POST-JUDGMENT

COLLECTION

How to ColleCt Your Judgment in tHe

distriCt Court of marYland

table of Contents

Introduction......................................................................................................................... 1

Steps in the Post Judgment-Collection Process

Step 1: Finding the Debtor’s Assets .................................................................................. 2

Judgment Debtor (Defendant) Information Sheet ....................................................... 2

Written Interrogatories in Aid of Execution ................................................................. 2

Oral Examination in Aid of Enforcement of Judgment ............................................... 3

Step 2: Handling an Uncooperative Debtor ....................................................................... 4

Step 3: Collecting Your Money .......................................................................................... 4

Request for Service ...................................................................................................... 4

Garnishing the Debtor’s Wages.. .................................................................................. 5

Garnishing the Debtor’s Bank Account ....................................................................... 5

Seizing the Debtor’s Real Estate or Personal Property. ............................................... 6

Real Estate .................................................................................................................. 6

Personal Property ......................................................................................................... 8

Writ of Execution ........................................................................................................ 8

Judgment Creditor’s Monthly Report ................................................................................ 9

Renewing Your Judgment .................................................................................................. 9

Notice of Satisfaction ......................................................................................................... 9

Checklist .......................................................................................................................... 10

This booklet was developed by the District Court of Maryland, in cooperation with Eliot M.

Wagonheim, Esquire. Mr. Wagonheim is the author of The Art of Getting Paid: The Business

Owner’s Guide to Collecting Debts and Managing Receivables in Maryland.

1

INTRODUCTION

Were you awarded money in a lawsuit (the plainti/judgment creditor)? This guide will help you

collect your judgment from the defendant/judgment debtor.

Collecting the judgment (money you are owed) can be complicated. THE COURT DOES NOT

COLLECT THE MONEY. If the debtor will not pay the debt or work out a payment plan, in order

to use the court process for collecting money, you must:

• complete and le more forms,

• pay ling fees (if not waived), and

• possibly appear in court again.

Additional fees will be added to the judgment.

You may want to talk to or hire a lawyer to help you. The Maryland Court Help Centers provide

free limited legal services for people who are not represented by a lawyer. Call the

Help Center at 410-260-1392 or chat with a lawyer online at mdcourts.gov/courthelp.

First Steps

If you win your case, your judgment is recorded in

the court in which you won. There is an automatic

10-day stay (waiting period) before you can begin

the collection process. Send the debtor a copy of

all motions and correspondence you le with the

court about your case.

There are three (3) options available to you to

collect your judgment:

• Garnishing the debtor’s wages;

• Garnishing the debtor’s bank account; or

• Seizing the debtor’s personal property or

real estate.

You will need information about the debtor. Do

you know where the debtor banks? Do you know

where they work? Do you know what property

the debtor owns?

There are three (3) options

available to you to collect

your judgment:

1. Garnishing the debtor’s

wages;

2. Garnishing the debtor’s

bank account; or

3. Seizing the debtor’s

personal property or real

estate.

2

The rst step to nd the debtor’s assets is to send the debtor a Judgment Debtor (Defendant)

Information Sheet (form CC-DC-CV-114). If the debtor doesn’t return the Information Sheet to you

with the information you request by the deadline set by law, then you may (1) require the debtor to

answer written questions or (2) require the debtor to appear in court to answer questions under oath.

The debtor will receive a notice from the court after the entry of the judgment. The notice tells the

debtor (1) they may receive a form from you or your attorney requesting information about their assets

and (2) that if they send the form back as instructed with the information that you have requested

they will not have to come to court to give the information.

You can send form CC-DC-CV-114 to the debtor no earlier than ten (10) days after the entry of the

judgment. You cannot add to the form, but you can strike through information you do not need. You

must keep any information returned to you condential (such as the debtor’s social security number,

nancial account or tax information), except to pursue collection eorts authorized by law.

In order to take another step to learn about the debtor’s assets and income, one of these three (3)

things must be true:

1) you decide not to use the Judgment Debtor Information Sheet;

2) the judgment debtor did not return the Judgment Debtor Information Sheet to you with the

information you asked for within 30 days after the date the form was mailed or otherwise

delivered to the judgment debtor; or

3) the judgment debtor did properly complete and return the Judgment Debtor Information

Sheet; and

• it has been at least one (1) year since the entry of the judgment; or

• it has been less than one (1) year since the entry of the judgment but the court has

given you permission to le interrogatories (questions) or request a hearing (oral

examination).

If you qualify, the next step is either Written Interrogatories in Aid of Execution or an Oral

Examination (hearing).

Interrogatories in Aid of Execution are up to fteen (15) written questions to the debtor about

their assets and income. The debtor is required to answer these questions under oath.

You may serve interrogatories on the debtor through rst-class mail.

After the debtor is served with the order signed by the judge, they have another fteen (15) days

to answer your interrogatories.

3

After you serve the debtor with the questions, send written proof of service to the court. Proof of

service may be a letter to the court that includes the case number, your name and address, and the

debtor’s name and address.

The purpose of these questions is to help you nd the debtor’s assets that can be used to satisfy your

judgment. The questions may cover the debtor’s bank accounts, employment, personal property,

and real estate.

The debtor has fteen (15) days to answer. If you do not receive an answer in fteen (15) days, you

can le a Motion Compelling Answers to Interrogatories in Aid of Execution (form DC-CV-030).

This motion asks the judge to order the debtor to answer your questions.

After the debtor is served with the order signed by the judge, they have another fteen (15) days to

answer your interrogatories.

No sooner than 30 days after the court enters a judgment, you may ask that the debtor appear in court

and answer your questions. The debtor will be under oath. You may ask questions about the debtor’s

assets and income. Complete the Request for Order Directing Judgment Debtor or Other Person to

Appear for Examination in Aid of Enforcement of Judgment (form CC-DC-CV-032). The court will

issue an order that tells the debtor when to appear. You have 30 days to serve the debtor with this order.

At the oral examination,

you may ask the debtor about

real estate, cars and other

assets owned, bank accounts

maintained, sources of income

received, and wages earned.

4

Handling an Uncooperative Debtor

If the debtor has been properly served and will not cooperate with your attempts to discover their

assets, you may le a Request For Show Cause Order for Contempt (form DC-CV-033). The order

will summon the debtor to court to explain why they should not be held in contempt for ignoring your

discovery eorts. You can only le the request for a Show Cause Order after the debtor has either:

• ignored written interrogatories, as well as an order from the judge requiring their answers; or

• failed to appear for an oral examination hearing ordered by the court.

If the debtor fails to appear for the Show Cause hearing, the judge may issue a body attachment. If the

judge orders a body attachment but it is not issued on the day of the hearing, you can le a Request to

Issue a Body Attachment (form CC-DC-108).

Before issuing a body attachment, the plainti must provide either:

• proof the debtor was personally served with the order (either the order to appear or the show cause

order, if issued).

• proof the debtor signed for the order (either the order to appear or the show cause order, if

issued) when served by restricted delivery mail.

OR

• an adavit from

a person with rsthand knowledge that the

debtor

has been willfully evading

service.

The sheri’s ofce will take the debtor into custody and will bring the person before the court to

explain why they did not appear. The debtor may have to post a bond for their release. The bond

will be forfeited to the State if they do not appear at the next hearing. Both parties will receive a

new hearing date.

Collecting Your Money

Once you have the information you need to garnish the debtor’s wages or bank account or seize

the debtor’s property, you can begin the collection process.

The collection process requires you to le many forms, especially if you choose to use more than one

method. You may have to select the method of service:

• notication by mail;

• through the Sheri’s Oce (or constable in Baltimore County only); or

• by private process server.

When you choose a method of service, you should complete a Request for Service (form DC-CV-002).

The post ofce, sheri, constable, or private process server should return the Request for Service to the

court to certify that service has been made properly.

Fill out the case caption information - the address of the court in which you are ling the form, your

case number, and the names of the parties. You must also ll in the addresses for both parties, required

in the

bottom left-hand corner of the form.

5

Garnishing the debtor’s wages means that a portion of their pay will be given to you each month

until the judgment has been paid.

The rst step in garnishing someone’s wages is ling a Request for Writ of Garnishment of Wages

(form DC-CV-065). You must know the name and address of the debtor’s employer, the amount

of your judgment, and any additional money owed to you (such as court costs and post-judgment

interest).

If you have submitted the proper information:

• The clerk will issue a Writ of Garnishment.

• The debtor’s employer (“garnishee”) will be served with the writ instructing the garnishee to

withhold a portion of the debtor’s wages to satisfy your judgment.

• The debtor/garnishee then has 30 days to le an answer to the Writ of Garnishment.

• You will receive a copy of the garnishee’s answer listing any other attachments, or

garnishments, against the debtor’s wages.

Your garnishment may not take eect immediately if the debtor has to satisfy other judgments.

Attachments are satised in the order in which they are served on the garnishee.

The Maryland Rules require garnishees (employers) to give the withheld wages to the judgment

creditor within fteen (15) days of the close of the debtor’s last pay period each month. In other

words, if the debtor’s pay period ends March 26, you should receive the funds withheld during

March, no later than April 10.

Your garnishment is valid as long as the debtor remains with the same employer and your

judgment is unpaid. You are not required to rele.

Garnishing a debtor’s bank account means you will be given money from the debtor’s bank

account to help satisfy your judgment. Normally, you cannot garnish funds from:

• jointly-held accounts (unless your judgment is against both owners),

• retirement accounts,

• escrow accounts.

Financial institutions must comply with certain requirements, prohibitions, and limitations under

federal law. The law prohibits holding “protected amounts” such as Social Security, Veteran’s

Administration, Railroad Retirement Board, and Oce of Personnel Management (Federal

Regulation 31 C.F.R. Part 212 and Maryland Rule 3-645.1).

Up to $500.00 in a deposit account or other accounts of a judgment debtor held by a depository

institution is automatically protected from execution on the judgment without an election by the

debtor (Courts and Judicial Proceedings § 11-504).

Step One in garnishing a bank account: Complete the Request for Writ of Garnishment of

Property Other Than Wages (form DC-CV-060). You need to know the name and address of the

debtor’s nancial institution, the amount of your judgment, and any additional money owed to

you (such as court costs and post-judgment interest).

6

The clerk will issue a Writ of Garnishment if you provide the proper information. The debtor’s

nancial institution (“garnishee”) will be served with the writ, and a Garnishee’s Confession of

Assets of Property Other Than Wages (form DC-CV-061). The garnishee has 30 days from the date

of service to le the Confession of Assets with the court. You will receive a copy listing the debtor’s

assets held.

If 30 days pass after the original Request for Writ of Garnishment of Property Other Than Wages is

served and the garnishee has led an answer to the request, you can le the Request for Judgment-

Garnishment (form DC-CV-062). You must mail a copy of the request to the garnishee and the

debtor before ling the request.

If you do not seek to enforce or dismiss the writ within 120 days after the garnishee’s answer is

led, after proper notice to both the judgment debtor and the judgment creditor, the garnishee may

request to terminate the writ.

If the judge enters a judgment in your favor, the order will direct the garnishee to give you the

amount ordered from the debtor’s bank account.

Property or real estate can be sold to help satisfy your judgment. Seizing personal property or real

estate is the most complicated and time-consuming collection methods. You may want to consider

hiring an attorney to assist you with the process.

There are costs to seizing real estate or property. You are responsible for any costs associated with the

sale. Be sure that the proceeds from the sale, minus your costs, make this procedure worth your time

and eort.

There are also exceptions to what can be sold. If the

debtor’s property is jointly-owned, you cannot sell it unless

you have a judgment against both owners.

You can, however, sell the debtor’s interest in a property.

For example, if the debtor owns a home jointly with a

sibling, the home cannot be sold. However, you will be

able to sell the debtor’s interest in the home. Whoever buys

the interest will become a joint owner with the debtor’s

sibling.

The debtor is permitted to request certain other exemptions

listed under the Notice to the Defendant on the reverse side

of the Request for Writ of Execution.

File a Request for Writ of Execution (form DC-CV-040) if

you choose to seize the debtor’s personal property or real

estate. Before ling your request for writ there are steps you may be required to take.

If you would like to sell the debtor’s real estate, prior to ling the Writ of Execution, you must record

your judgment in the circuit court for the county in which the property is located (with the exception of

Baltimore City).

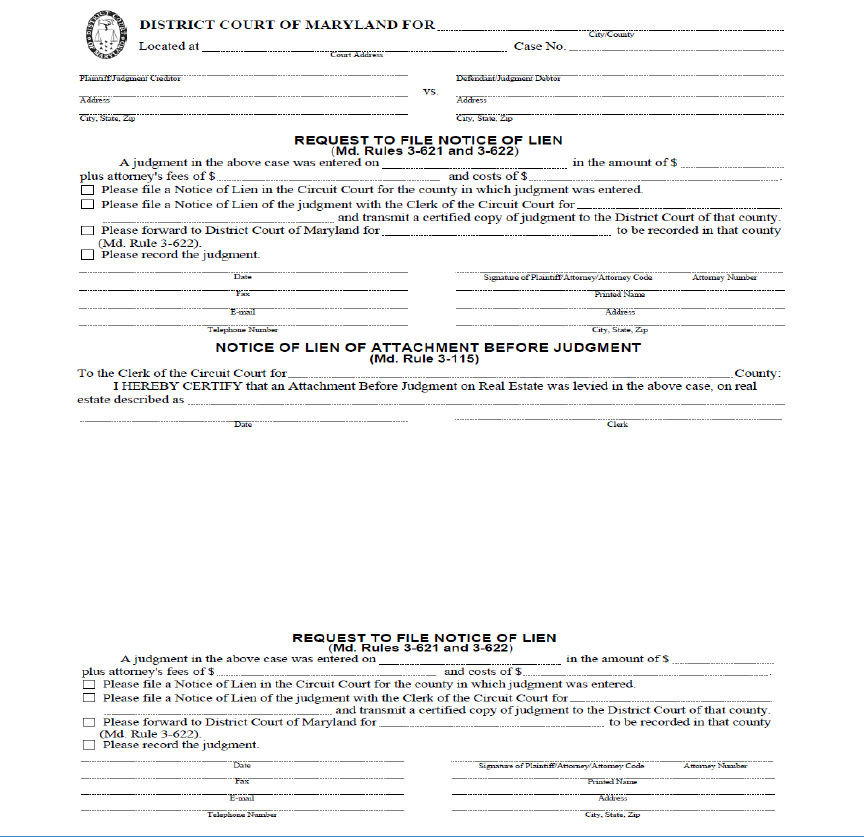

Request to File Notice of Lien.

You are responsible for

the costs of seizing real

estate or property. Be

sure the proceeds from

the sale, minus your costs,

make this procedure worth

your time and effort.

For example, if you win your case in Prince George’s County and know that the debtor owns real

estate there, you should complete the Notice of Lien and indicate that the property you would

like to sell is in Prince George’s County. Fill out the case caption information, including your

case number and the names and addresses of both parties. Under the Notice of Lien of Judgment

section of the form, enter the date your judgment was entered, the amount that you were awarded,

along with any attorney’s fees or court costs. Because the real estate you would like to sell is

located in the same county in which your judgment was entered, you should check the rst

box. File the completed Notice of Lien in the Prince George’s County District Court, which will

forward the information to the circuit court.

If you win your case in Prince George’s County and nd that the debtor owns real estate in Anne

Arundel County, you should complete the Notice of Lien and indicate that the property you are

interested in selling is in Anne Arundel County. Because the real estate is located in a county

other than the one in which your judgment was entered, check the second box and enter the

name of the county where the property is located. File the completed Notice of Lien in the Prince

George’s County District Court, which will forward the information to the correct circuit court.

7

8

If you are trying to seize real estate in a county other than the one in which your judgment was

entered, complete the Request for Transmittal of Judgment (form DC-CV-034). Include the name

of the county in which you would like your judgment recorded (Anne Arundel in the example

above).

I

f you intend to seize personal property, such as a car or a boat, in a county other than the one in

which you won your judgment, complete the Request for Transmittal of Judgment (form DC-CV-034).

When

lling out the form, put the name of the county in which you would like your judgment

recorded.

The court will send you a notice once your judgment has been recorded properly. At this point,

you may le the Request for Writ of Execution (form DC-CV-040). You should le the Writ of

Execution in the county in which the property you intend to seize is located.

When you le this request, you are asking the court to have the debtor’sproperty levied or seized

to satisfy your judgment. In most counties, the sheri’s ofce is responsible for levying or seizing

property. In Baltimore County, constables perform these duties.

, you are required to le a copy of the title with the

Request for Writ of Execution. The copy cannot be more than 90 days old when you le your

request. Contact the Motor Vehicle Administration to nd out how to obtain a copy of the title

and for information about the fees involved.

, you must have a copy of the deed. Deeds are

public records that can be found at the circuit court for the county in which the real estate is

located. Use the legal description found on the deed for the description of the property when

completing the Request for Writ of Execution.

In the top half of the Request for Writ of Execution, you should enter: (1) the amount of money

that is owed to you, (2) the debtor’s last known address, and (3) the location of the property to be

levied and a detailed description of the property. Be specic.

The next question deals with what you would like the sheri to do with the property.

• Select “leave the property where found” to have the sheri post a notice alerting the debtor

that the property has been levied. If you would like to sell the property, you must have it seized.

• Select “exclude others from access to it or use of it,” to have the sheri leave the property

but render it inaccessible. For instance, the debtor can be barred from using their car. You may be

required to post a bond with the sheri if you choose this option.

• Select “remove it from the premises,” to have the sheri remove the property. The sheri’s

ofce will use the bond to meet its costs; any unused portion will be returned to you.

9

There is a 30-day waiting period before property can be sold. The waiting period allows the

debtor the opportunity to le a motion to request that the property be exempted.

If no motion is led after the 30 days, you must contact the sheri to start the sale of the property.

If after 120 days, the sales process has not started, the property may be released to the debtor.

Judgment Creditor’s Monthly Report

You are required to document any payments. Send a Judgment Creditor’s Monthly Report to the

debtor and any garnishees within fteen (15) days after the end of each calendar month in which

you receive a payment. Do not le the Judgment Creditor’s Monthly Report with the District Court.

A sample form is posted for your convenience at: mdcourts.gov/district/forms/civil/dccv066.pdf

Renewing Your Judgment

In Maryland, a judgment is only valid for twelve (12)

years. If you have not been able to collect your judgment

within that time, you will have to renew the judgment to

continue your collection eorts. Complete the Request to

Renew Judgment (form DC-CV-023) and le it with the

court. The renewal form must be completed while your

judgment is still valid. For example, if your judgment was

entered on February 1, 2006, your judgment is valid until

February 1, 2018.

If you le a renewal of judgment on February 2, 2018, your judgment has expired and will no

longer be honored.

Notice of Satisfaction

When your judgment has been paid in full, you must le a Notice of Satisfaction (form DC-CV-031).

The clerk will process the order and notify each court which recorded the judgment.

If you do not le the Notice of Satisfaction and the debtor les a Motion for Order Declaring the

Judgment Satisfied (form DC-CV-051), the court can order you to reimburse the debtor for any

costs incurred.

A judgment is only

valid for 12 years,

but can be renewed

by filing a request to

renew judgment with

the court.

10

CHeCklist

The following checklist is provided for your convenience. Track your progress by entering the

date when each action is taken. The page numbers refer you to the specic instructions for each

step.

Address Amount of Judgment

Date awarded

Judgment Debtor (Defendant) Information Sheet (p. 2):

Written questions/ interrogatories sent (p. 2):

Motion Compelling Answers led (if necessary, see p. 3):

Request for Order Directing Judgment Debtor or Other Person to

Appear for Examination in Aid of Enforcement of Judgment

(Oral Exam) led (p.

3

):

Request for Show Cause Order led (p.

4

):

Request to Issue a Body Attachment led (p.

4

):

Request for Garnishment on Wages led (p.

5

)

Writ of Garnishment issued (p.

5

)

Garnishee’s answer led (p.

5

):

Request for Garnishment of Property Other Than Wages led (p. 5)

Writ of Garnishment issued (p.

6

):

Garnishee’s Confession of Assets led (p.

6

):

Request for Judgment - Garnishment led (p.

6

)

Real Estate or Personal Property

Request to File Notice of Lien led (if necessary, see p. 6)

Request for Transmittal of Judgment (if necessary, see p. 8)

Notice that judgment is properly recorded received (p. 8)

Request for Writ of Execution led (p. 8)

Notice of Satisfaction (p.

9

):

Notes

It is the mission of the District Court of Maryland to provide equal and exact justice for

all who are involved in litigation before the Court.

DC-CV-060BR (Rev. 10/01/2023)

mdcourts.gov

The Maryland Court Help Centers provide free limited legal services

for people who are not represented by a lawyer.

See: mdcourts.gov/courthelp

For more information about the Maryland Judiciary and the District

Court visit the website, at:

Information contained in this brochure is intended to inform the public and not serve as legal advice. Brochure is subject to

unscheduled and unannounced revisions. Any reproduction of this material must be authorized by the Ofce of the Chief Clerk of

the District Court of Maryland.