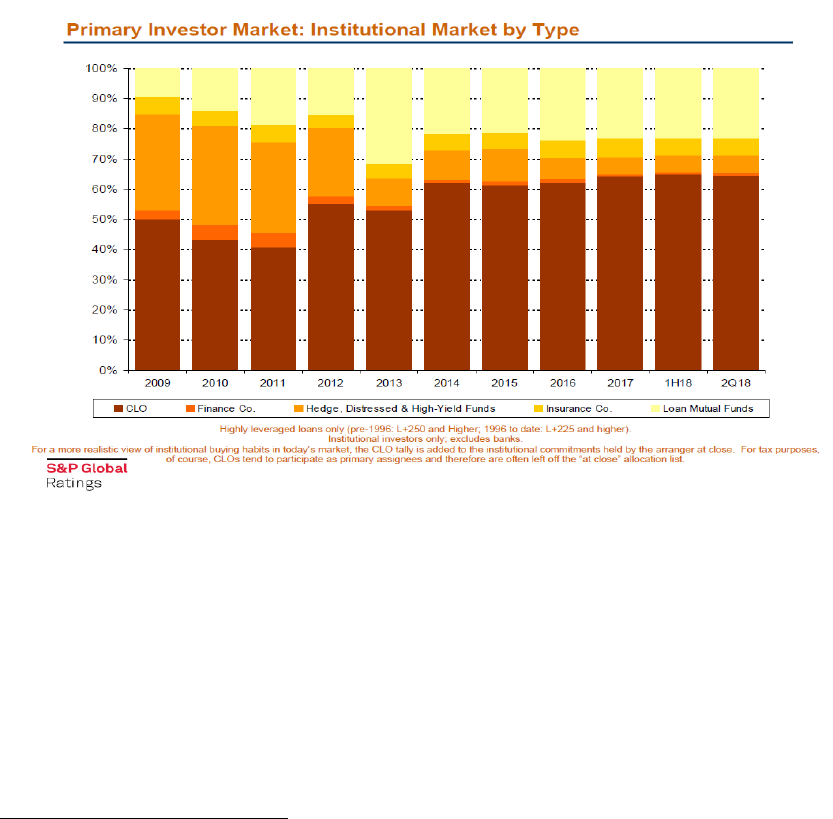

Primary Investors in Bank Loans

As shown in Chart 4, consistently over the years since at least 2009, CLOs have been the largest investor leveraged

bank loans. Post-financial crisis, CLOs were considered “survivors,” with investors not having experienced

significant defaults due in part to the credit enhancement provided by the structures. While hedge funds,

distressed and high-yield funds have decreased their investments in leveraged bank loans—perhaps seeking

opportunities in alternative investments for higher yields—insurance companies’ direct investment in leveraged

bank loans appears to have remained relatively consistent.

Chart 4:

What Are the Risks?

When investing in leveraged bank loans, appetite for risk should take into consideration the credit rating assigned

to the leveraged loan (or the issuer) by one or more of the nationally recognized statistical rating organizations

(NRSROs), as the ratings represent the NRSRO’s assessment of the loan’s (issuer’s) credit risk, or the risk that the

issuer will default on making timely principal and/or interest payments on the loan. Leveraged bank loans and/or

the companies that issue them, are typically assigned speculative grade credit ratings (BB+ and lower), reflecting

the NRSROs’ opinions regarding the loan’s collateral coverage, seniority in the company’s capital structure

(typically senior secured), industry trends and company management, among other factors. All of these

6

As defined in FitchRatings’ 2018 Annual Manual (U.S. Leveraged Finance Primer), May 2018. Middle market loans

may also be defined by some data providers as companies with EBITDA less than $100 million.

7

characteristics determine the likelihood that the borrower will be able to pay interest and principal on a timely

basis. “Loss-given – default” is the portion of credit risk that measures the severity of the loss if the borrower were

to default; as leveraged bank loans are typically senior secured, the holders usually have first priority among the

company’s creditors in the event impairment occurs, and often they are able to renegotiate with the

company/issuer before the loan becomes severely impaired.

Liquidity is another risk that could arise when investing in leveraged bank loans. Leveraged bank loans that are

liquid, or that trade relatively easily and quickly without impacting the market price, tend to be priced with narrow

spreads over the referenced rate. As previously mentioned, pricing leveraged bank loans takes into consideration

the bank loan’s credit quality, as well as market-based factors. In addition, large loans (those greater than

$200 million in size) are typically priced at a narrower spread than smaller loans, as the ability to package and sell

loans is in high demand (i.e., more liquid), resulting in smaller loans being priced at a premium. In addition, at

times, leveraged bank loans may experience “technical pressure” in the secondary market, resulting in reduced

liquidity that, in turn, affects the bank loan price. For example, as investors react to industry and/or market events,

forced sales can result in price declines.

Leveraged bank loans are subject to market risk, or the risk of a market decline that, in turn, reduces their value.

As such, investors in leveraged bank loans mark-to-market the value of their loans; that is, they obtain price data

from broker-dealers or mark-to-market services to assess the price with which they might receive if they had to

sell the loan at a moment’s notice. This trend has resulted in more transparency within the leveraged bank loan

market and, in turn, valuing leveraged bank loans has become more efficient.

Prepayment risk on leveraged bank loans may also occur as interest rates decrease, and bank loan issuers

refinance higher-yielding coupons for lower yields. Conversely, as interest rates rise, borrowers may experience

challenges making payments on the bank loans resulting in delinquencies and/or defaults (i.e., credit risk).

8

Key Terminology

Leveraged Bank Loan

A commercial loan to a high-yield company provided by a group of lenders; typically, senior secured debt and at

the top of a company’s capital structure, they are often floating rate, priced at a spread over a referenced rate.

Broadly Syndicated Loan (BSL)

The largest segment of the leveraged bank loan market; they are made to large companies and syndicated by

banks to investors.

Institutional Bank Loan

A type of BSL that is a term loan invested in by institutional investors such as mutual funds, insurance companies

and CLOs.

Pro-Rata Loan

A type of broadly syndicated bank loan that includes a revolving credit facility and term loan) that is typically

invested in by banks.

Revolving Credit Facility

Line of credit to a company that is arranged by a bank.

Covenant-Lite (Cov-Lite)

Loans with loose or no financial covenants that have high-yield bond-like conventions.

Positive/Affirmative Covenant

Indicates what the borrower must do to be compliant with the bank loan terms.

Negative Covenant

Indicates what the borrower is not permitted to do to remain compliant with the bank loan terms.

Financial Covenants

Financial performance measures to be conducted by the issuer; includes financial performance tests that must be

maintained throughout the life of the loan (i.e., minimum levels of cash flow coverage, or maximum amount of

leverage), as well as incurrence tests that are only necessary when the issuer takes certain actions (e.g., issuing

more debt).

9

Second-Lien Loan

Loans that are second in priority to first-lien loans in terms of claims to assets in the event of a company’s

bankruptcy.

Middle Market Loan

Most commonly defined as loans from issuers with no more than $50 million EBITDA and less than, or equal to,

$500 million in gross revenues.

Business Development Company (BDC)

BDCs are special investment vehicles designed to facilitate capital formation for small and middle-market

companies.

Collateralized Loan Obligations (CLOs)

Structured finance securities collateralized by broadly syndicated bank loans and/or middle market loans.

Term Loan

An installment loan that either amortizes (Term Loan A) via a repayment schedule, which is typically syndicated

with revolving credit facilities; or is institutional (Term Loan B, Term Loan C or Term Loan D), which is a facility for

nonbank, institutional accounts. It may include second-lien and cov-lite loans.

Fed Funds Rate

Interest rate at which depository institutions lend reserve balances to other depository institutions overnight, on

an uncollateralized basis.

Primary Market

Where new issues/securities are sold.

Secondary Market

Where post-new issuance trading occurs, after new issues/securities have closed and been allocated to primary

investors; also known as the “aftermarket.”

Credit Risk

Possibility that a payment obligation will be missed, resulting in a loss; possibility of loss if a borrower defaults on

making a principal and/or interest payment.

10

Liquidity Risk

Risk that a company may not be able to meet short-term obligations due to not being able to convert short-term

assets to cash without impacting the market price.

Market Risk

The risk of loss or devaluation due to a market decline.

Prepayment Risk

The risk that a borrower will repay a loan before its maturity, depriving the lender of future interest payments.