12659690

1

Small Business Checkpoint

Striking a balance on credit

15 February 2024

Key takeaways

• With small business demand for credit softening, rising outstanding loan balances might reflect some of the pressures small

businesses are under from tighter credit and higher interest rates. Additionally, Bank of America internal data suggests small

businesses are relying more on their credit cards.

• Positively, however, we find that 'inflation-adjusted' balances remain below pre-pandemic levels, even for small businesses with

annual revenue greater than $1 million, whose 2023 average balance increased by approximately 13% compared to the 2019

average.

• Plus, elevated deposit levels appear to be supporting small businesses across revenue tiers. Furthermore, total payments growth

per small business client rose year-over-year (YoY) in January, particularly in services sectors, a sign that small businesses

remain well-positioned.

Small Business Checkpoint is a regular publication from Bank of America Institute. It aims to provide a real-time assessment of small business spending

activities and financial well-being, leveraging the depth and breadth of Bank of America’s proprietary data. Such data is not intended to be reflective or

indicative of, and should not be relied upon as, the results of operations, financial condition or performance of Bank of America.

Outstanding loan balances might put pressure on credit card use

Recent surveys suggest that rising small business loan balances are increasing due to firms slowing repayments rather than

taking out new loans. The most recent Small Business Lending Survey from the Federal Reserve Bank of Kansas City showed

outstanding small business commercial and industrial (C&I) loan balances increased year-over-year (YoY) for the first time since

the first quarter of 2021, despite remaining stable in the last two quarters.

At the same time, the January 2024 Senior Loan Officer Opinion Survey found that banks continue to report a decrease in the

number of inquiries from potential small business borrowers seeking new or increased credit lines. Higher outstanding loan

balances, however, are likely to increase outlays for these firms, particularly as the actual interest rate paid on short-term loans

by borrowers has risen, according to National Federation of Independent Businesses (NFIB) respondents (Exhibit 1).

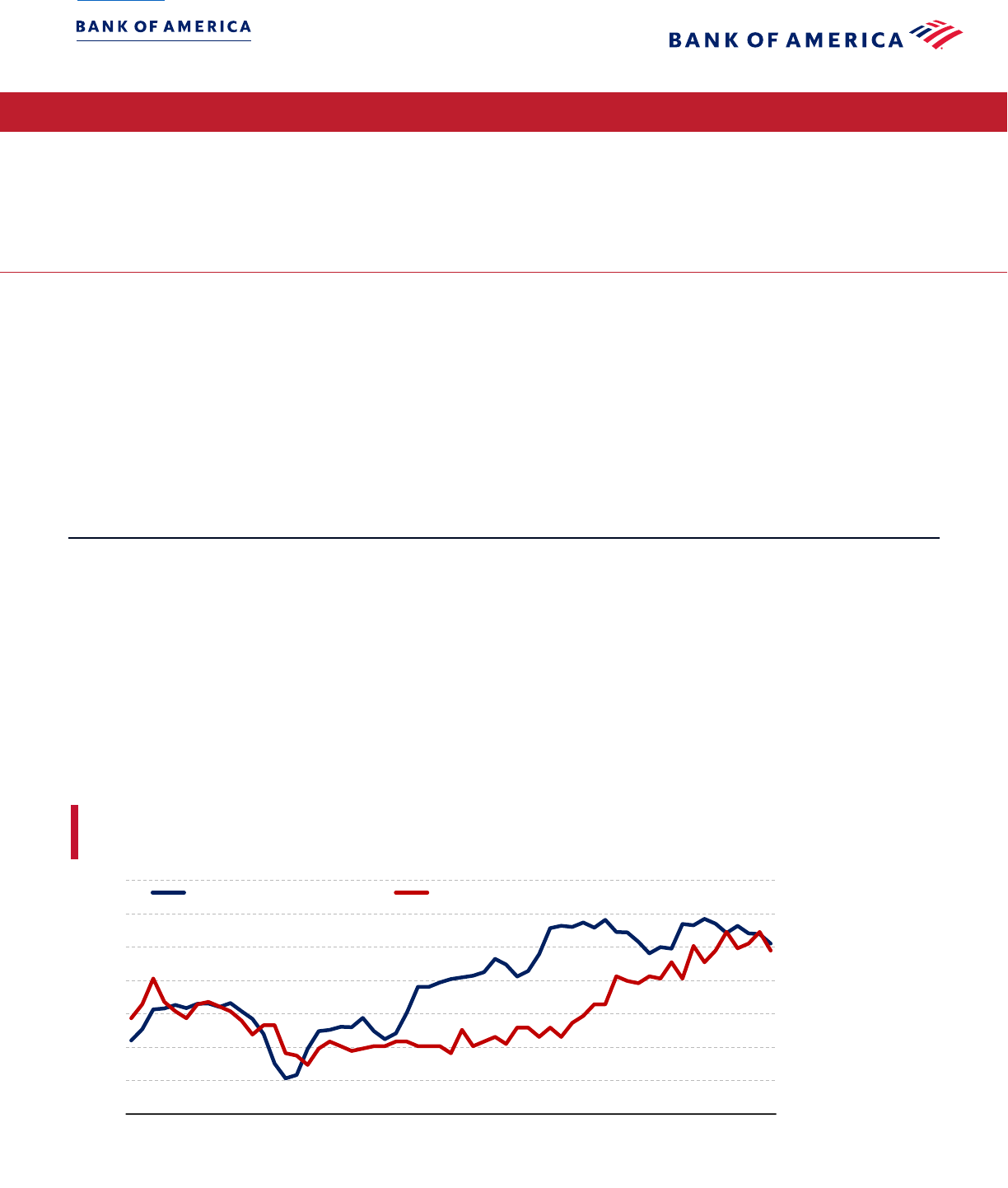

Exhibit 1: Though actual interest paid on short-term loans has increased according to NFIB data, credit card spending has remained relatively flat

Bank of America credit card spending per small business (SB) client (index, 2019 average = 100) and NFIB-reported actual interest rate paid on short-

term loan

by borrowers (%)

Source:

Bank of America internal data, NFIB

BANK OF AMERICA INSTITUTE

2

4

6

8

10

12

70

80

90

100

110

120

130

140

Mar-19 Oct-20 May-22 Dec-23

Small business credit card spending Actual interest rate paid on short-term loans by borrowers

I NSTITUTE

Accessible version

2

15 February 2024

I NSTI TUTE

So, is this a sign small firms are challenged by higher interest rates and tighter credit? Maybe. Bank of America aggregated and

anonymized small business credit card data signals small businesses are increasingly reliant on credit cards to finance their

operations. As we explained in November, credit card spending has been largely flat since halfway through 2023 (Exhibit 1

) and

has even recently started to decline on a per client basis, yet, credit card balances have continued to rise (Exhibit 2). This

suggests to us that more small businesses are using credit cards as source of financing this year with an increasing portion of

balances carrying interest after a decline in this revolving behavior during and post-pandemic.

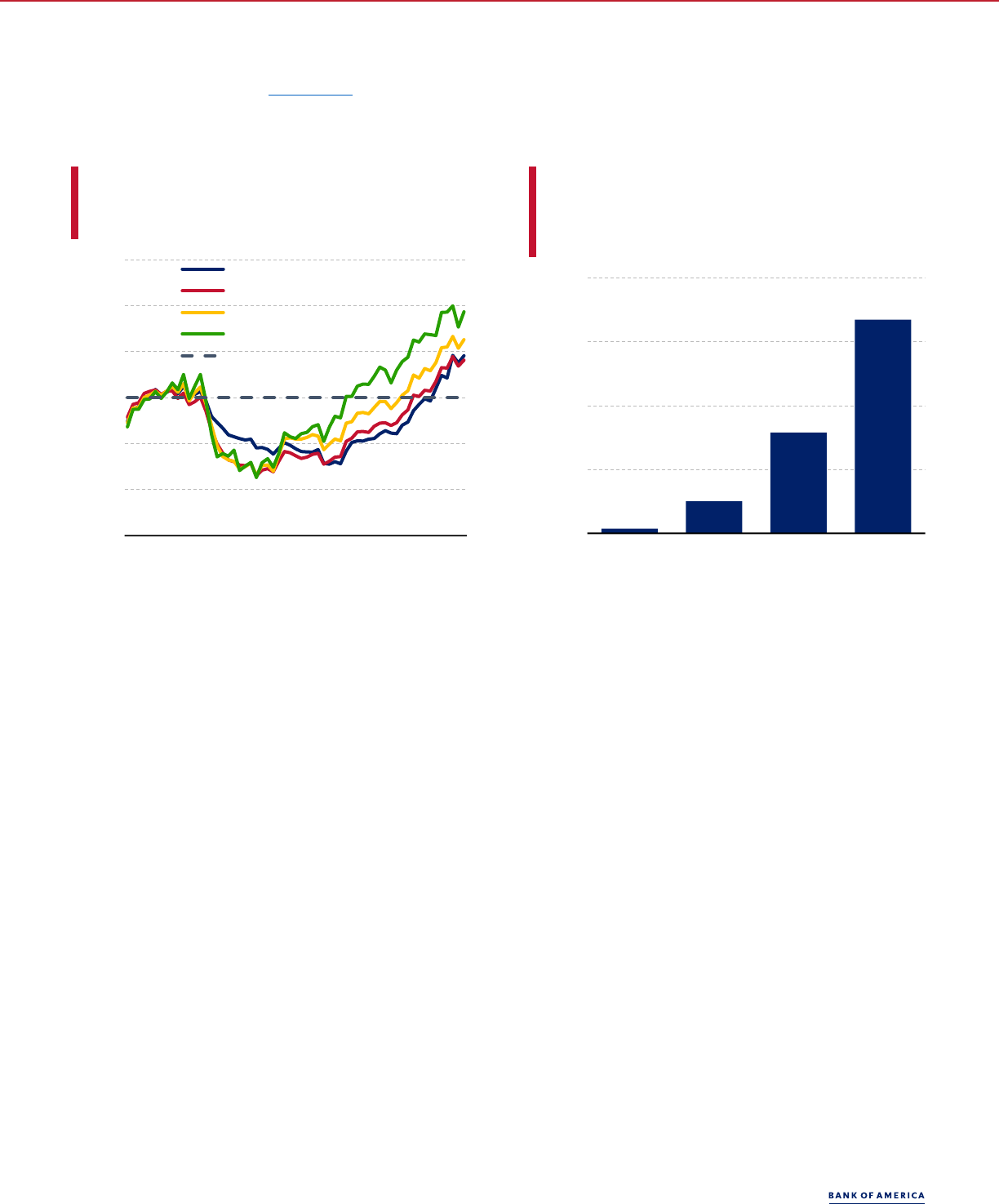

Exhibit 2: Credit card balances have continued to rise across all

revenue tiers

Credit card balances per small business client by revenue tier (index,

2019 average = 100)

Source:

Bank of America internal data

BANK OF AMERICA INSTITUTE

Exhibit 3: Average credit card balances in 2023 have increased the

most since 2019 for those small businesses with annual revenue

greater than $1 million

Average credit card balances in 2023 by revenue tier (index = 2019

average, YoY4%)

Source:

Bank of America internal data

BANK OF AMERICA INSTITUTE

While some small businesses may be starting to feel financial pressure, two positive factors have emerged. First, the increase in

credit balances on Bank of America small business accounts since 2019 has been lower than the rise in the Consumer Price Index

(CPI) over the same period (around 19%). This is true across all revenue tiers. Accordingly, inflation-adjusted balances remain

below pre-pandemic levels, even for the largest small businesses (annual revenue greater than $1 million). The average balance

for these companies increased by approximately 13% in 2023 compared to the 2019 average (Exhibit 3).

Strong deposit levels offer support

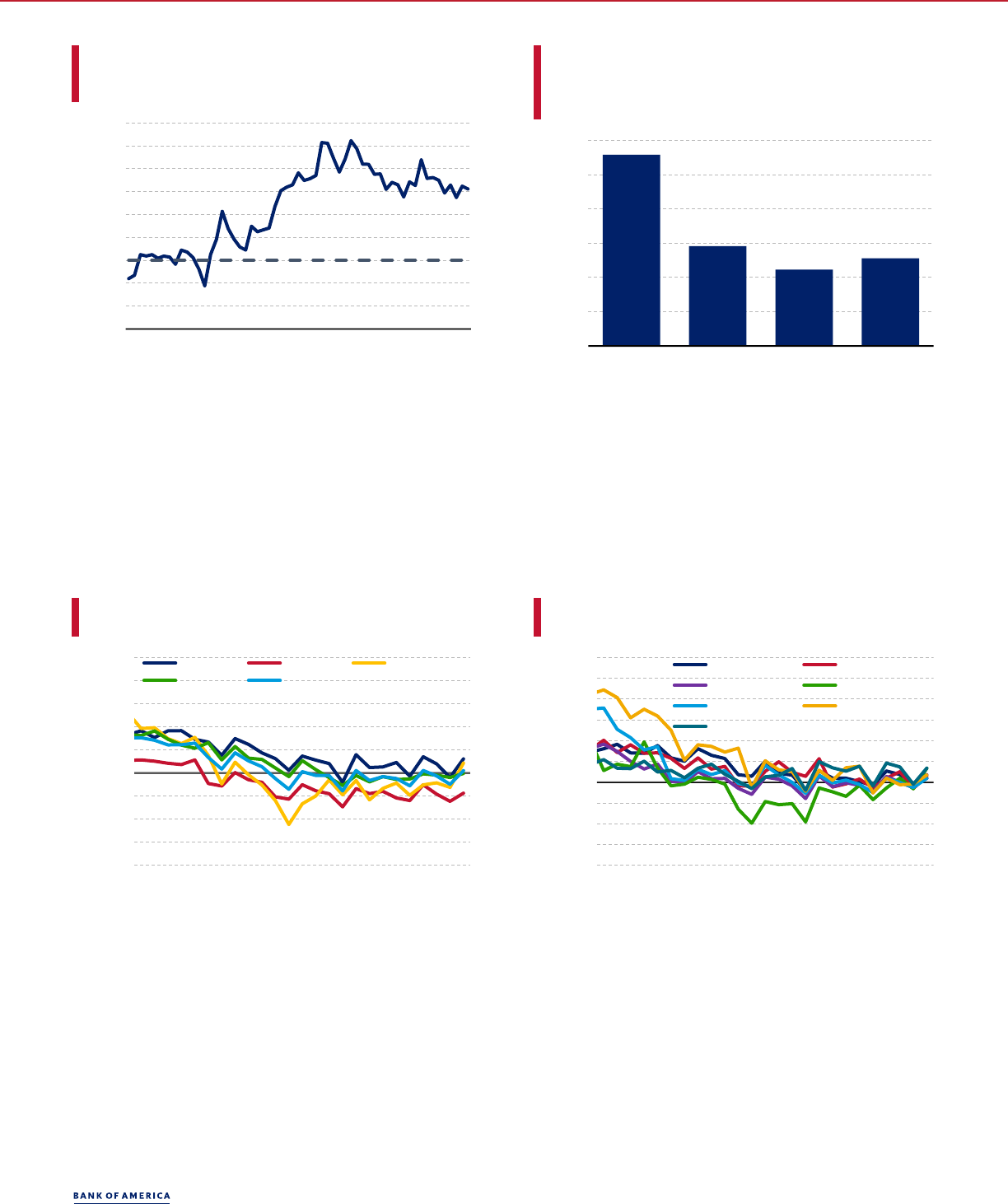

Bank of America internal data also reveals positive signs when we consider the asset side of small business balance sheets.

Small businesses liquid assets in the form of deposit levels appear relatively strong, according to Bank of America internal data.

Exhibit 4 shows total deposit levels per small business client remain approximately 20% above the 2019 average. Across revenue

tiers, Bank of America internal data shows that small businesses with annual revenue of <$100K (microbusinesses) have seen a

rise in the ratio of deposits balances to credit card balances relative to January 2019 (Exhibit 5). These results show that

microbusinesses, which are more likely to rely on credit cards than small businesses with a greater annual revenue, appear to be

in relatively better financial shape.

70

80

90

100

110

120

130

Jan-19 Apr-20 Jul-21 Oct-22

Jan-

<$100k

$100k-$500k

$500k-$1M

>$1M

2019 average

0%

4%

8%

12%

16%

<$100k $100k-$500k $500k-$1M >$1M

15 February 2024

3

I NSTI TUTE

Exhibit 4: Deposit levels remain elevated compared to the 2019

average

Deposit levels per small business client (indexed, 2019 average = 100)

Source:

Bank of America internal data

BANK OF AMERICA INSTITUTE

Exhibit 5: The ratio of deposits to credit card balances relative to

2019 has increased for microbusinesses

Ratio of credit card balances to deposit levels per small business client

in January 2024 (indexed, January 2019 = 100)

Source:

Bank of America internal data

BANK OF AMERICA INSTITUTE

Monthly payments update

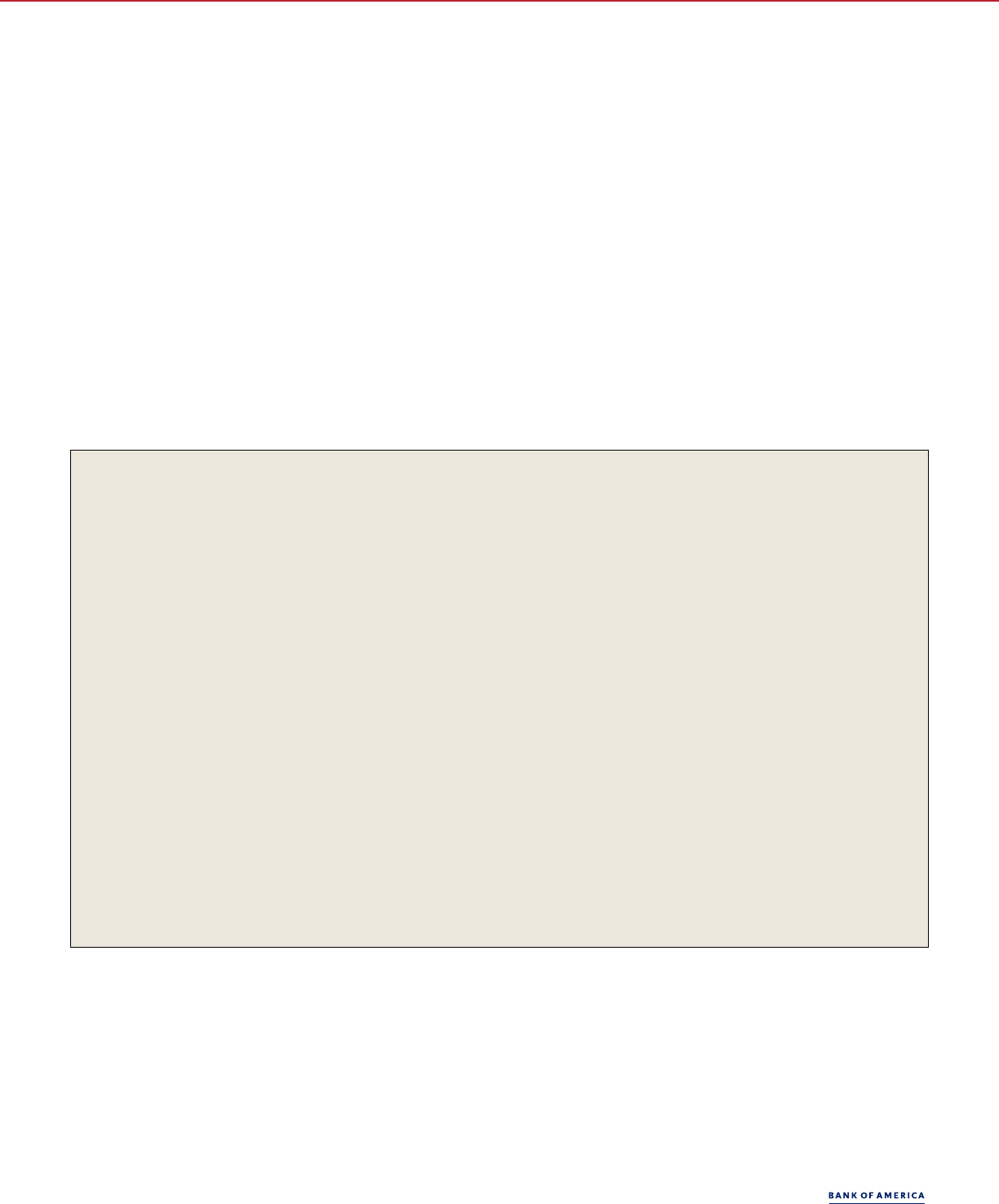

Looking more broadly at small business activities in January, we find total payments per small business client were up 1.0% YoY

(Exhibit 6). Among the major components, ACH jumped 6.1% YoY in January. Conversely, the largest decrease %YoY was

payments by check.

Across sectors, payments growth turned positive across the board in January (Exhibit 7). Most notably, Finance increased 6.7%

YoY, after a decline of 3.2% YoY in December. Health Services and leisure-related businesses like Restaurants and Lodging were

also fairly strong.

Exhibit 6: Across all select channels, payments growth increased

Payments per small business client by select channels (%YoY)

Source:

Bank of America internal data

BANK OF AMERICA INSTITUTE

Exhibit 7: Across all select sectors, payments growth increased

Payments per small business client by select sectors (%YoY)

Source:

Bank of America internal data

BANK OF AMERICA INSTITUTE

Methodology

Selected Bank of America transaction data is used to inform the macroeconomic views expressed in this report and should be

considered in the context of other economic indicators and publicly available information. In certain instances, the data may

provide directional and/or predictive value. The data used is not comprehensive; it is based on aggregated and anonymized

selections of Bank of America data and may reflect a degree of selection bias and limitations on the data available.

85

90

95

100

105

110

115

120

125

130

Mar-19 Oct-20 May-22

Dec-2

80

85

90

95

100

105

110

<$100k $100k-$500k $500k-$1M $1M+

-40%

-30%

-20%

-10%

0%

10%

20%

30%

40%

50%

Jan-22 May-22 Sep-22 Jan-23 May-23 Sep-23

Jan-2

ACH Check Wires

Total Card Total

-40%

-30%

-20%

-10%

0%

10%

20%

30%

40%

50%

60%

Jan-22 Jul-22 Jan-23 Jul-23

Jan-2

Construction Manufacturing

Retail Finance

Restaurants Lodging

Health Services

4

15 February 2024

I NSTI TUTE

Any Small Business payments data represents aggregate spend from Small Business clients with a deposit account or a Small

Business credit card. Payroll payments data include channels such as ACH (automated clearing house), bill pay, checks and wire.

Bank of America per Small Business client data represents activity spending from active Small Business clients with a deposit

account or a Small Business credit card and at least one transaction in each month. Small businesses in this report include

business clients within Bank of America and are generally defined as under $5mm in annual sales revenue.

Unless otherwise stated, data is not adjusted for seasonality, processing days or portfolio changes, and may be subject to

periodic revisions.

Revenue tiers are determined by the combination of following factors: 1) stated revenue on small businesses credit or PPP

applications, 2) actual account inflow into BofA Deposit Accounts, and 3) third party revenue estimation.

Data regarding merchants who receive payments are identified and classified by the Merchant Categorization Code (MCC)

defined by financial services companies. The data are mapped using proprietary methods from the MCCs to the North American

Industry Classification System (NAICS), which is also used by the Census Bureau, in order to classify spending data by subsector.

Spending data may also be classified by other proprietary methods not using MCCs.

Additional information about the methodology used to aggregate the data is available upon request.

Contributors

Taylor Bowley

Economist, Bank of America Institute

David Michael Tinsley

Senior Economist, Bank of America Institute

Sources

Patrick Williams

Senior Vice President, Digital Marketing

Josh Long

Consumer Product Strategy Manager, Consumer and Small Business

Kevin Burdette

Consumer Product Strategy Analyst, Consumer and Small Business

Michael Lutz

Strategy Executive, Small Business, Specialty Lending & Banking

15 February 2024

5

I NSTI TUTE

Disclosures

These materials have been prepared by Bank of America Institute and are provided to you for general information purposes only. To the extent these materials reference Bank of

America data, such materials are not intended to be reflective or indicative of, and should not be relied upon as, the results of operations, financial conditions or performance of Bank

of America. Bank of America Institute is a think tank dedicated to uncovering powerful insights that move business and society forward. Drawing on data and resources from across

the bank and the world, the Institute delivers important, original perspectives on the economy, sustainability and global transformation. Unless otherwise specifically stated, any

views or opinions expressed herein are solely those of Bank of America Institute and any individual authors listed, and are not the product of the BofA Global Research department or

any other department of Bank of America Corporation or its affiliates and/or subsidiaries (collectively Bank of America). The views in these materials may differ from the views and

opinions expressed by the BofA Global Research department or other departments or divisions of Bank of America. Information has been obtained from sources believed to be

reliable, but Bank of America does not warrant its completeness or accuracy. Views and estimates constitute our judgment as of the date of these materials and are subject to change

without notice. The views expressed herein should not be construed as individual investment advice for any particular person and are not intended as recommendations of particular

securities, financial instruments, strategies or banking services for a particular person. This material does not constitute an offer or an invitation by or on behalf of Bank of America to

any person to buy or sell any security or financial instrument or engage in any banking service. Nothing in these materials constitutes investment, legal, accounting or tax advice.

Copyright 2024 Bank of America Corporation. All rights reserved.