Let’s start by explaining who an insurance producer is. An insurance producer is an

insurance agent or broker who advises their clients on their insurance needs and binds the

policies for their clients. When your insurance producer binds a policy, it means that he or

she, as a representative of the insurer, confirms that coverage is in place.

Insurance producers may represent a single insurer or multiple insurers, depending upon

whether they are authorized (or “appointed”) by the insurer(s). While an independent

insurance producer (sometimes called an “independent agent”) or broker can represent

multiple insurers, a captive insurance producer (sometimes called a “captive agent”) only

represents a single insurer. A captive insurance producer usually represents one insurer for

most types of property and casualty insurance policies such as auto, home, boat,

motorcycle and commercial insurance, as well as life insurance.

CONTINUED

HOW TO CHOOSE AN

INSURANCE PRODUCER

800-492-6116 Toll-free

insurance.maryland.gov

So how do you know which type of insurance producer

to contact? The answer is that you might want to

speak with both types. You could start by asking

friends or family for referrals and recommendations.

Another option is to ask the insurer for the names of

insurance producers - either captive or independent

agents or brokers - who sell their insurance located in

your area. Another resource is the Maryland Insurance

Administration’s (MIA) website. Although we cannot

recommend an insurance producer, you can check to

make sure that the insurance producer you selected is

licensed.

This consumer guide should be used for educational purposes only. It is not intended to provide legal advice or opinions regarding coverage under a specific

insurance policy or contract; nor should it be construed as an endorsement of any product, service, person, or organization mentioned in this guide. Please

note that policy terms vary based on the particular insurer and you should contact your insurer or insurance producer (agent or broker) for more information.

This publication has been produced by the Maryland Insurance Administration (MIA) to provide consumers with general information about insurance-related

issues and/or state programs and services. This publication may contain copyrighted material which was used with permission of the copyright owner.

Publication herein does not authorize any use or appropriation of such copyrighted material without consent of the owner. All publications issued by the MIA

are available free of charge on the MIA's website or by request. The publication may be reproduced in its entirety without further permission of the MIA

provided the text and format are not altered or amended in any way, and no fee is assessed for the publication or duplication thereof. The MIA's name and

contact information must remain clearly visible, and no other name, including that of the insurer or insurance producer reproducing the publication, may

appear anywhere in the reproduction. Partial reproductions are not permitted without the prior written consent of the MIA. Persons with disabilities may

request this document in an alternative format. Requests should be submitted in writing to the Director of Communications at the address listed above.

CONTINUED

If you are shopping around for insurance - either because you are unhappy with your current

insurer, are shopping for a better premium, or perhaps you are a first-time insurance buyer-

you might want to start by visiting the MIA’s website at insurance.maryland.gov. The MIA’s

website has comparison rate guides for both auto and homeowners insurance. After finding

a few companies that you want to receive quotes from, you can reach out to them for the

names of insurance producers in your area who represent that insurer.

Once you have decided on a few producers, either from referrals from family and friends or

insurance companies, you can ask the insurance producer for quotes for the policies you

need. It is important to ask for the quotes for the same types and amounts of coverage from

all of the insurance producers so that you can do an apples to apples comparison. If you

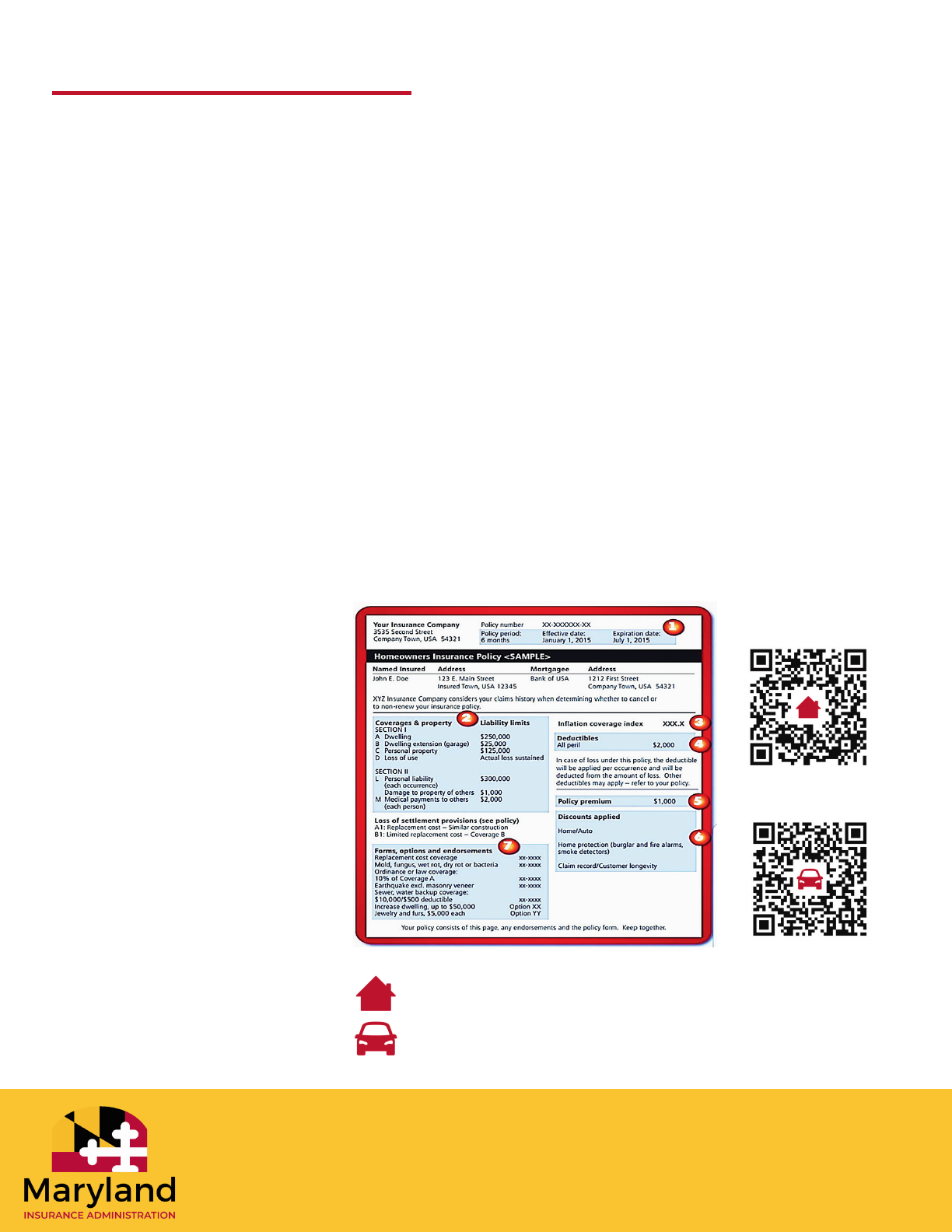

currently have insurance and are looking to make a change, you may find it helpful to have a

copy of your current insurance policy declarations page handy so you can get a quote for the

coverages that are the same as your current policy. The declarations page - which is often

within the first few pages of your insurance package - is the part of your policy that is specific

to you and provides important information about your policy limits for each type of coverage.

If you decide to make a change,

it is a good idea to review your

current policy, including

coverage amounts, deductibles

and endorsements, with your

new insurance producer to see

if they make any suggestions as

to things you might want to

consider changing to provide

better coverage or to help the

policy costs (premiums) better

fit your budget.

For additional information on

shopping for your insurance

needs and information to help

you better understand your

policies, please visit the MIA’s

website or call us at

410-468-2000 or

toll free 1-800-492-6116.

Declarations Page Sample

https://bit.ly/miahodeclarationspagesample

https://bit.ly/miaautodeclarationspagesample

Homeowners

Automobile