2 LAFAYETTE, 19TH FLOOR,

N

EW YORK, NY 10007

ERIC ADAMS

MAYOR

KEITH HOWARD

COMMISSIONER

NEVITA BAILEY

ASSOCIATE COMMISSIONER &

C

HIEF FINANCIAL OFFICER

BUREAU OF BUDGET AND FINANCE

FY24

FISCAL MANUAL

FOR PASSPORT USERS

USERS: All Human Service contracts including Adult

Literacy Discretionary and ONS Discretionary. All other

Discretionary contract types are excluded.

PASSPort Assistance

MOCS SERVICE DESK

https://mocssupport.atlassian.net/servicedesk/customer/portal/8

DYCD Help Desk

BudgetandFinanc[email protected]ov

LAST REVISED: 04.23.2024

2

TABLE OF CONTENTS

TABLE OF CONTENTS ................................................................................................................................................. 2

INDEX .............................................................................................................................................................................. 3

INTRODUCTION AND OVERVIEW............................................................................................................................. 5

Bureau of Budget and Finance (BBF) Overview ......................................................................................................... 6

SECTION ONE: THE BUDGET ..................................................................................................................................... 8

Budget Overview .......................................................................................................................................................... 9

General Information ..................................................................................................................................................... 9

Completing The DYCD Budget ................................................................................................................................. 13

PASSPort ITEM CATEGORIES ............................................................................................................................... 13

SECTION TWO: PURCHASE ORDER CHANGE REQUESTS (POCR) BUDGET MODIFICATIONS .................. 27

Purchase Order Change Request and Procedures Overview ...................................................................................... 28

SECTION THREE: INTERNAL CONTROLS & GENERAL...................................................................................... 29

ACCOUNTING PROCEDURES ................................................................................................................................... 29

Internal Controls & General Accounting Procedures Overview ................................................................................ 30

SECTION FOUR: PURCHASING PROCEDURES ..................................................................................................... 36

General Procurement Policies .................................................................................................................................... 37

SECTION FIVE: CREDIT/DEBIT CARDS POLICIES AND PROCEDURES ........................................................... 40

Credit/Debit Cards Policies and Procedures Overview ............................................................................................... 41

SECTION SIX: PETTY CASH POLICY ....................................................................................................................... 43

Petty Cash Fund Use Establishment ............................................................................................................................ 44

SECTION SEVEN: GENERATED INCOME ............................................................................................................... 46

Overview of Generated Income .................................................................................................................................. 47

SECTION EIGHT: PASSPORT ADVANCES, INVOICES & PAYMENTS ................................................................. 48

PASSPort – Invoices and Payments ........................................................................................................................... 49

SECTION NINE: YEAR-END CLOSEOUT ................................................................................................................. 54

Year-End Closeout Overview ..................................................................................................................................... 55

SECTION TEN: CENTRAL INSURANCE PROGRAM............................................................................................... 58

Central Insurance Program (CIP) ................................................................................................................................ 59

for Participating Providers .......................................................................................................................................... 59

SECTION ELEVEN: REPORTING & AUDIT REQUIREMENTS ............................................................................. 61

Audit ........................................................................................................................................................................... 62

3

INDEX

Appendix of Forms

The forms below are available on the DYCD Website.

All applicable forms must be uploaded into PASSPort including:

Budget forms can be found in the Budget Review, Insurance Compliance and Contracting Systems

(BRICCS) Unit section:

https://www1.nyc.gov/site/dycd/involved/funding-and-support/cbo-budget-review-risk-

management.page

1. FY 2024 Budget Form

2. FY 2024 Budget Reminders

3. FY 2024 Budget Reminders Non-Discretionary Contracts

4. FY 2024 Budget Modification Forms

5. FY 2024 Consultant Agreement Form

6. Consultant Agreement Modification Form

7. Subcontract Agreement Modification Form

8. Subcontract Agreement

9. Subcontract Agreement for Fiscal Conduit

10. Space Rental Cost Allocation Form

11. Insurance Sample Package

12. Broker Certification

13. DYCD (ONS) Equipment Vehicle Approval Form

14. Personnel Services Allocation Form

Back-up documentation for Invoice submission can be found on the Agency Payment Unit (APU):

https://www1.nyc.gov/site/dycd/involved/funding-and-support/cbo-contract-agency-finance-

department-payment-unit.page

1. Salaries and Wages Justification Details

2. DYCD Provider Attestation Form for Vaccine Related Expenses

3. WIOA Salaries and Wages Justification Details

4. Equipment Purchase Inventory Report

5. CSBG Invoice-Attachment Template

6. Fiscal Agent - Indirect Cost Rate Attestation Statement Form

Additional forms

EFT Enrollment Form (Direct Deposit)

Petty Cash Voucher (Sample)

4

Frequently Used Acronyms:

ACCO

Agency Chief Contracting Officer

AIR

Audit & Internal Review

APU

Agency Payment Unit

BBF

Bureau of Budget and Finance

BRICCS

Budget Review, Insurance Compliance & Contracting System

CBO

Community Based Organization

CCMS

Comprehensive Contract Management System

CDBG

Community Development Block Grant

CDU

Contract Development Unit

CIP

Central Insurance Program

COMPASS

Comprehensive After School System

CSBG

Community Service Block Grant

DYCD

Department of Youth and Community Development

EFT

Electronic Fund Transfer / Direct Deposit

EIN#

Employee Identification Number

FCCR

Financial Contract Change Request

FFR

Fiscal Field Review

FICA

Federal Insurance Contributions Act

FMS

Financial Management System

FTE

Full Time Equivalent

FUTA

Federal Unemployment Tax

HHS

Health and Human Services Accelerator

ICR

Indirect Cost Rate

ISY/Learn & Earn

In School Youth/Learn & Earn

MCTMT

Metropolitan Commuter Transportation Mobility Tax

NYCHA

New York City Housing Authority

OCA

Office of Contract Agency Audits

OMB

Office of Management & Budget

ONS

Office of Neighborhood Safety

OSY/Train & Earn

Out-of-School Youth/Train & Earn

OTPS

Other Than Personnel Services

PACE

Procurement Automations Contracts & Evaluations

PASSPort

Procurement and Sourcing Solutions Portal

PERS

Program Expense Report Summary

PIP

Payee Information Portal

PS

Personnel Services

PO

Purchase Order

POCR

Purchase Order Change Request

RFP

Request for Proposal

SUI

State Unemployment Insurance

WIOA

Workforce Innovation Opportunity Act

5

INTRODUCTION AND OVERVIEW

The Bureau of Budget and Finance (BBF) is responsible for monitoring the fiscal compliance of

DYCD’s human services contracts. Depending on the funding stream, there are different regulations

that govern the administration and expenditure of program funds. To provide guidance to our Providers,

DYCD has developed the following fiscal manuals based on program and funding sources:

PASSPort

HHS Accelerator Financials (HHS)

Comprehensive Contract Management System (CCMS) / Program Expense Summary Report

(PERS)

Workforce Innovation Opportunity Act (WIOA)

Fiscal Agent (YMS Management Associates, Inc.)

All manuals are available on DYCD’s website under the section for CBO Financial Services.

Effective April 01, 2024, the requirements outlined in this Fiscal Manual apply to all Human

Service contracts including Adult Literacy Discretionary and ONS Discretionary. Other Discretionary

contract types are excluded.

Cost Policies and Procedures Manual

The City of New York Health and Human Services Cost Policies and Procedures Manual (“Cost

Manual”) governs the treatment and claiming of costs for health and human service contracts. If

there is a conflict between the terms of DYCD’s Fiscal Manuals and the Cost Manual, the Cost

Manual shall take precedence.

The Cost Manual was established to set guidance on indirect cost rate development and cost policies.

The Cost Manual is updated continuously. Providers must check the Nonprofit Resiliency

Committee website for the most updated version.

https://www.nyc.gov/site/nonprofits/funded-providers/nonprofit-resilience-committee-resources.page

Exceptions:

Discretionary Contracts

The maximum Indirect Cost rate allowed by DYCD for Discretionary contracts is 10%.

City Council Discretionary contracts are exempt from the Cost Manual and from the ICR

funding initiative.

Fiscal Agent Contracts

Providers under the Fiscal Agent with an Indirect Cost Rate must submit an attestation form

for reimbursement. Forms are available from the Fiscal Agent upon request and on the

DYCD website, Agency Payment Unit, Required Documents for HHS section.

6

BUREAU OF BUDGET AND FINANCE (BBF) OVERVIEW

BBF has three units that interact with Providers. Below is a description of each unit and its functions.

1. Budget Review, Insurance Compliance and Contracting Systems (BRICCS)

Budget Review is responsible for ensuring that budgets and budget modifications are in compliance

with City of New York and DYCD rules and regulations regarding budgetary requirements and

fiscal accountability. Budget Review is also responsible for providing final approval of all budgets

and budget modifications submitted by DYCD Providers.

Budgets and Budget Modifications must be submitted via PASSPort and will be routed to the

assigned Budget Analyst. Once approved by the Budget Analyst, budgets and budget

modifications are routed to Budget Review Supervisor for final approval.

Insurance Compliance coordinates New York City’s Central Insurance Program (CIP) for Providers

that do not have their own general liability insurance. CIP includes specific insurance (General

Liability, Worker’s Compensation and Disability Insurance and Paid Family Leave Coverage) that

pertains to DYCD funded activities. Note: If a Provider chooses to participate in CIP but has

Worker’s Compensation and Disability coverage through another carrier, then the Provider will

have to submit those certificates to DYCD, and CIP will only provide General Liability coverage.

This unit is also responsible for collecting and maintaining the general liability insurance certificate

of each Provider not participating in CIP, to ensure compliance with contract requirements and

New York City Law Department’s insurance requirements.

2. Agency Payment Unit (APU)

The Agency Payment Unit (APU) is responsible for receiving PASSPort invoices, analyzing data,

issuing payments, and providing guidance on policy decisions for contracts paid through PASSPort.

A Fiscal Analyst is assigned to each contract and is responsible for the fiscal management of the

contract. The Fiscal Analyst will serve as the Provider’s contact person for policy and payment

Once a contract is registered with the NYC Comptroller’s office and there is an approved detailed

budget, an initial advance will be automatically initiated and processed by DYCD. Providers whose

contracts will not receive automatic advances will receive further instructions via email.

7

3. Contract Development Unit (CDU)

The DYCD Centralized Contracting Unit (CDU) offers specialized contract support and

guidance to providers funded under all DYCD Initiatives. CDU works directly with PACE (our

Procurement Department) and DYCD funded providers on the development of their contracts

from initiation to submission, by moving them through the City’s PASSPort Portal system to

ensure timely registration. CDU’s role in the contract management process starts once the contract

is initiated in PASSPort. CDU Contract Associates will review documents for accuracy and

completion and track the contract until it is registered. Contract Associates are also available to

assist with troubleshooting problems that may arise with PASSPort.

8

SECTION ONE: THE BUDGET

9

BUDGET OVERVIEW

After a contract is registered in PASSPort, Providers must prepare and submit a budget based on the

proposed services, funding availability and contract term.

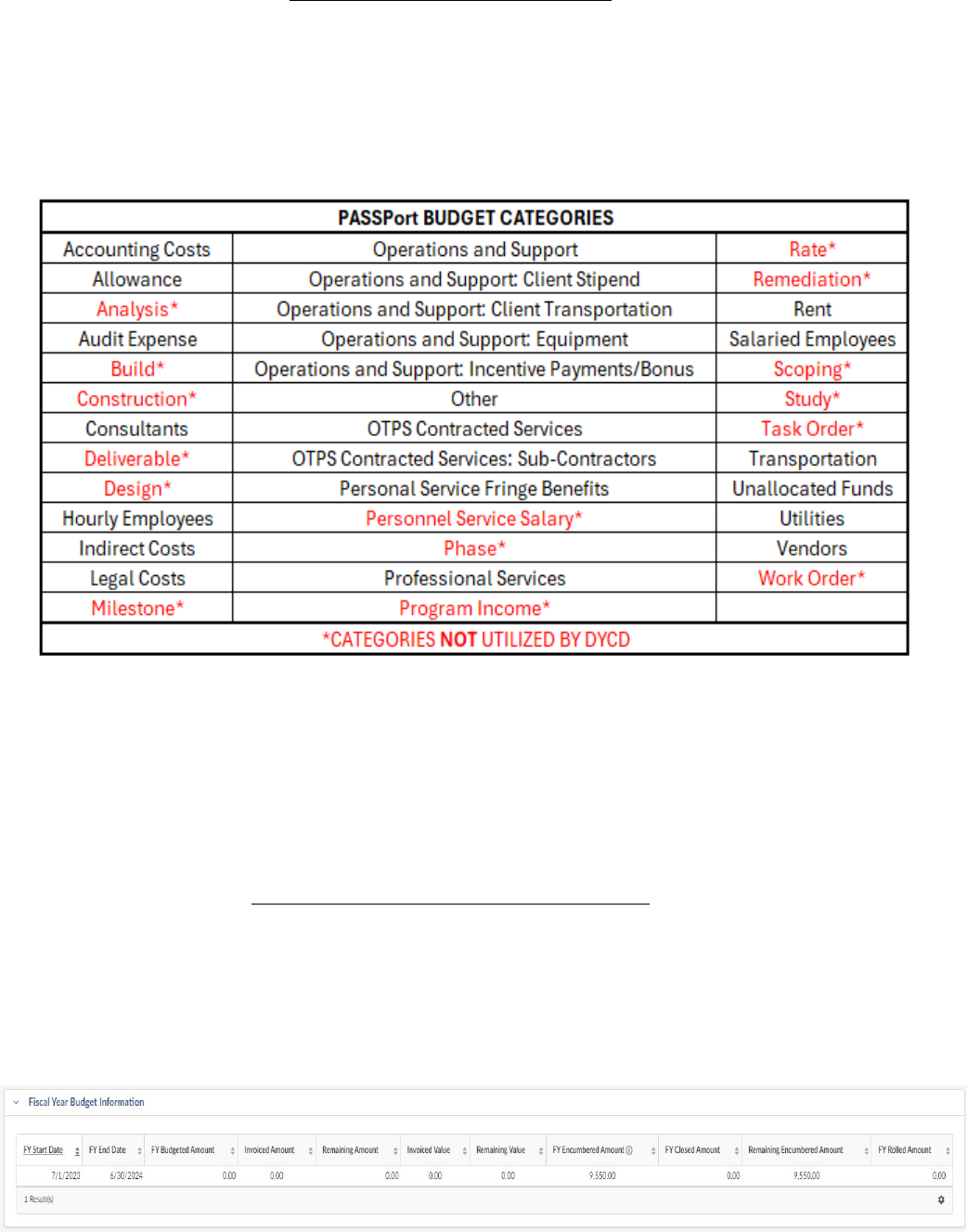

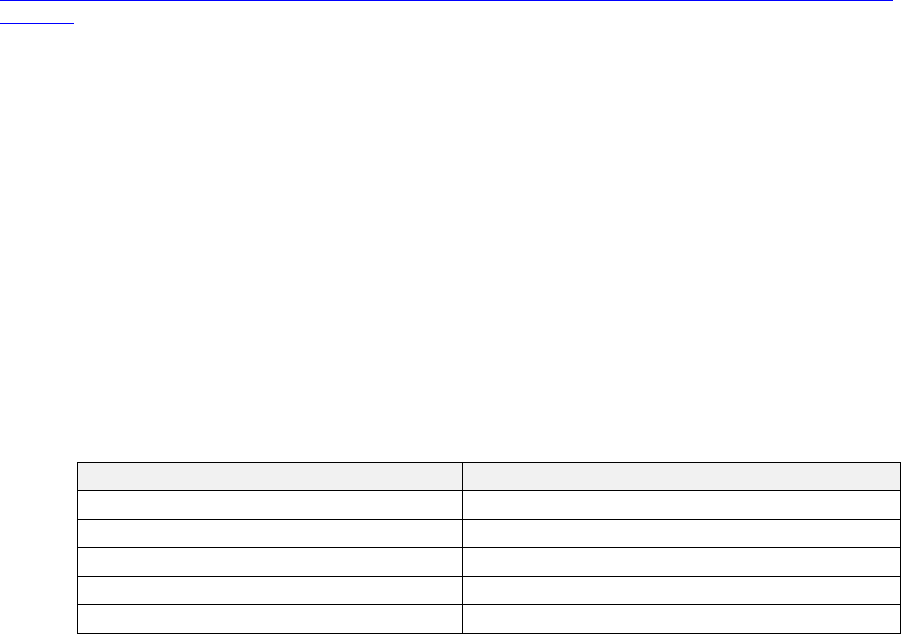

Below are the main budget item categories used by DYCD in PASSPort:

Completed budgets are submitted via PASSPort and first routed to the assigned DYCD Budget

Compliance Associate. The budget will be reviewed by fiscal staff within DYCD who will either

approve the Budget or return it to the Provider for revision.. The final budget approved by DYCD

will be included and made a part of the Provider’s contract.

GENERAL INFORMATION

Below is information to keep in mind as a DYCD budget is completed in PASSPort.

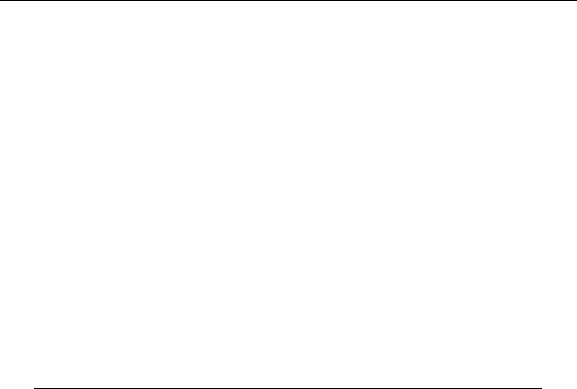

The first header in PASSPort is the Fiscal Year Budget Information which is pre-populated with the

FY Start Date, FY End Date and the FY Budgeted Amount applicable to the contract.

10

Operating Period

The term of the contract (start date to end date) may overlap with more than one Fiscal Year. The

City’s Fiscal Year runs from July 1

st

to June 30

th

.

PASSPort

Providers will submit their budgets through PASSPort . If a contract spans multiple years, the next

year’s budget template becomes available for submission within the final quarter of the current fiscal

year.

Insurance

Providers that choose not to buy into the CIP Insurance Program must provide DYCD with a

Certificate of General Liability Insurance, as well as any renewal certificates required during the

contract term. Providers are required to have General Liability Insurance in the sum of not less than

one million dollars ($1,000,000) per occurrence to protect Providers themselves and the City of New

York and its officials and employees against claims, losses, damages, etc. Required certificates not

presented in a timely manner may result in a delay in contract registration or may result in

suspension of a contract. The policy must include theft insurance to guard against loss of equipment

because of a break-in or robbery. Each Provider must be covered for loss due to burglaries,

vandalism, fire, or floods that affect equipment or furniture that is leased or purchased with DYCD

funds. If such equipment is lost or stolen, the Provider must obtain a police report detailing the

nature of the incident as well as submit a claim to the insurance carrier. In addition, the Provider

must submit an official report to DYCD. The Provider must replace lost or stolen DYCD equipment

with funds obtained from settlement of the claim. The Insurance Compliance Unit must receive

written notification within fifteen (15) days if the policy is cancelled during the contract term.

Insurance Requirements as of FY2024

The New York City Comptroller’s Office now requires that the Certificates of General

Liability Insurance have the National Association of Insurance Commissioner (NAIC #)

included on the right of the page, next to the insurer A box.

The City Law Department requires DYCD to ensure that all the Certificates of General Liability

for our contracted Providers contain the following statement in the box labeled “Description of

Operations/Locations/Vehicles”:

“The City of New York, including its officials and employees, is included as Additional

Insured.”

Furthermore, Programs located in Department of Education (DOE), or New York City

Housing Authority (NYCHA) facilities must carry insurance that covers and names the City

of New York and DOE or NYCHA, as the case may be, as Additional Insured. The

Certificate for such a program must contain the following statement in the box labeled

“Description of Operations/Locations/Vehicles”:

11

“The City of New York, and the Department of Education of the City School District of the

City of New York [or New York City Housing Authority], including their officials and

employees, are included as an Additional Insured.”

Additionally, each certificate of insurance must be accompanied by a copy of the

endorsement that is used for the Provider’s policy. If the endorsement contains a box titled

“Location(s) Of Covered Operations,” then it must list the location where services are being

provided.

If services are provided in multiple locations, under “Location(s) Of Covered Operations,” the

Provider must include the following language: “All locations of operations that are listed

in the contract(s)” in lieu of having to list each location where services are provided.

Samples of the Certificates of Insurance and endorsements are available on the DYCD

website.

Providers must make available a Certificate of Insurance, together with a notarized Broker’s

Certificate, and the Additional Insured Endorsement, to DYCD. Providers must also submit

any renewal certificates required during the contract term. Required certificates not presented

in a timely manner may result in suspension of the contract. DYCD retains the right to enroll

a non-compliant Provider in CIP and to withhold 4.5% of the contract to cover the cost of

CIP participation.

Additionally, Providers must also provide proof of Workers’ Compensation, Disability

Insurance and Professional Liability (if applicable), as well as any renewal certificates

required during the contract term. Please note that the ACORD forms are not acceptable

proof of Worker’s Compensation and Disability Insurance. Acceptable forms include but

are not limited to: C-105.2, U-26.3, SI-12, GSI-105.2, DB-120.1, DB-155 and CE-200.

Providers can email these proofs of insurance documents directly to

Automobile Liability Insurance

a. If vehicles are used in the provision of services under this Agreement, then the

Contractor shall maintain Business Automobile Liability insurance in the amount of

at least One Million Dollars ($1,000,000) for each accident combined single limit

for liability arising out of ownership, maintenance, or use of any owned, non-

owned, or hired vehicles to be used in connection with this Agreement. Coverage

shall be at least as broad as the most recently issued ISO Form CA0001.

b. If vehicles are used for transporting hazardous materials, then the Business

Automobile Liability Insurance shall be endorsed to provide pollution liability

broadened coverage for covered vehicles (endorsement CA 99 48) as well as proof of

MCS-90.”

Please submit copies of the policy to [email protected].

All other mandatory insurance policies must be made available for inspection by DYCD staff, CPA

Auditors, and/or other authorized agents.

12

Employers

Employer’s FICA and MTA Tax are budgeted at 8.25% of total salaries. The maximum of wages

taxed for the Social Security portion of FICA can be found at www.ssa.gov. Please note that these

rates and dollar amounts are determined by the Federal government and are subject to change.

The Metropolitan Commuter Transportation Mobility Tax (MCTMT) is imposed on employers

and/or self- employed individuals who are required to withhold New York State income tax from

wages and whose payroll expense for covered employees in the Metropolitan Commuter

Transportation District (MCTD) exceeds $312,500 in any calendar quarter. The MCTD consists of

the five boroughs of New York City.

MTA Tax Rate Effective 07/01/2023: 0.60% (0.0060)

If a lower rate applies to your organization, then kindly provide documentation upon budget

submission.

A full list of rates based on payroll expenses can be found at the following link:

https://www.tax.ny.gov/bus/mctmt/emp.htm

State Unemployment Insurance (SUI)

SUI is budgeted at the Provider’s insurance rate for up to and including the “wage base,” which is --

the amount of an employee’s wages used to calculate an employer’s Unemployment Insurance

contributions. The table below lists the wage bases for 2017-2026.

Please note: Terminated staff as well as new staff hired within the same calendar year must be

covered by SUI.

January 2017

$10,900

January 2024

$12,500

January 2018

$11,100

January 2025

$12,800

January 2019

$11,400

January 2026

$13,000

January 2020

$11,600

January 2021

$11,800

January 2022

$12,000

January 2023

$12,300

After 2026, the wage base will be adjusted on the first day of January each year to 16 percent of the

state's average annual wage.

Medical Benefits, Life Insurance, Pension, Workers Compensation, and Disability costs are to be

calculated based upon the Provider’s policies.

13

COMPLETING THE DYCD BUDGET

Organizations can create and modify budgets of their active contracts in PASSPort, using Purchase

Orders and Purchase Order Change Request (POCRs.)

The user creating and modifying budgets must have the Vendor Admin or Vendor Financial L2

roles in PASSPort.

Below are the Item Categories applicable to DYCD contracts available in the detailed budget in

PASSPort and a description of each category.

PASSPORT ITEM CATEGORIES

Accounting Costs

Expenses for financial record-keeping, reporting, and analysis. This includes hiring Accountants and

Bookkeepers, accounting software subscriptions, and related expenditures.

Allowance

Health and Human Service contracts increased the contract authority by 25%; however, the full

amount reflected in the allowance are not funds Providers immediately have access to. As additional

funding is awarded to an existing contract and the contingency amendment is registered, DYCD will

process a financial contract change request (FCCR) to the contract in PASSPort to reflect the

additional funds. This will appear in PASSPort as a Change Order Budget. When submitting a

Change Order Budget, please include the PDF emailed to your organization. Budgets will not be

approved without the PDF included in the PASSPort budget submission.

Audit Expense

Expenses for financial review services, including fees for external auditors, internal audit teams,

consulting, and related expenses

Consultants

A consultant hired on a health and human service contract is often a subject matter expert and does

not perform or directly deliver a part of the prime contractor’s programmatic contractual obligations.

This means anyone assisting the Provider and not dealing directly with participants (ex: a STEM

curriculum developer). Consultants cannot be salaried employees of the Provider. For each

consultant listed, a signed Consultant Agreement must be uploaded to the Documents tab in the

budget. Consultants retained by a Provider must enter into a written agreement detailing the specific

tasks to be performed. Consultant Agreements and invoices must be maintained by the Provider for

at least six (6) years. Consultant invoices must include the following details: rate, hours, type of

services, date of service, consultant signature, and approval by the Provider’s Executive Director or

his/her designee.

14

Hourly Employees

For DYCD contracts, an Hourly Employee is defined as someone who is scheduled to work less than

35 hours per week and/or is paid on an hourly basis and retains a part-time employment status with

the Provider. An hourly employee is allowed to work more than 35 hours per week during a specific

season (e.g., summer) but must maintain an overall part-time status.

New York City Minimum Wage is $16/hr.

Indirect Rate

Indirect Rate (Indirect Costs)

Effective July 1, 2019, The City of New York Health and Human Services Cost Policies and

Procedures Manual (“Cost Manual”) governs the treatment and claiming of costs for health and

human service contracts. If there is a conflict between the terms of DYCD’s Fiscal Manuals and

the Cost Manual, the Cost Manual shall take precedence. The Cost Manual was established to set

guidance on indirect cost rate development and cost policies. The Cost Manual can be found at

the link below:

For additional information on Indirect Costs, refer to the Nonprofit Resiliency Committee

Indirect Implementation.

https://www1.nyc.gov/site/nonprofits/funded-providers/indirect-implementation.page

Discretionary Contracts

The maximum Indirect Cost rate allowed by DYCD for Discretionary contracts is 10% of the

cleared amount. City Council Discretionary contracts are exempt from the Cost Manual and from

the ICR funding initiative.

Fiscal Agent Contracts

Providers under the Fiscal Agent with an Indirect Cost Rate must submit an attestation form for

reimbursement.

Legal Costs

Legal costs cover expenses for legal services vital to ensuring compliance, risk management, and

protection of organizational interests. Funds cannot be used for litigation expenses, legal settlements,

or legal judgements.

Operations and Support

Consumable supplies that do not last or are not permanent in nature. This category includes

office and maintenance supplies such as pens, stationery, chalk, erasers, towels, cleaning

supplies and books. This category also includes expenses for background checks of the

Provider’s employees and Facility Safety inspections. The cost of waste and recycling removal

services may also be included in this category. Costs for facilities and building maintenance may

also be included in this category. Other costs that fall within this category are cost of materials

associated with recruitment such as flyers, newspaper, and online advertisements for

Participants; costs of General Liability, Property, and Other Insurance charged to a DYCD

contract; costs of vehicle insurance associated with the DYCD contract. Providers must charge

expenses for business-owned vehicles such as car maintenance, gasoline, and tolls to this

15

category. Provider-owned vehicles used for DYCD purposes must be co-insured with the City

of New York as named beneficiary. Tickets for traffic violations may not be paid with funds

from DYCD contracts; Standard banking fees associated with the DYCD contract. and may not

be paid with funds from DYCD contracts.

Office of Neighborhood Safety

Due to the nature of the services provided under Office of Neighborhood Safety (ONS) contracts,

certain emergency participant expenses are allowable which are otherwise not allowable for other

DYCD contracts. These emergency participant expenses are expected to be infrequent and only

required in the most critical circumstances to prevent loss of life and or an imminent threat of

violence.

Operations and Support: Client Stipends

Unless the RFP or other contract documents specifically require use of stipends as part of the

program design, the DYCD funded Program must as part of the budget approval process explain, in

writing, how the type and amount of stipend were selected and how the stipend advance the

program. To ensure fair access to and fair distribution of stipends, DYCD funded programs seeking

to use a stipend must also provide written notification to participants and volunteers regarding the

stipend policy, at the outset of program participation. The notice must explain how the stipend will

work. In addition, a copy of the notice must be provided to DYCD, along with the written

explanation of the proposed stipend program being submitted as part of the budget approval process.

Programs will not be able to use program funds to pay volunteers (including mentors) for their time

volunteering. Instead, Programs may thank volunteers by offering to defray the cost of them

travelling by public transportation to the program location, by providing a subsidized meal or snack,

or by recognizing volunteers with a certificate. All use of program funds for payment of stipends are

subject to review by DYCD program staff and are also subject to audit by DYCD or DYCD’s

oversight agencies. Adequate records of expenses for stipends must be maintained, and those will

include invoices for any items purchased and receipts signed by the specific individuals receiving

any item.

In addition, appropriate safeguards must be followed. For example, items with a cash value, such as

gift cards, must be maintained in a safe or other secure location. In all cases, proper procedures must

be followed to make sure that only the intended recipients of the stipend or incentive actually receive

them and then that the stipends are paid/distributed in accordance with the terms of the plan

approved by DYCD.

Please note that for programs funded with federal funds, additional limitations do apply, including prohibition

of the use of federal funds for entertainment costs, compliance with the federal cost’s principles in 2 CFR Part

200, and programmatic guidelines and requirements that may be provided by certain programs.

Operations and Support: Client Transportation

All participant-related travel expenses, e.g., bus trips and local travel, are to be budgeted under this

category. Bus companies used for transporting participants must be insured.

16

Operations and Support: Equipment

Equipment purchases are supplies that are durable or permanent in nature, such as furniture, printers,

fax machines, televisions, cameras, and computers. All equipment purchased with DYCD funds

must be listed on the budget. All equipment and/or furniture purchased with DYCD funds is the

property of the New York City Department of Youth and Community Development and must be

tagged “Property of DYCD.” At the end of the contract, all non-depreciated equipment that still has

a useful life and was purchased with DYCD funds must be returned if requested by DYCD. DYCD

will consider requests for continued use or other recommended disposition of such equipment, upon

termination or nonrenewal of a contract. Contact the assigned Contract Manager regarding continued

use or other disposition of equipment.

An Equipment Purchase Inventory report will be required at the time of invoice submission.

For equipment $500 or more the following must be provided:

*This also applies to CDBG funded contracts for equipment valued at $250 or more.

1. Equipment Amount

2. Invoice Amount

3. Item description

4. Serial number

5. Model number

6. Manufacturer

7. Date Purchase

8. Delivery Date

For equipment under $500 or for CDBG funded contracts for equipment valued under $250 the

following must be provided:

1. Equipment Amount

2. Invoice Amount

3. Item description

4. Manufacturer

5. Date Purchase

6. Delivery Date

WIOA Equipment Requirements

Equipment valued at $5,000 or more may not be budgeted or purchased without prior approval

from DYCD, which is also subject to obtaining approval from the New York State Department of

Labor (NYS DOL). Accordingly, Providers will not be reimbursed the cost of any Equipment

purchased without such prior approvals.

The Equipment category also includes costs associated with equipment rental, lease, licensing

fees, computer software, repair and maintenance of office/programmatic equipment used in the

performance of the Provider’s operation. All items must be listed in the budget. Maintenance

service contracts and payments for equipment repair and maintenance may also be reflected in

this category. (Equipment or furniture leased with an option to buy may also become the property

of DYCD at the end of the contract.)

17

Office of Neighborhood Safety

Due to the nature of the services provided under Office of Neighborhood Safety (ONS) contracts,

Vehicle Purchases are allowable which are otherwise not allowable for other DYCD contracts. A

signed Equipment Vehicle Approval form is required prior to purchase. The completed form must be

submitted to DYCD Program Operations for approval. The form is available on the DYCD website,

Budget Review & Risk Management page.

Operations and Support: Incentive Payment/Bonus

Unless the RFP or other contract documents specifically require use of incentives as part of the program

design, the DYCD funded Program must as part of the budget approval process explain, in writing, how the

type and amount of incentive were selected and how the incentive advance the program. To ensure fair

access to and fair distribution of incentives, DYCD funded programs seeking to use an incentive must also

provide written notification to participants and volunteers regarding the incentive policy, at the outset of

program participation. The notice must explain how the incentive will work. In addition, a copy of the

notice must be provided to DYCD, along with the written explanation of the proposed stipend/incentive

program being submitted as part of the budget approval process.

Programs will not be able to use program funds to pay volunteers (including mentors) for their time

volunteering. Instead, Programs may thank volunteers by offering to defray the cost of them travelling by

public transportation to the program location, by providing a subsidized meal or snack, or by recognizing

volunteers with a certificate. All use of program funds for payment of stipends and incentives are subject to

review by DYCD program staff and are also subject to audit by DYCD or DYCD’s oversight agencies.

Adequate records of expenses for stipends and incentives must be maintained, and those will include

invoices for any items purchased and receipts signed by the specific individuals receiving any item.

In addition, appropriate safeguards must be followed. For example, items with a cash value, such as gift

cards, must be maintained in a safe or other secure location. In all cases, proper procedures must be

followed to make sure that only the intended recipients of the incentive actually receive and that the

incentives are paid/distributed in accordance with the terms of the plan approved by DYCD. Please note

that for programs funded with federal funds, additional limitations do apply, including prohibition of the

use of federal funds for entertainment costs, compliance with the federal cost’s principles in 2 CFR Part

200, and programmatic guidelines and requirements that may be provided by certain programs

Other

Any allocation that cannot be placed in other defined categories. A detailed explanation must be provided.

OTPS Contracted Services: Sub-Contractors

A Subcontractor hired on a health and human service contract is hired to perform or directly deliver a part

of the prime contractor’s programmatic contractual obligations. This means that anyone dealing directly

with participants, whether an individual or an entity, (ex: a STEM teacher that teaches a robotics class).

Subcontractors are to be listed in the Subcontractor section of the Contracted Services tab of the Budget.

For each Subcontractor listed, a signed Subcontractor Agreement must be uploaded to the Documents tab

in the budget.

18

Subcontractor Approval Process

If a Provider proposes to engage a Subcontractor on a human service contract,

DYCD requires:

1. The Subcontractor to be listed in the City’s Payee Information Portal (PIP) nyc.gov/pip and

2. The Provider must identify the Subcontractor through the budget and invoice process. The Provider

shall attach the Subcontract agreement to the fiscal year budget.

For any Subcontractor of more than $20,000*, DYCD also requires:

1. The Subcontractor to be prequalified in PASSPort, and

2. For subcontract agreements $20K and over, the CBO must submit the agreement to the

Program Team for transmittal to the Procurement Unit.

3. The CBO must upload the Subcontract Agreement with a copy of the letter of

confirmation from DYCD’s PACE unit to the fiscal year budget.

Subcontractors are approved for work on a human service contract when:

1. DYCD’s PACE Unit approves the subcontractor in PIP.

2. The Provider has received a letter of confirmation from DYCD’s PACE unit

The Provider should not engage a subcontractor until DYCD has approved that subcontractor.

The prime vendor is responsible for listing all payments to subcontractors in PIP.

*For determining the value of a subcontract, all subcontracts with the same

subcontractor shall be aggregated.

PASSPort requirement also applies to Subcontractors receiving more than $100,000 in City

dollars.

DYCD offers a standard Subcontract Agreement template for human service contracts that

Providers may use but are not required to use.

For Subcontract agreements pending approval, please allocate funds to the Unallocated Funds category.

Once the Subcontractor agreement is approved, the provider must complete a POCR to reallocate funds

to the OTPS Contracted Services: Subcontractors category.

Personnel Services: Fringe Benefits

The maximum rate allowed for fringe benefits is 35% of total salaries. The rate includes all benefits under

the Fringe Benefits category. Fringe Benefits may include FICA, MTA Tax, Unemployment Insurance,

Workers Compensation, Disability, Life Insurance, Pension, and Medical Benefits.

Effective fiscal year 2024, the minimum Fringe Benefit rate of 8.25% for FICA and MTA tax is required

for all contracts. If a Provider utilizes the service of the Fiscal Agent, then the minimum allocation for

fringe is 13.25%. This represents 7.65% for FICA, 0.6% for MTA Tax plus a 5% estimated

Unemployment Insurance rate.

Professional Services

Expenses associated with specialized expertise and support essential for the operation which includes but is

not limited to training and professional development programs, outsourced administrative support.

Additionally, it may encompass expenses for licensing, accreditation, and regulatory compliance services.

Costs for Vendors, Consultant and Sub-contractor must NOT be allocated to this line.

Allocations for AmeriCorps or City Year must be allocated to this category.

19

Rent

Space costs include expenses associated with paying for space necessary for the operation of a

program. Space Cost is separated into two subcategories that will require additional fields:

Public School

Opening fees and room rentals paid to the Department of Education for school rental costs.

Providers must complete a Space Cost Allocation Plan and provide the DOE permit.

Space Cost/Other

All rent, mortgage and other expenses associated with the use of a facility.

Along with the budget, Providers are required to upload into the Documents tab the following:

1. A copy of their mortgage, lease, or month-to-month rental agreement.

2. A copy of their floor plan (annotated with dimensions of all space leased/mortgaged/rented

and the dimensions of just the space used by the program funded by the contract).

3. A completed Space Cost Allocation Form.

The FY2024 Space Cost Allocation form is available on DYCD’s website, under Budget Forms,

Fiscal Year 2024. Note that the form was revised in FY 2023 and the revised version must be

submitted with all budgets that include space costs.

The updated Space Cost Allocation form includes:

1. An expanded section to document the calculation used to determine the space cost dollar amount

allocated to the contract budget.

2. A second page, titled Space Cost Allocation Attestation. The Attestation captures information about

the landlord/lessor of the property. The Attestation must be completed (completion includes

checking at least one of the six boxes on the form and being signed and dated by the Executive

Director).

No renovation or construction projects may be paid for with funds from DYCD contracts unless

otherwise specified in the contract. Some repairs may be allowed, subject to prior written approval

by DYCD. Rent or mortgage expense greater than the amount stated in the mortgage, lease, or

month-to-month rental agreement is not allowed.

Salaried Employees

For DYCD contracts, a Salaried Employee is defined as a full-time employee who works 35 hours or

more per week, is paid on a salary or hourly basis and retains a full-time position with the Provider. A

full-time employee shall not be claimed as a part-time employee because their hours are cost-allocated

between contracts. For example, if the employee is full-time and is scheduled to work 20% of their time

on a DYCD contract, they are still considered a full-time employee per DYCD claiming purposes.

Limitation on Salary for Federally Funded Contracts (CSBG, CDGB and WIOA)

The limitation on salary compensation which can be charged to federally funded contracts is based on

Federal Executive Pay Level II under US Public Law 109-234 enacted in 2006. The annual rate for

Federal Executive Pay Level II is $212,100 (Effective January 2023). Individuals who have a

percentage of their total salary cost allocated are limited to their cost allocated percentage applied to the

Executive Pay Level II rate. For example, someone who earns $200,000 that spends 50% of their time

on is eligible to have up to $98,650, not $100,000.

20

The pay level may change annually; refer to this website for updates:

https://www.opm.gov/policy-data-oversight/pay-leave/salaries-wages/2023/executive-senior-level

Salaries & Wages chart can be obtained below:

https://www.opm.gov/policy-data-oversight/pay-leave/salaries-wages/salary-tables/pdf/2023/EX.pdf

Cost Allocation

An employee paid with DYCD funds must perform work related to the DYCD contract.

Administrative staff performing work under DYCD contracts must be cost-allocated under Personnel

Services or budgeted under the Indirect Costs rate category. Providers may have employees work

under multiple program budgets. Actual hours of service are the preferred statistical basis upon

which to allocate salaries and fringe benefits for shared staff who work on multiple programs.

Providers must maintain appropriate documentation reflecting the hours used in this allocation.

Acceptable documentation may include payroll records or time studies. The total of all amounts

budgeted to one staff person (including programs not funded by DYCD) cannot exceed 100%.

Time sheets for all full-time and part-time employees must be dated and signed by the employee and the

employee’s supervisor and are subject to review by DYCD and its designees.

The Executive Director’s time sheet must be signed by a member of the Board of Directors. The

required director’s signature may NOT be replaced by the signature of another member of management

(e.g., comptroller or accountant).

Transportation

Transportation costs refer to costs incurred for local travel by the employees to conduct official business

related to the DYCD contract. Travel may be by public transportation, by a Provider’s vehicle, or personal

automobiles used for Provider business. Costs for the use of a personal automobile will be reimbursed at

the maximum rate provided on the IRS website IRS Standard Mileage Rate. A mileage log must be

maintained for both personal and business-owned vehicles used to conduct business related to the funded

program. Tickets for traffic violations may not be paid for with funds from DYCD contracts. Additionally,

costs for employees to commute to and from work may not be paid with funds from DYCD contracts.

Office of Neighborhood Safety (ONS)

Office of Neighborhood Safety (ONS) contracts are exempt from this requirement.

Due to the nature of services provided under the Office of Neighborhood Safety (ONS), certain

emergency expenses in local transportation for uber and cabs are allowable, which are otherwise

not allowable for other DYCD contracts. These emergency staff expenses are expected to be

infrequent and only required in the most critical circumstances to prevent loss of life and or an

imminent threat of violence.

Out of Town travel (outside of the five boroughs) costs may be allowed for expenses that are relevant

to the program, such as training, professional development, and conferences.

Expenses include transportation, accommodations, and meals. Pre-Approval is required.

21

Unallocated Funds

Providers must identify the category and allocation being budgeted under Unallocated Funds.

The only categories allowed under Unallocated Funds are:

1. Central Insurance Program (CIP)

Providers have the option of buying into New York City’s CIP. The package offered under this program

includes General Liability Insurance, Workers Compensation, and Disability Insurance and Family Leave

Coverage. The insurance does not cover property loss and theft insurance. The cost of the CIP Insurance

Package is 4.5% of the contract’s total budget and must be allocated in the Unallocated Funds tab. CIP

cannot be purchased for a portion of the contract term. Entering the Central Insurance Program covers the

Provider for the full contract year.

2. Subcontractor Agreements (Pending Approval)

Allocations for subcontractors that have not yet been identified or for those whose agreements are

pending approval, must go into the Unallocated Funds tab. Once the Subcontractor has been

identified, or the agreement, if applicable, has been approved, the Provider must modify these

funds into the Subcontractor line on the Contracted Services tab. All applicable subcontract (s)

must be approved prior to the start of subcontractor services.

3. Fiscal Agent Services and associated Fiscal Agent Fees)

DYCD has contracted with a firm to provide fiscal agent services to DYCD funded Providers.

Providers have the option of purchasing the services of the Fiscal Agent who will:

Establish financial records.

Maintain and report on available Provider budget balance.

Verify invoices.

Provide payroll services and personnel reporting.

Ensure the timely filing and payment of employment-related taxes.

Ensure that Accounts Payable and Ledger system and activities are in accordance with

generally accepted accounting practices and procedures.

File Federal Tax Form 941 and 941B.

Prepare W2s, W3s, and 1099s.

Fiscal Agent Fees

Fees for using the services of the Fiscal Agent must be allocated in the Unallocated Funds tab in

accordance with the scale indicated below. Separate fees must be allocated for each individual site

for master contracts with multiple sites. Effective 07/01/18 the Fiscal agent fee has changed, see

below.

DOLLAR VALUE FISCAL AGENT SERVICE FEES

$2,500 - $25,000 $420

$25,001 and Over 3% of each sub budget

Note: There is no Fiscal Agent fee required for Providers with standalone Discretionary contracts,

valued under $25,000. A Provider that chooses to be placed under, or is mandated to use, the services

of the Fiscal Agent, must have all its non WIOA DYCD contracts administered by the Fiscal Agent.

The Fiscal Agent fees are centrally administered costs and are not reimbursable. Those agencies

mandated for Fiscal Agent services will receive written notification from DYCD.

22

4. Rent (pending duly executed lease agreement)

5. Consultant (pending duly executed agreement)

6. Incentive Plans (WIOA - pending approval)

7. Vehicle Purchase Request (pending approval)

These items are covered and paid for by DYCD. The costs are non-reimbursable, and Providers will not

have access to these funds.

Once agreements are approved and duly executed, Providers may process a POCR/budget modification

and allocate these costs to the appropriate budget item category.

Utilities

This category includes costs such as Telephone; Electric; Water/Sewer; Oil-Heating; Gas-Heating; Security

Systems; Internet Connectivity; Mobile Phones; Bundled Communication.

Vendors

A vendor hired on a health and human service contract provides non-programmatic services or goods.

Examples of services provided by vendors are cleaning and security. Vendor Agreements must be

maintained on file with the Provider for a minimum of six (6) years. Providers must follow the purchasing

procedures outlined in the Fiscal Manual for the procurement of services from vendors (Section 4)

23

PROVIDERS: COMPLETING

THE

DYCD

BUDGET

A Provider’s base contract or amendment will be registered with a simplified budget. Once it is

registered, the Provider will be required to submit a Purchase Order Chage Request (POCR) to

reallocate funds to specific budget item categories applicable to their contract.

Once the POCR is initiated, the first step is to void the original budget used for registration.

Step 1: Void Budget Lines

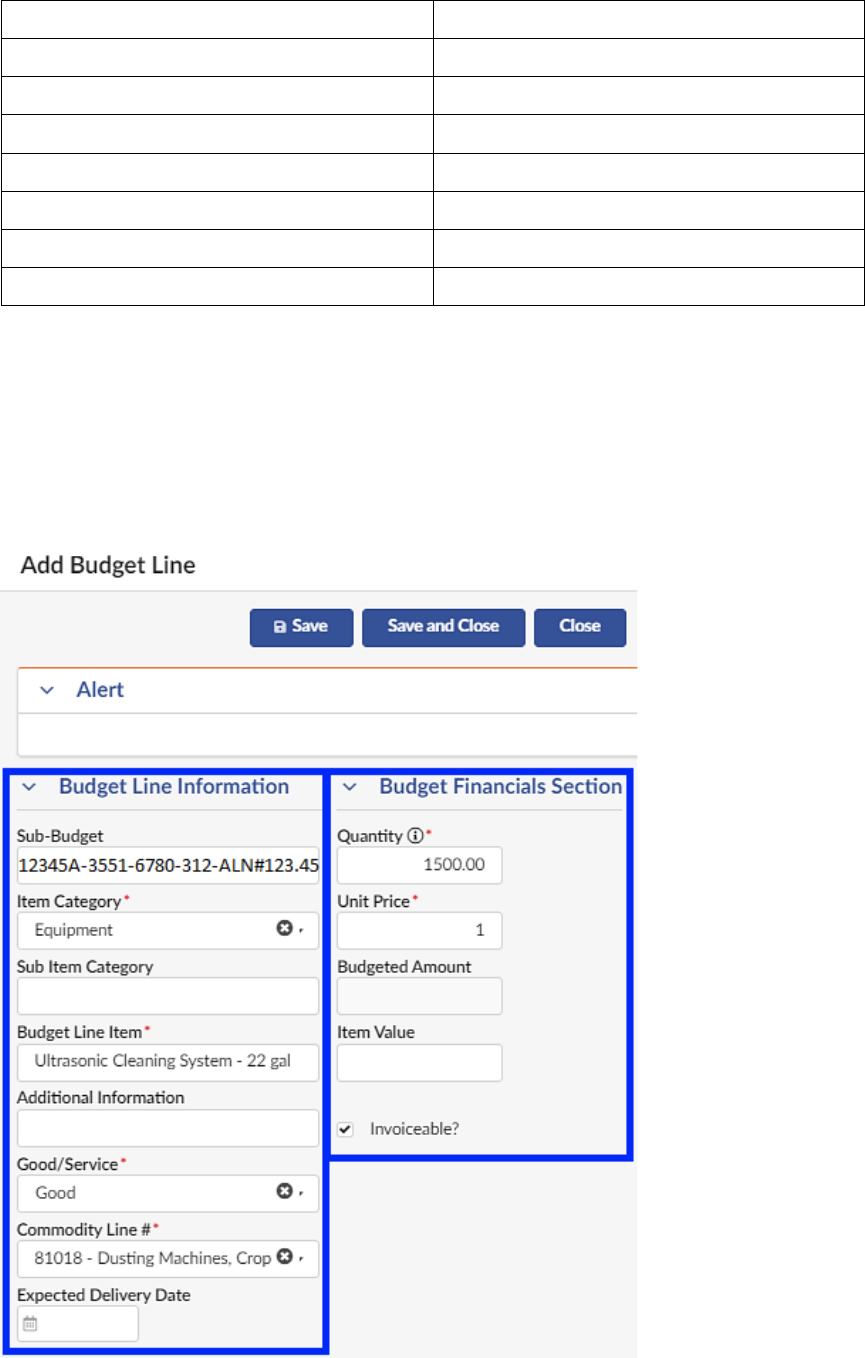

To edit or void an existing line, click the pencil icon on the left of the budget line. This will open

an Add Budget Line window.

In the Add Budget Line window, remove information from the following text fields in the

Budget Line Information section:

Sub-budget

Sub Item Category

Additional Information

For required fields under the Budget Line Information section:

Click on the Item Category drop-down field and select Other.

Click on the Budget Line Item text field and enter "Void Line".

For fields under the Budget Financials Section:

Click on the Quantity text field and enter 0.

Click the Save and Close button to close the Add Budget Line window.

Step 2: Add Budget Lines

To add new budget lines individually, click the Add Budget Line button. An Add Budget

Line window will pop up.

Fill out the required information in the Budget Line Information section:

1.

i. Migrated budgets of site-based contracts will reflect the sites in

PASSPort on every budgeted line. When creating POCRs to these

budgets, remove the site names from the sub-budget title.

ii. For example: The sub-budget name will change from Contract number

- budget code/object code/u of a - site to Contract number - budget

code/object code/u of a

• 12345 - 9562/6950/312 - P.S. 30 to 12345 –

9562/6950/312

iii. For a non-site-based contract, the sub budget column should

reflect: 12345 - 9562/6950/312

24

b. For Tax Levy contracts, the Sub-Budget field must be in the following format:

Contract number - budget code/object code/u of a

i. Example for contract 12345 funded by budget code 9562, object code

6950, u of a 312

ii. The sub budget column should reflect: 12345 - 9562/6950/312

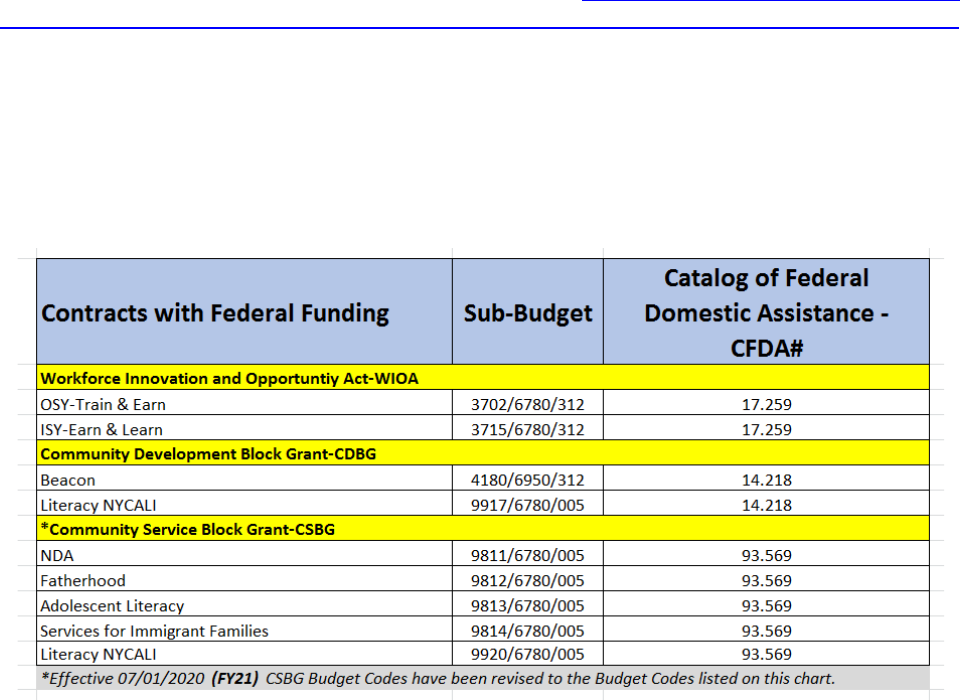

c. Federally funded contracts must include the ALN# in the following format:

Contract number/budget code/object code/u of a - ALN#[Number]

i. Example for contract 12345 funded by budget code 9562, object code

650, u of a 312, funded by WIOA ISY 1015 with ALN# 93.75

ii. The sub budget column would reflect: 12345 - 9562/6950/312 - ALN#93.75

d.

e.

2. If applicable, complete “Personnel Services Allocation Form” providing appropriate title codes,

number of positions, and where applicable the annual salary and/or hourly rate.

a. Providers should consolidate Personnel Services line items based on title code

while preserving a clear differentiation between salary structures. Hourly

positions should not be consolidated with salaried positions and not combined

across sub-budgets. For example: Two hourly-paid Accountants can be

consolidated on one line and two salaried Accountants can be consolidated on one

line, but the hourly paid and salaried paid Accountants cannot be consolidated on

one line. If one of the salaried accountants is being allocated to budget code 9825,

and the other to 3625, they must not be combined.

b. Additional Information text box must be used to reflect # of positions for

personnel services.

Click the Item Category drop-down field and select a category that describes your

deliverable.

Click the Budget Line Item text field and enter a description for your deliverable.

o Ultrasonic Cleaning System – 22 gal.

o Personnel Service Salaried or Hourly

Click the Good/Service drop-down field and select ‘Service’. Only the

“service” category is applicable to DYCD contracts. This field is

mandatory, and your budget cannot be approved if it is not selected.

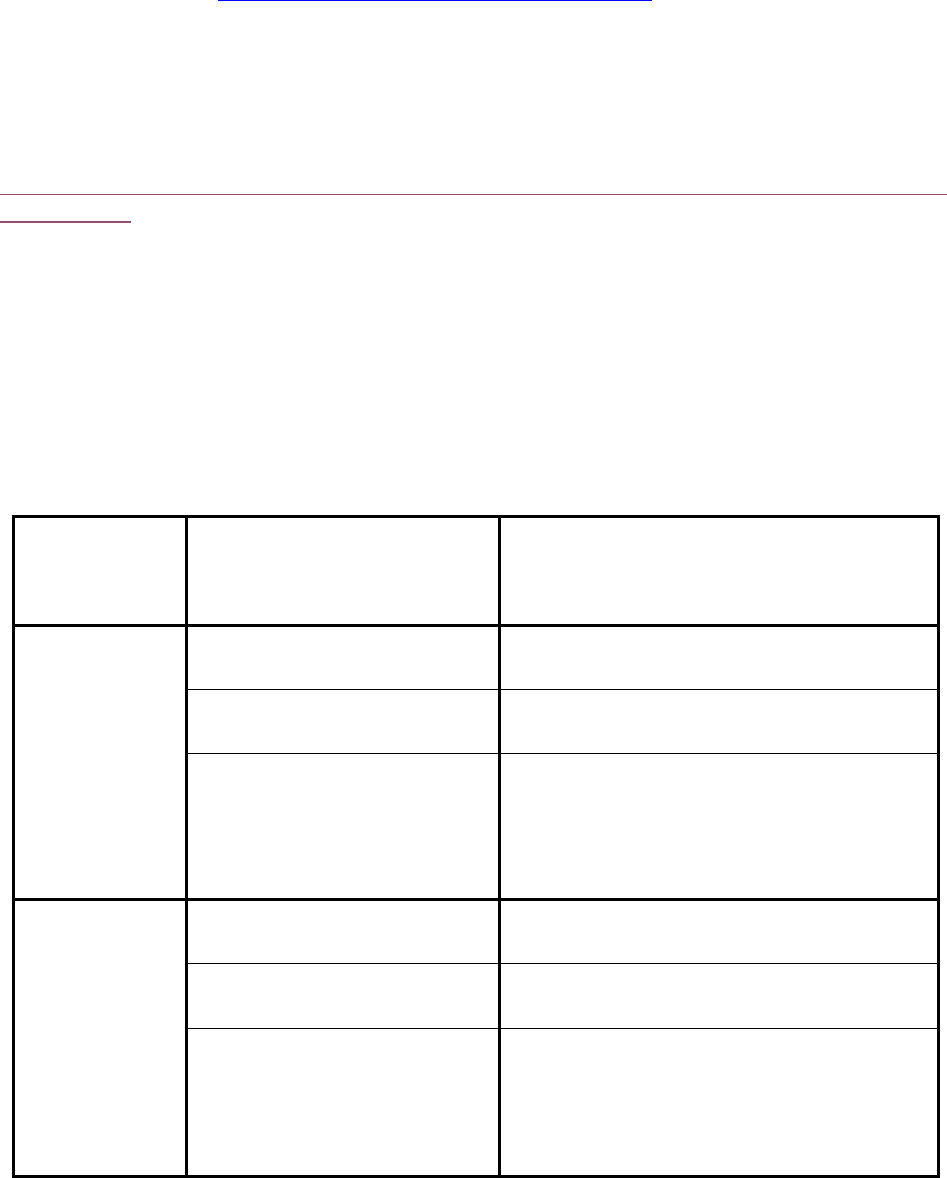

Step 3: Upload Backup Documentation

DYCD requires submission of backup documentation if a Provider has funding allocation in the

categories listed below. If not applicable, proceed to step 4.

In the Overview Tab, scroll down to Vendor Files, click the “Click or Drag to add files” to upload

required documents.

25

Budget Allocation Required Attachment

Rent Space Cost Allocation Form

Learn and Earn Learn and Earn Work Experience Tracker

Train and Earn Train and Earn Work Experience Tracker

Personnel Service Personnel Services Allocation Form

Consultants Consultant Agreement

Subcontractor Subcontractor Agreement

Vehicle Purchase Vehicle Purchase Approval Form

Fill out the required information in the Budget Financials Section:

Click the Quantity text field and enter the budget amount.

Click the Unit Price text field and enter 1. Setting Unit Price to 1 is required since the

unit price is not editable after submission.

Quantity should reflect the dollar amount being allocated to the contract for that line

item.

26

Click the Save and Close button near the top of the Add Budget Line window.

If necessary, add more budget lines to ensure the Total Budgeted Amount matches the FY

Budgeted Amount.

Click the Add Budget Line button and repeat the process for additional

deliverables until the budget is balanced.

For more detailed budgets, see Using Upload Budget below.

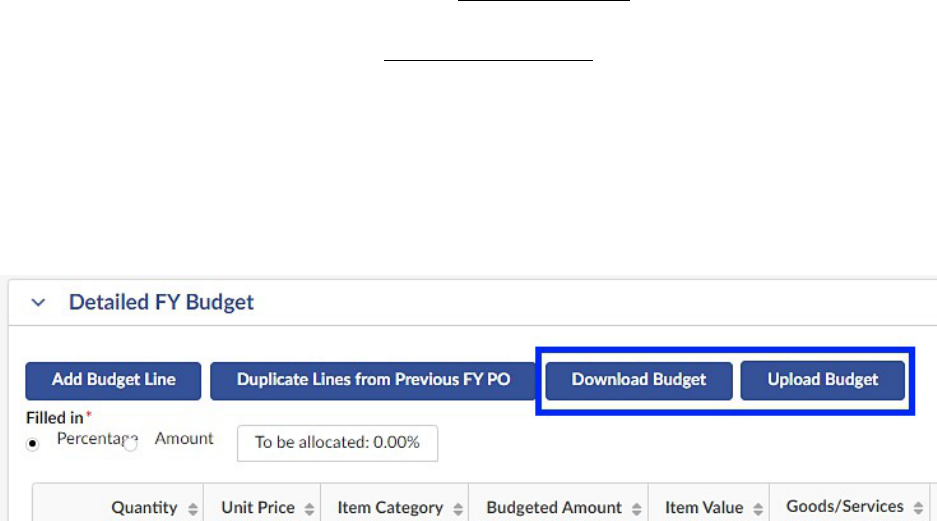

Using Download/Upload Budget Feature

On the Budget page, find the Detailed FY Budget section.

Click the Download Budget button. An Excel template will be downloaded that can be used

to process several budget lines at once. The columns for required information will be in red.

Follow steps listed above for guidance on the budget structure requirements.

Providers will receive emails from DYCD which will provide a breakdown of contract

funding. It’s important that the total of each budget code in the contract funding letter

matches the total allocated in the budget in PASSPort.

After completing the budget, proceed to uploading the budget using the Upload Budget

button. In order for the upload to work correctly, do not change the name of the file.

The budget file being uploaded must have the same name as the downloaded budget. The

information will then be listed as budget lines in the Detailed FY Budget section.

Once satisfied with the budget changes, click the Submit for Approval button near the top

of the page to begin the review and approval process by DYCD.

27

SECTION TWO: PURCHASE ORDER

CHANGE REQUESTS (POCR) BUDGET

MODIFICATIONS

28

PURCHASE ORDER CHANGE REQUEST AND

PROCEDURES OVERVIEW

A Purchase Order Change Request (POCR) does not increase or decrease a contract award amount; it

serves to reallocate money between line items of an already approved budget. Changes to the

approved and registered purchase order (budget) may be submitted only as they relate directly to the

accomplishment of services required in the contract. Once a POCR is initiated in PASSPort,

Providers will not be allowed to submit invoices and will not be able to be paid until the change

order request is approved. The “Request for Modification” form is no longer required for POCR

submission.

Questions regarding the purchase order change request process must be directed to your DYCD

Program Manager or Budget Compliance Associate.

29

SECTION THREE: INTERNAL

CONTROLS & GENERAL

ACCOUNTING PROCEDURES

30

INTERNAL CONTROLS & GENERAL ACCOUNTING

PROCEDURES OVERVIEW

The Provider’s executive and management staff are responsible for establishing and maintaining an

internal control structure. Internal controls will vary from one Provider to the next, depending on

such factors as their size, nature of operations and objectives. However, the need for internal

controls remains the same; a Provider should find the most efficient and effective way of

implementing its needed internal control procedures.

The following are examples of internal control activities:

Segregation of Duties: Duties and responsibilities must be divided among different staff

members to reduce the risk of error or fraud. In large Providers, there are often different

staff members responsible for procurement and for payment.

Proper Execution of Transactions and Events: Transactions and significant events must

be authorized only by persons acting within the scope of their authority.

Documentation of Transactions: All transactions need to be clearly documented, and all

documents must be readily available for inspection.

Secure Physical and Financial Assets: A Provider must safeguard its assets, including

cash and equipment. Periodic inventory checks will help prevent loss or unauthorized

use of the Provider’s assets.

Retention of Accounting Records

In accordance with City contract requirements, Providers must retain all contract related financial

records, including auditors’ reports, for six (6) years after the final invoice of the contract is paid.

Providers are subject to audit/or investigation for such an additional period.

Bookkeeping Practices and Procedures

Providers must maintain separate accounting records for funds received through each contract with

DYCD. Separate accounting records means that Providers must create separate general ledgers and

trial balances, or use sub-accounts, to separate funds received through each contract with DYCD.

Contracts with DYCD must be tracked in separate accounting records from each other and must be

tracked in separate accounting records from all other Provider funding sources.

Accounting records must be established and maintained in accordance with Generally Accepted

Accounting Principles. It is essential that the Provider maintains accurate, complete, and permanent

books and records, available for inspection by a DYCD staff member or designee.

DYCD staff and its representatives will conduct both announced and unannounced site visits to

Providers during the contract term to ensure that the books and records are being appropriately

maintained.

Timesheets

Timesheets must be completed for all full and part-time employees. Each timesheet must be signed

and dated by the employee and the employee’s supervisor. The Executive Director’s timesheet must

be reviewed and approved by a member of the Board of Directors. Electronic timesheets may be

maintained if they are certified as accurate by the signature of the Executive Director or a senior

level management designee.

31

Cost Allocation

Cost allocation is the distribution of one cost across multiple funded contracts. A cost allocation

methodology identifies the type of expenses that are being claimed and establishes a basis for

allocating costs to business units or cost centers based on an appropriate allotment of such cost.

Requirement

Each Provider must develop a written cost allocation plan. The plan must include an

explanation of its methodology detailing the basis used in allocating cost to its various

DYCD programs. Time distribution records must reflect an after-the-fact determination of

the actual activity of each employee. Cost allocation is established on the premise that

Providers maintain an adequate accounting system and accounting records to document costs

and support claims. Allocation methods and distribution of cost must be based on a generally

accepted accounting practice prescribed by Federal Uniform Guidance/OMB Super Circular

regulatory guidance and in accordance with Generally Accepted Accounting Practice. Refer

to Office of Management and Budget for guidance: 2 CFR Chapters I, and Chapter II, Parts

200, 215, 220, 225, and 230 Uniform Administrative Requirements, Cost Principles, and

Audit Requirements for Federal Awards and promptly made available to DYCD or its

contracted CPA firms.

Approach

When allocating cost to a particular contract the following must be considered:

Allowable direct costs that apply to only one program must be charged directly to that

program or contract and cannot be cost allocated.

Allowable direct costs that can be identified across multiple programs must be pro-

rated using a base most appropriate to the particular cost being pro-rated.

Allowable indirect costs (cost that benefit all programs and cannot be identified to a

specific program) are allocated to programs, grants, etc., using a base that results in an

equitable distribution.

A Provider is not allowed to charge more than 100% of a cost across programs.

Documentation

Regardless of the cost allocation method used, expenses claimed must be supported by

documentation of cost distribution showing the benefit each program received. Please note

that approval of a DYCD budget does NOT constitute approval of a Provider’s cost

allocation plan and method used.

A reasonable cost allocation plan must be presented to show the basis used to allocate the

amounts incurred in each of the funded programs. The basis applied cannot be based on the

budgeted amount; rather it must be based on the benefit derived by each program from that

particular expense (e.g., time, space, usage, etc.).

Audit

All expenses submitted for reimbursement are subject to an audit to assess whether the

expenses are allowable and reasonable based on the cost allocation method used.

Unreasonable cost allocations will result in disallowed costs. See Section Eleven for

additional details on audit requirements.

32

Compliance with the Requirements of the Non-profit Revitalization Act of 2013

as amended

DYCD expects all funded Providers to be in compliance with the new requirements of the New York

Not-for-Profit Corporation Law, as mandated by the Non-Profit Revitalization Act (the Act) signed

into law in New York in 2013 and subsequent amendments passed in 2016. Compliance with the

requirements of the Nonprofit Revitalization Act is subject to verification by DYCD or its contracted

audit firms.

There are many publicly available resources to help Providers understand the new governance

requirements of New York law (which go beyond the points highlighted here). DYCD can suggest

possible resources, if necessary. For further information please visit the New York Attorney

General's Charities of Bureau website: http://www.charitiesnys.com.

Conflict of Interest

In particular (and without limitation), DYCD expects all funded not-for-profit Providers to

maintain and follow a conflict-of-interest policy as required by the act S 715-A Conflict of

Interest Policy,

Whistleblower Compliance Requirements

Providers with 20 or more employees and with prior year annual revenue in excess of

$1,000,000, are required to have a whistleblower policy in accordance with the Non-Profit

Revitalization Act S-715-B Whistleblower Policy.

Audit Requirement

Providers are required to be in compliance with the requirement to file an independent

certified public accountant's audit/review report to the Charities Bureau and submission to

DYCD. See Section Eleven for further detail on audit requirements.

Employees Personnel Files

Employee personnel files must include all pertinent documents used in the hiring process. The hiring

documents must include at the minimum, the following documents:

Employment Application

I-9 Employment Eligibility Verification

Authorized working papers for individual under 18

Job Description

W-4 form

Resume

Copy of Educational Degree, Diplomas or Certificate

Background Check

Fingerprint Clearance (For employees with direct contact with youth or as required in the contract)

Personnel Action Form

33

Resigned Employees

Employee vacation and sick time accumulated during the course of employment are allowed to be

paid to that employee under the DYCD contract upon separation from employment, when such

separation occurs during the contract operating period and the Provider has a policy allowing for

payment for such time. If the employee’s time is cost allocated, it must be charged accordingly.

Vendor Invoices

All invoices maintained as documentation to support a claim must be in their original form and

must display the Provider’s name as the recipient of the goods/services. All invoices must be

maintained and made available for review, in accordance with Generally Accepted Accounting

Principles and the record-keeping requirements of the contract. This includes online purchases such

as from Amazon, etc.

In the event that an allowable purchase is made by a staff member, itemized receipts and proof of

payment are required for staff reimbursement.

Bank Accounts

Providers are not required to maintain separate bank accounts for each contract award. Electronic

Funds Transfers (EFT) of the contract award can now be made to a single Provider bank account.

EFT/Direct Deposit

Enroll in the EFT/Direct Deposit program online via the Payee Information Portal (PIP) at

nyc.gov/PIP. PIP is now available for vendors to set up a single bank account for all vendor

payments made from the New York City Financial Management System (FMS). Both

existing and new city vendors can sign up for EFT/Direct Deposit through PIP.

Existing EFT enabled vendors with a PIP User ID and password can update their bank

account information in PIP.

New vendors doing business with the City of New York can create a new PIP account and

vendor code, and then add their bank account information for EFT/Direct Deposit

immediately.

Providers are required to transfer all DYCD funds from the EFT account to the appropriate

payroll and general accounts. Bank reconciliation of all accounts must be prepared

monthly, reviewed by upper management, and kept on file for examination by DYCD or its

designees.

Signatories

DYCD requires that a Provider have at least two signatures on each check. Every Provider is

expected to comply with this policy unless it has received prior written authorization from DYCD

stating otherwise.

34

Cash Flow

The cash flow process is initiated following registration of the contract with the New York City

Comptroller’s Office. DYCD is unable to release funds until the contract is registered. An initial

advance equivalent to three months of the Provider’s approved budget will be processed PASSPort

upon contract registration. If the contract term is less than six (6) months, then the initial advance

cannot exceed 50% of the approved budget. Funds will be electronically transferred to the accounts

of Providers enrolled in the EFT Program.

Disbursements

Disbursements, except those from petty cash funds and payments with the Provider’s corporate

credit or debit card, must be made by check.

DYCD will allow Providers to use electronic payments; however, the control functions listed as

bullets under the Disbursements section must still be followed, even when paying electronically.

Additionally, all disbursements, whether made by check, positive pay, or an e-pay system, should be

approved by someone other than the person who physically makes the payment. The approver

should confirm that the payment is supported by an appropriate check request, invoice and/or

purchase order, that the same invoice is not paid more than once, and that the stated amount of goods

or services were truly received by the organization.

Providers should adhere to the following control functions when handling DYCD disbursements:

The function of approving vouchers, preparing checks, and recording disbursements must

be handled by different employees.

Employees handling disbursements must not have duties related to cash receipts or the

reconciliation of bank accounts.

Vouchers payable must be established for each payment and recorded promptly.

Payment must be made only after the original voucher and all copies of pertinent papers have

been approved.

Invoices should be cancelled or stamped “Paid” to prevent duplication of payment.

Confirmation receipts for online purchases must be printed out and retained by Providers.

A periodic review of vouchers must be made by an authorized person to determine that all

processing steps are being followed properly.

If a Provider is unable to comply with the control functions described above, comparable reasonable

procedures must be developed to allow for proper accountability and segregation of duties in

handling disbursements. A written description of these comparable procedures must be sent to your

DYCD Program Manager.

Unclaimed Funds

Unclaimed funds are funds that become available in the Provider’s bank account due to returned

checks or checks that were never cashed by the intended recipient. Undistributed funds remain the

property of DYCD and must be reimbursed to DYCD at the end of the fiscal year. The following

steps must be taken to account for DYCD unclaimed funds:

35

Providers are required to exhaust all efforts to contact the intended recipient, in a timely

manner, within ninety (90) days from the check date.

After the 90-day period, the Provider is required to place a stop payment on those checks and

return the funds to DYCD within ten (10) days.

Providers are required to retain all evidence of the steps used to contact the intended

recipients.

Providers are not allowed, at any time, to submit DYCD unclaimed funds to the New York

State Office of Unclaimed Funds.

36

SECTION FOUR: PURCHASING

PROCEDURES

37

GENERAL PROCUREMENT POLICIES

Any procurement of goods and/or services is to be conducted in the Provider’s name. The Provider

is responsible for ordering, receiving, inspecting, and accepting merchandise. The name of the

Department of Youth and Community Development, its officials, employees, or the City of New

York must not be used, under any circumstances, for the purpose of ordering and/or securing goods

and services from a vendor. Invoices, bills, receipts, etc., must be issued in the name and address of

the Provider. All expenditures must comply with applicable laws and contract regulations and are

subject to audit.

Purchasing Requirements/Competitive Bidding

The procurement of goods shall be governed by the competitive bidding requirements described

below. The purpose of competitive bidding requirements is to establish a procedure that will secure

the best possible price for goods and services while allowing for appropriate competition. The

procurement process must be open and competitive (that is, no vendor qualified to provide the goods

or services may be restricted from bidding and there must be fair competition among those bidders).

These procedures also apply to the rental or leasing of equipment. A procurement shall not be

artificially divided to meet the requirements of this section. The monetary thresholds identified

below refer to payments made, or obligations undertaken in the course of a one (1) year period with

respect to any one (1) person or entity.

For purchases with a value of $5,000 or less:

No competitive bids are required provided the price is determined to be reasonable

and prudent.

Documentation of the purchase must be maintained by the Provider. This

documentation must include:

o The name of the vendor

o Item purchased

o Date

o Amount paid

For purchases from $5,001 - $25,000:

The Contractor shall conduct sufficient market research and/or competition to

support its determination that the price of such purchased goods, supplies,

services, or equipment is reasonable.

Documentation of the market research and the purchase must be maintained by

the Provider. This documentation must include the name of the entities contacted,

the vendor, the item purchased, the date, and amount paid.

For purchases $25,001 or greater:

A minimum of three (3) written bids must be obtained for the purchase of goods,

supplies, or services of similar items where the cost can reasonably be expected to

be $25,001 or greater. The bids must contain:

o A description of the item requested.

o Time, date, place, and form of requested responses.

o Name of the employee responsible for securing bids. The bids must be

maintained by the Provider.

38

Federal Funding Only

As of June 2018, the Federal threshold for purchases increased from $3,500 to $10,000.

For purchases with a value of $10,000 or less:

A purchase may be awarded without soliciting competitive quotations if the

provider considers the price to be reasonable.

For purchases $10,001 or greater:

A minimum of three (3) written bids must be obtained from three qualified

sources.

The bids must contain:

o A description of the item requested

o Time, date, place, and form of requested responses

o Name of the employee responsible for securing bids. The bids must be

maintained by the Provider.

If there is any inconsistency with the information contained in this manual governing federal

funds with the Federal Uniform Guidance/OMB Super Circular, then the Super Circular

controls.

Sole Source Procurement