BIENNIAL REPORT

of the

ATTORNEY GENERAL

STATE OF FLORIDA

January 1, 2013, through December 31, 2014

PAM BONDI

Attorney General

Tallahassee, Florida

2015

ii

CONSTITUTIONAL DUTIES OF THE

ATTORNEY GENERAL

The revised Constitution of Florida of 1968 sets out the duties of

the Attorney General in Subsection (c), Section 4, Article IV, as:

“...the chief state legal offi cer.”

By statute, the Attorney General is head of the Department of

Legal Affairs, and supervises the following functions:

Serves as legal advisor to the Governor and other executive

offi cers of the State and state agencies;

Defends the public interest;

Represents the State in legal proceedings;

Keeps a record of his or her offi cial acts and opinions;

Serves as a reporter for the Supreme Court.

iii

STATE OF FLORIDA

OFFICE OF ATTORNEY GENERAL

PAM BONDI

February 27, 2015

The Honorable Rick Scott

Governor of Florida

The Capitol

Tallahassee, Florida 32399-0001

Dear Governor Scott:

Pursuant to my constitutional duties and the statutory

requirement that this offi ce periodically publish a report on

the Attorney General offi cial opinions, I submit herewith the

biennial report of the Attorney General for the two preceding

years from January 1, 2013, through December 31, 2014.

This report includes the opinions rendered, an organizational

chart, and personnel list. The opinions are alphabetically

indexed by subject in the back of the report with a table of

constitutional and statutory sections cited in the opinions.

It’s an honor to serve with you for the people of Florida.

Sincerely,

Pam Bondi

Attorney General

iv

TABLE OF CONTENTS

Page

Constitutional Duties of the Attorney General ....................................... ii

Letter of Transmittal ..................................................................................... iii

Table of Contents ........................................................................................... iv

Attorneys General of Florida since 1845 .................................................... v

Department of Legal Affairs .........................................................................vi

Statement of Policy Concerning Attorney General Opinions ........... xii

Seal of the Attorney General of Florida ................................................ xvii

OPINIONS

Opinions 2013 .................................................................................................... 1

Opinions 2014 ................................................................................................ 125

INDEX AND CITATOR

General Index ................................................................................................181

Citator to Florida Statutes, Constitution,

and Session Laws ..........................................................................................192

v

ATTORNEYS GENERAL OF FLORIDA

SINCE 1845

Joseph Branch ......................................................1845-1846

Augustus E. Maxwell ...........................................1846-1848

James T. Archer ...................................................1848-1848

David P. Hogue .....................................................1848-1853

Mariano D. Papy ...................................................1853-1860

John B. Galbraith .................................................1860-1868

James D. Wescott, Jr. ...........................................1868-1868

A. R. Meek ...............................................................1868-1870

Sherman Conant ...................................................1870-1870

J. P. C. Drew ..........................................................1870-1872

H. Bisbee, Jr. ..........................................................1872-1872

J. P. C. Emmons ....................................................1872-1873

William A. Cocke ...................................................1873-1877

George P. Raney ...................................................1877-1885

C. M. Cooper...........................................................1885-1889

William B. Lamar ..................................................1889-1903

James B. Whitfi eld ................................................1903-1904

W. H. Ellis ...............................................................1904-1909

Park Trammell ......................................................1909-1913

Thomas F. West .....................................................1913-1917

Van C. Swearingen ...............................................1917-1921

Rivers Buford ........................................................1921-1925

J. B. Johnson .........................................................1925-1927

Fred H. Davis .........................................................1927-1931

Cary D. Landis.......................................................1931-1938

George Couper Gibbs ..........................................1938-1941

J. Tom Watson .......................................................1941-1949

Richard W. Ervin ..................................................1949-1964

James W. Kynes.....................................................1964-1965

Earl Faircloth ........................................................1965-1971

Robert Shevin ........................................................1971-1979

Jim Smith ...............................................................1979-1987

Robert A. Butterworth ........................................1987-2002

Richard E. Doran ................................................. 2002-2003

Charlie Crist ......................................................... 2003-2007

Bill McCollum ........................................................2007-2011

Pam Bondi ..............................................................2011-

vi

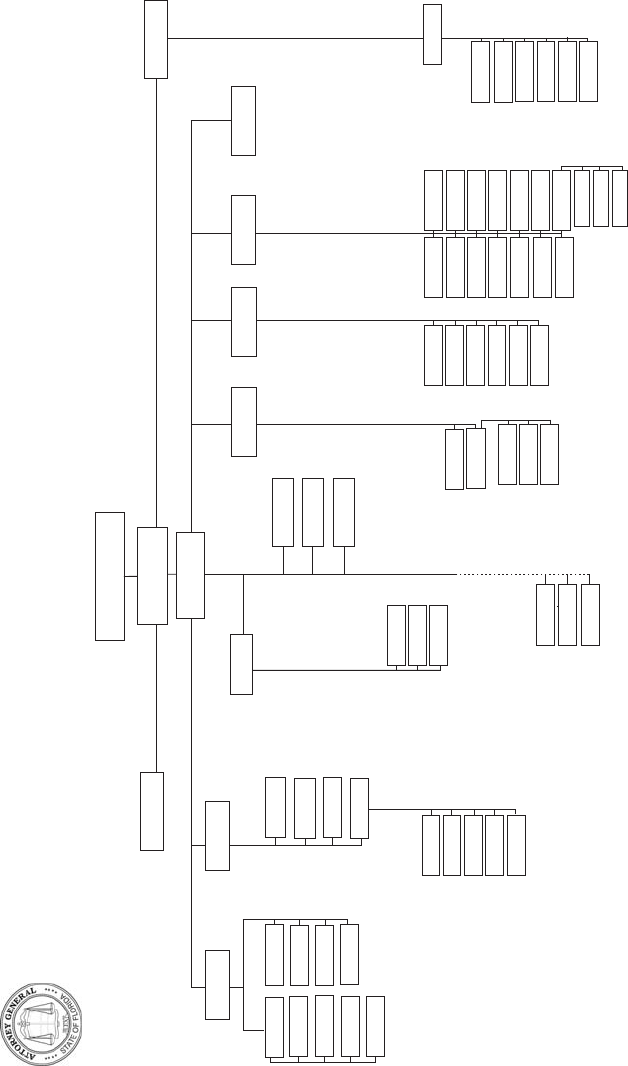

!

!

"

vii

OFFICE OF THE ATTORNEY GENERAL

The Capitol, Tallahassee, Florida 32399-1050

(850) 245-0140

PAMELA BONDI

Attorney General

TYLER CATHEY

Chief Deputy

Attorney General

NICOLAS COX

StatewideProsecutor

STEVE RUMPH JR.

Inspector General

KENT PEREZ

Deputy

Attorney General

PATRICIA GLEASON

Special Counsel

For Open

Government

PATRICIA CONNERS

Deputy

Attorney General

CAROLYN SNURKOWSKI

Associate Deputy

Attorney General

For Criminal Appeals

EMERY GAINEY

Director of Law

Enforcement

Victims & Criminal

Justice Program

CHESTERFIELD SMITH JR.

Associate Deputy

Attorney General

For General Civil Litigation

ALLEN WINSOR

Solicitor General

Richard Lawson

Director of

Economic Crimes

JIM VARNADO

Associate Deputy

Attorney General

For Medicaid Fraud

Danille Carroll

Director of Civil Rights

Dana Wiehle

Acting Director of

Lemon Law

Bonnie Rogers

Director of

Administration

Vacant

Director of Opinions

Jennifer Meale

Communications

Director

Robert Johnson

Director of Legislative

& Cabinet Affairs

Jason Rodriguez

External Affairs

Director

Vacant

Director of

Information Services

Kimberli Oswald

Director of

Citizen Services

viii

Shayne Burnham

Victoria Butler

Arabella Campbell

David Campbell

Leslie Campbell

Kristin Cantrell

James Carney

Cynthia Carrino

Danille Carroll

Eual Cathey

Justin Chapman

Emmanuela Charles

Carrol Cherry

Maria Chisholm

Brandon Christian

Mary Clark

Rachel Clark

Robert Clements

Katherine Cline

Robin Compton

Cynthia Comras

Anne Conley

Bethany Connelly

Patricia Conners

Antony Constantini

Carmen Corrente

James Cox

Shelley Cridlin

Sara Dahod

Ralph Damato

Stephanie Daniel

Howard Dargan

Jessica Dasilva

Kristen Davenport

Jason Davis

Michael Davis

Carol Degraffenreidt

Patrick Delaney

Peter Delia

Arielle Demby Berger

Cornelius Demps

Timothy Dennis

Diane Dewolf

Blair Dickert

Robert Dietz

Joanne Diez

Jeffrey Dikman

Jennifer Dillon

Carol Dittmar

Douglas Dolan

Kendrick Donnelly

Susan Dunlevy

Mark Dunn

Shirley Durham

David Earl

Angel Eason

Mitchell Egber

Melissa Eggers

Carine Emplit

Alex Ershock

Diana Esposito

Elizabeth Everson

Charles Fahlbusch

Bilal Faruqui

Laura Fisher

Ryann Flack

Michael Flury

David Flynn

Robert Follis

William Foster

Deborah Fraim

Colin Fraser

Timothy Fraser

Timothy Freeland

Allie Freshman

Timothy Frizzell

David Fugett

Anne Furlow

William Gandy Jr

Sonia Garcia-Solis

Steven Gard

Cedell Garland

Sean Garvey

Jared Gass

Allan Geesey

Jeffrey Geldens

Sean Gellis

Fulvio Gentili

Donna Gerace

Jeanine Germanowicz

Peter Gioia

Douglas Glaid

David Glantz

Patricia Gleason

Jill Adams

Rotem Adar

Jacob Addicott

Stephen Ake

Jeannette Andrews-

Thompson

Thomas Arden

Albert Arena

Alexa Argerious

William Armistead

David Asti

John Bajger

Samantha Josephine Baker

Thomas Barnhart

Glen Bassett

Marilyn Beccue

Carla Bechard

Kenneth Beck

Kelly Behmke

Jill Bennett-Bodner

Laurie Benoit-Knox

Stephanie Bergen

Toni Bernstein

Heidi Bettendorf

Kristin Bigham

Sofi a Bilokryla

William Bissell

Meghdut Biswas

Jennifer Blanton

Laura Boeckman

Kirsten Bonjour

Jessica Bouis

Albert Bowden

Jessica Boxer

James Boynton Jr

Lisabeth Brady

Ravi Brammer

William Branch

Jamie Braun

Cheryl Brittle

Jerrett Brock

Karen Brodeen

Scott Browne

Lauren Brudnicki

Cindy Bruschi

Wendy Buffi ngton

David Bundy

ix

Lisa Glick

Jonathan Glogau

Stacey Gomez-Sutter

Ely Gonzalez

Eric Gonzalez

Alicia Gordon

Ashley Grafton

Ashley Grant

Marcus Graper

James Graulich

Dayle Green

David Grimes

David Grossman

Diane Guillemette

Lindsey Guinand

Tonya Guinn

Maria Guitian Barker

Lee Gustafson

Melody Hadley

Kathleen Hagan

Lori Hagan

Meredith Hall

Mark Hamel

Mark Hamilton

Gerry Hammond

Christi Hankins

Julia Harris

Lawrence Harris

Virginia Harris

Wesley Heidt

Joshua Heller

Angela Hensel

Donna Hernandez

Nikole Hiciano O’neil

Jennifer Hinton

Benedict Hoffman

Sonya Horbelt

Martha Hurtado

Angela Huston

Elmer Ignacio

Nicholas Igwe

Lee Istrail

Akio Ito

Jamie Ito

Nancy Jack

Sandra Jaggard

Clark Jennings

Georgina Jimenez-Orosa

Caroline Johnson Levine

Kristen Johnson

Robert Johnson

Bryan Jordan

Aniska Joseph

Keri Joseph

Linda Katz

Brent Kelleher

Russell Kent

Ann Keough

Denise Kim

Stacey Kircher

Robin Kissin

Katherine Kiziah

John Klawikofsky

Donna Koch

Peter Koclanes

Pamela Koller

Jill Kramer

Robert Krauss

Jay Kubica

Jacqueline Kurland

Donna Laplante

Nancy Lawler

Richard Lawson

Lisa-Marie Lerner

Norman Levin

Gillian Leytham

Catherine Linton

Wendy Linton

Sandy Lipman

Deborah Loucks

Michele Lucas

Amdrea Luedecker

Christopher Lumpkin

Giselle Lylen

Sara Macks

Susan Maher

Patrice Malloy

Daryl Manning

Luz Maria-Montero

Julian Markham III

Luis Martinez

Elba Martin-Schomaker

Linda Matthews

James McAuley

Amanda McCarthy

Patricia McCarthy

Charles McCoy

Michael McDermott

Anne McDonough

Rebbeca McGuigan

Katherine McIntire

James McNamara III

Carrie McNamara

Caroline McNulty Bernal

Donna McNulty

Jennifer Meister

Melynda Melear

Michael Mervine

Tammy Metcalf

John Mika

Jason Miller

Charmaine Millsaps

Robert Milne

Ilana Mitzner

Jacqueline Moody

Audrey Moore

Jennifer Moore

Nicole Moore

Allison Morris

Thomas Munkittrick

Teresa Mussetto

Luke Napodano

Bill Navas

Lance Neff

Eric Neiberger

Betty Nestor

Kellie Nielan

Elizabeth Nixon

Angela Noble

Rachel Nordby

Diane Oates

Matthew Ocksrider

Mary Ottinger

Magdalena Ozarowski

Robert Palmer

Michelle Pardoll

Titania Parker

Helene Parnes

Bonnie Parrish

Matthew Parrish

Trisha Pate

x

Matthew Pavese

Wesley Paxson III

Joi Pearsall

Ivy Pereira Rollins

Kent Perez

Samuel Perrone

Steven Perry

Kristen Pesicek

Mary Pettit

Ann Phillips

Richard Polin

Priscilla Quinones

Lisa Raleigh

Jonathan Rhodes

James Riecks

Marie Rives

Priscilla Roberts

Magaly Rodriguez

Don Rogers

Susan Rogers

Monique Rolla

Evan Rosen

Aimee Rosenblum

Heather Ross

Seth Rubin

Candance Sabella

Johnny Salgado

Amanda Sansone

Alfred Saunders

Alisha Savani

Richard Schiffer

Carolyn Schwarz

Jessica Schwieterman

Susan Shanahan

Tiffany Short

Sarah Shullman

Jay Silver

David Silverstein

Holly Simcox

Darlene Simmons

Hagerenesh Simmons

Jamie Simons

Carol Simpson

Rebecca Sirkle

Gregory Slemp

Janet Smith

Joshua Soileau

Mary Soorus

Joseph Spejenkowski

Douglas Squire

William Stafford III

Elizabeth Starr

Samuel Steinberg

Rachel Steinman

Jessica Stephans

Jillian Stephens

Marlene Stern

Paul Stevenson

Monica Stinson

Jacek Stramski

Betsy Stupski

Melanie Surber

Adam Tanenbaum

Matthew Tannenbaum

Kaylee Tatman

Cerese Taylor

Elizabeth Teegen

Edward Tellechea

Celia Terenzio

Britt Thomas

Stephen Thomas

Lisa Tietig

Dawn Tiffi n

Andrea Totten

Mimi Turin

Jason Vail

Alycia Vajgert

Donna Valin

Richard Valuntas

Erin Van De Walle

Elizabeth Van Den Berg

Katherine Varsegi

Osvaldo Vazquez

Ann Vecchio

Tonja Vickers

Marjorie Vincent-Tripp

Matthew Vitale

Kathleen Von Hoene

Rebecca Wall

Gretchen Wallace

Shane Weaver

Nicholas Weilhammer

Marlon Weiss

Katie Welch

W Joseph Werner

Stephen White

Dana Wiehle

Jaakan Williams

Kenneth Wilson

Blaine Winship

Allen Winsor

Katelyn Wright

Colleen Zaczek

Jason Zapper

Danielle Zemola

Christina Zuccaro

xi

ASSISTANT STATEWIDE PROSECUTORS

Lisa Acharekar

Lawonda Athouriste

Dayna Baskette

Diana Bock

Shireen Brueggeman

Melissa Checchio

Jessica Costello

Nicholas Cox

Diane Croff

Nickolaus Davis

Katherine Diamandis

Jessica Dobbins

Paul Dontenville

Kelly Eckley

Nicole Pegues

Michael-Anthony Pica

Priscilla Prado Stroze

Brent Riggle

John Roman

Laura Rose

James Schneider

Jeremy Scott

Julie Sercus

Joseph Spataro

Jeffrey Stone

Stephanie Tew

Audra Thomas-Eth

John Wethington III

Michael Williams

Robert Finkbeiner

Jeremy Franker

Oscar Gelpi

Kathleen George

David Gillespie

Kelsey

Hellstrom

Julie Hogan

Stephen Immasche

Margery Lexa

John Maceluch

Hannon MacGillis

Gary Malak

Kelly McKnight

Michael Nieman

xii

DEPARTMENT OF LEGAL AFFAIRS

Attorney General Opinions

I. General Nature and Purpose of Opinions

Issuing legal opinions to governmental agencies has long been

a function of the Offi ce of the Attorney General. Attorney General

Opinions serve to provide legal advice on questions of statutory

interpretation and can provide guidance to public bodies as an

alternative to costly litigation. Opinions of the Attorney General,

however, are not law. They are advisory only and are not binding in a

court of law. Attorney General Opinions are intended to address only

questions of law, not questions of fact, mixed questions of fact and

law, or questions of executive, legislative or administrative policy.

Attorney General Opinions are not a substitute for the advice and

counsel of the attorneys who represent governmental agencies and

offi cials on a day to day basis. They should not be sought to arbitrate

a political dispute between agencies or between factions within an

agency or merely to buttress the opinions of an agency's own legal

counsel. Nor should an opinion be sought as a weapon by only one side

in a dispute between agencies.

Particularly diffi cult or momentous questions of law should be

submitted to the courts for resolution by declaratory judgment.

When deemed appropriate, this offi ce will recommend this course

of action. Similarly, there may be instances when

securing a

declaratory statement under the Administrative Procedure Act will

be appropriate and will be recommended.

II. Types of Opinions Issued

There are several types of opinions issued by the Attorney General's

Offi ce. All legal opinions issued by this offi ce, whether formal or

informal, are persuasive authority and not binding.

Formal numbered opinions are signed by the Attorney General

and published in the Annual Report of the Attorney General. These

opinions address questions of law which are of statewide concern.

This offi ce also issues a large body of informal opinions.

Generally these opinions address questions of more limited

application. Informal opinions may be signed by the Attorney

General or by the drafting assistant attorney general. Those

xiii

signed by the Attorney General are generally issued to public offi cials

to whom the Attorney General is required to respond. While an

offi cial or agency may request that an opinion be issued as a formal

or informal, the determination of the type of opinion issued rests with

this offi ce.

III. Persons to Whom Opinions May Be Issued

The responsibility of the Attorney General to provide legal opinions

is specifi ed in section 16.01(3), Florida Statutes, which provides:

Notwithstanding any other provision of law, shall, on the written

requisition of the Governor, a member of the Cabinet, the head

of a department in the executive branch of state government,

the Speaker of the House of Representatives, the President of

the Senate, the Minority Leader of the House of Representatives,

or the Minority Leader of the Senate, and may, upon the written

requisition of a member of the Legislature, other state offi cer, or

offi cer of a county, municipality, other unit of local government,

or political subdivision, give an offi cial opinion and legal advice in

writing on any question of law relating to the offi cial duties of the

requesting offi cer.

The statute thus requires the Attorney General to render opinions

to “the Governor, a member of the Cabinet, the head of a department

in the executive branch of state government, the Speaker of the House

of Representatives, the President of the Senate, the Minority Leader of

the House of Representatives, or the Minority Leader of the Senate....”

The Attorney General may also issue opinions to “a member of the

Legislature, other state offi cer, or offi cer of a county, municipality,

other unit of local government, or political subdivision.” In addition,

the Attorney General is authorized to provide legal advice to the

state attorneys and to the representatives in Congress from this state.

Sections 16.08 and 16.52(1), Florida Statutes.

Questions relating to the powers and duties of a public board

or commission (or other collegial public body) should be requested

by a majority of the members of that body. A request from a board

should, therefore, clearly indicate that the opinion is being sought by

a majority of its members and not merely by a dissenting member or

faction.

xiv

IV. When Opinions Will Not Be Issued

Section 16.01(3), Florida Statutes, does not authorize the Attorney

General to render opinions to private individuals or entities, whether

their requests are submitted directly or through governmental

offi cials. In addition, an opinion request must relate to the requesting

offi cer's own offi cial duties. An Attorney General Opinion will not,

therefore, be issued when the requesting party is not among the

offi cers specifi ed in section 16.01(3), Florida Statutes, or when an

offi cer falling within section 16.01(3), Florida Statutes, asks a question

not relating to his or her own offi cial duties.

In order not to intrude upon the constitutional prerogative of the

judicial branch, opinions generally are not rendered on questions

pending before the courts or on questions requiring a determination

of the constitutionality of an existing statute or ordinance.

Opinions generally are not issued on questions requiring an

interpretation only of local codes, ordinances or charters rather

than the provisions of state law. Instead such requests will usually

be referred to the attorney for the local government in question. In

addition, when an opinion request is received on a question falling

within the statutory jurisdiction of some other state agency, the

Attorney General may, in the exercise of his or her discretion, transfer

the request to that agency or advise the requesting party to contact the

other agency. For example, questions concerning the Code of Ethics

for Public Offi cers and Employees may be referred to the Florida

Commission on Ethics; questions arising under the Florida Election

Code may be directed to the Division of Elections in the Department

of State.

However, as quoted above, section 16.01(3), Florida Statutes,

provides for the Attorney General's authority to issue opinions

"[n]otwithstanding any other provision of law," thus recognizing the

Attorney General's discretion to issue opinions in such instances.

Other circumstances in which the Attorney General may decline to

issue an opinion include:

• questions of a speculative nature;

• questions requiring factual determinations;

• questions which cannot be resolved due to an irreconcilable

confl ict in the laws although the Attorney General may attempt

to provide general assistance;

xv

• questions of executive, legislative or administrative policy;

• matters involving intergovernmental disputes unless all

governmental agencies concerned have joined in the request;

moot questions;

• questions involving an interpretation only of local codes,

charters, ordinances or regulations; or

• where the offi cial or agency has already acted and seeks to

justify the action.

V. Form In Which Request Should Be Submitted

Requests for opinions must be in writing and should be

addressed to:

Pam Bondi

Attorney General

Department of Legal Affairs

PL01 The Capitol

Tallahassee, Florida 32399-1050

The request should clearly and concisely state the question of law

to be answered. The question should be limited to the actual matter

at issue. Suffi cient elaboration should be provided so that it is not

necessary to infer any aspect of the question or the situation on which

it is based. If the question is predicated on a particular set of facts or

circumstances, these should be fully set out.

The response time for requests for Attorney General Opinions

has been substantially reduced. This offi ce attempts to respond to

all requests for opinions within 30 days of their receipt in this offi ce.

However, in order to facilitate this expedited response to opinion

requests, this offi ce requires that the attorneys for public entities

requesting an opinion supply this offi ce with a memorandum of law to

accompany the request. The memorandum should include the opinion

of the requesting party's own legal counsel, a discussion of the legal

issues involved, together with references to relevant constitutional

provisions, statutes, charter, administrative rules, judicial decisions,

etc.

Input from other public offi cials, organizations or associations

representing public offi cials may be requested. Interested parties

may also submit a memorandum of law and other written material

xvi

or statements for consideration. Any such material will be attached to

and made a part of the permanent fi le of the opinion request to which

it relates.

VI. Miscellaneous

This offi ce provides access to formal Attorney General Opinions

through a searchable database on the Attorney General’s website at:

myfl oridalegal.com

Persons who do not have access to the Internet and wish to obtain a

copy of a previously issued formal opinion should contact the Florida

Legal Resource Center of the Attorney General’s Offi ce. Copies of

informal opinions can be obtained from the Opinions Division of the

Attorney General's Offi ce.

As an alternative to requesting an opinion, offi cials may wish to

use the informational pamphlet prepared by this offi ce on dual offi ce-

holding for public offi cials. Copies of the pamphlet can be obtained

by contacting the Opinions Division of the Attorney General's Offi ce.

In addition, the Attorney General, in cooperation with the First

Amendment Foundation, has prepared and annually updates the

Government in the Sunshine Manual which explains the law under

which Florida ensures public access to the meetings and records of

state and local government. Copies of this manual can be obtained

through the First Amendment Foundation.

xvii

Pam Bondi

The Capitol

Tallahassee

BIENNIAL REPORT OF THE ATTORNEY GENERAL

13-01

1

BIENNIAL REPORT

of the

ATTORNEY GENERAL

State of Florida

January 1, 2013, through December 31, 2014

AGO 13-01 – January 29, 2013

MUNICIPALITIES – FARM BUILDINGS – SIGNS – FENCES –

LAND DEVELOPMENT REGULATIONS

REGULATION OF NONRESIDENTIAL FARM BUILDING BY

MUNICIPALITIES

To: Mr. Michael D. Cirullo, Jr., Town Attorney for the Town of

Loxahatchee Groves

QUESTION:

Does section 604.50, Florida Statutes, exempt nonresidential

farm buildings, farm fences, and farm signs from land

development regulations adopted pursuant to Chapter 163,

Florida Statutes?

SUMMARY:

Section 604.50, Florida Statutes, exempts nonresidential farm

buildings, farm fences, and farm signs from land development

regulations adopted by the Town of Loxahatchee Groves

pursuant to Chapter 163, Florida Statutes.

Section 604.50, Florida Statutes, makes provision for nonresidential

farm buildings, farm fences, and farm signs:

(1) Notwithstanding any provision of law to the contrary,

any nonresidential farm building, farm fence, or farm sign

is exempt from the Florida Building Code and any county or

municipal code or fee, except for code provisions implementing

local, state, or federal fl oodplain management regulations. A

farm sign located on a public road may not be erected, used,

operated, or maintained in a manner that violates any of the

standards provided in s. 479.11(4), (5)(a), and (6) (8).

The statute defi nes the terms used in the section for purposes of

statutory construction.

1

BIENNIAL REPORT OF THE ATTORNEY GENERAL

13-01

2

Prior to the adoption of Chapter 2011-7, Laws of Florida, this statute

provided that “[n]otwithstanding any other law to the contrary, any

nonresidential farm building is exempt from the Florida Building Code

and any county or municipal building code.”

2

(e.s.) The Legislature’s

removal of the term “building” from the language of the statute relating

to county or municipal codes has resulted in your request for an opinion

from this offi ce.

The Town of Loxahatchee Groves has adopted land development

regulations pursuant to Chapter 163, Florida Statutes, entitled the

“Unifi ed Land Development Code.” The town’s land development

regulations contain typical setback requirements for properties in

the town. Subject to consistency with the Right to Farm Act, the

town has sought to enforce setback requirements upon nonresidential

farm buildings, such as shade houses, corrals, and barns.

3

However,

the change to section 604.50(1), Florida Statutes, which exempts

nonresidential farm buildings, farm fences, and farm signs from “any

county or municipal code” would prevent the town from enforcing its

zoning regulations, such as setbacks for nonresidential farm buildings,

farm fences, and farm signs if it is determined that section 604.50,

Florida Statutes, provides an exemption for nonresidential farm

buildings and farm fences and signs from the town’s land development

regulations.

It is a general rule of statutory construction, frequently expressed by

Florida courts that:

When a statute is clear, courts will not look behind the

statute’s plain language for legislative intent or resort to rules

of statutory construction to ascertain intent. Instead, the

statute’s plain and ordinary meaning must control, unless this

leads to an unreasonable result or a result clearly contrary to

legislative intent.

4

Section 604.50(1), Florida Statutes, clearly states that “[n]ot

withstanding any provision of law to the contrary, any nonresidential

farm building, farm fence, or farm sign is exempt from . . . any county or

municipal code or fee[.]” The Legislature has maintained an exception

for code provisions implementing local, state, or federal fl oodplain

management regulations. Applying the rule of construction set forth

above compels the conclusion that the Town of Loxahatchee Groves has

no authority to enforce “any county or municipal code or fee” provision

on any nonresidential farm building, farm fence, or farm sign.

Further, a review of the legislative history surrounding the enactment

of CS/HB 7103 during the 2010 and 2011 legislative sessions, suggests

that this was the legislative intent. Staff analysis of the bill by both

the House and the Senate states that the amendment to section 604.50,

Florida Statutes, will exempt farm fences from the Florida Building

BIENNIAL REPORT OF THE ATTORNEY GENERAL

13-01

3

Code and farm fences and nonresidential farm buildings and fences

from county or municipal codes and fees, except fl oodplain management

regulations. It provides that a nonresidential farm building may

include, but not be limited to, a barn, greenhouse, shade house, farm

offi ce, storage building, or poultry house.

5

The intent of the Legislature is the primary guide in statutory

interpretation.

6

Where the language used by the Legislature makes

clear its intent, that intent must be given effect.

7

Thus, absent a

violation of a constitutional right, a specifi c, clear and precise statement

of legislative intent will control in the interpretation of a statute.

8

Your memorandum of law suggests that the word “code” as used

in section 604.50(1), Florida Statutes, may not include the Town of

Loxahatchee Groves’ “Unifi ed Land Development Code.” While the

Florida Statutes contain a number of defi nitions for the word “code,”

9

the

fact that the Legislature provided no defi nition for purposes of section

604.50(1), or Chapter 604, Florida Statutes, requires that the word be

understood in its common and ordinary sense.

10

“Code” is generally

defi ned as:

3. any set of standards set forth and enforced by a local

government agency for the protection of public safety, health,

etc., as in the structural safety of buildings (building code),

health requirements for plumbing, ventilation, etc. (sanitary or

health code), and the specifi cations for fi re escapes or exits (fi re

code). 4. a systematically arranged collection or compendium

of laws, rules, or regulations.

11

Black’s Law Dictionary defi nes “code” as “[a] complete system of

positive law, carefully arranged and offi cially promulgated; a systematic

collection or revision of laws, rules, or regulations[.]”

12

The term “land development regulations” is defi ned in section

163.3164, Florida Statutes, as:

“Land development regulations” means ordinances enacted by

governing bodies for the regulation of any aspect of development

and includes any local government zoning, rezoning,

subdivision, building construction, or sign regulations or any

other regulations controlling the development of land, except

that this defi nition does not apply in s. 163.3213.

13

You have advised that the Town of Loxahatchee Groves developed

its land development code pursuant to Chapter 163, Florida Statutes.

You state that while a collection of land development regulations would

appear to fall within the general defi nition of “code,” section 604.50,

Florida Statutes, applies solely to “nonresidential farm buildings” and

“farm fences.” You contrast this with land development regulations

BIENNIAL REPORT OF THE ATTORNEY GENERAL

13-01

4

which apply to “the development of land,” but which include, as set forth

in the defi nition above, such matters as zoning, building construction,

and sign regulations.

I cannot draw such a distinction. The Town of Loxahatchee Groves

“Unifi ed Land Development Code” appears to be a “code” within the

scope of that term as used in section 604.50(1), Florida Statutes. The

Legislature clearly intended to exempt nonresidential farm buildings,

farm fences, and farm signs from “any county or municipal code.” Thus,

recognizing the Legislature’s intent, it is my opinion that nonresidential

farm buildings, farm fences, and farm signs are exempted from

regulation under the land development regulations of the town.

14

In sum, it is my opinion that section 604.50, Florida Statutes, exempts

nonresidential farm buildings, farm fences, and farm signs from land

development regulations adopted by the Town of Loxahatchee Groves

pursuant to Chapter 163, Florida Statutes.

15

1

Section 604.50(2), Fla. Stat., defi nes these terms as follows:

(a) “Farm” has the same meaning as provided in s. 823.14.

(b) “Farm sign” means a sign erected, used, or maintained on

a farm by the owner or lessee of the farm which relates solely

to farm produce, merchandise, or services sold, produced,

manufactured, or furnished on the farm.

(c) “Nonresidential farm building” means any temporary or

permanent building or support structure that is classifi ed as a

nonresidential farm building on a farm under s. 553.73(10)(c)

or that is used primarily for agricultural purposes, is located on

land that is an integral part of a farm operation or is classifi ed

as agricultural land under s. 193.461, and is not intended to

be used as a residential dwelling. The term may include, but

is not limited to, a barn, greenhouse, shade house, farm offi ce,

storage building, or poultry house.

2

See s. 604.50, Fla. Stat. (2002).

3

See Ops. Att’y Gen. Fla. 09-26 (2009) and 01-71 (2001) in which this

offi ce concluded that a county could enforce land development regulations

pursuant to s. 823.14, Fla. Stat., Florida’s Right to Farm Act, so long as

those regulations did not limit the operational activities of a bona fi de

farm operation inconsistent with the Right to Farm Act. Both of these

opinions addressed s. 823.14, Fla. Stat., and were issued prior to the

amendment to s. 604.50, Fla. Stat., in 2011 by CS/HB 7103.

4

See e.g., State v. Burris, 875 So. 2d 408 (Fla. 2004); State v. Egan,

287 So. 2d 1 (Fla. 1973); Van Pelt v. Hilliard, 78 So. 693 (Fla. 1918);

Legal Environmental Assistance Foundation, Inc. v. Board of County

Commissioners of Brevard County, 642 So. 2d 1081 (Fla. 1994); Goddard

BIENNIAL REPORT OF THE ATTORNEY GENERAL

13-01

5

v. State, 438 So. 2d 110 (Fla. 1st DCA 1983); Ops. Att’y Gen. Fla. 93-

47 (1993) (in construing statute which is clear and unambiguous, the

plain meaning of statute must fi rst be considered); 93-2 (1993) (since it

is presumed that the Legislature knows the meaning of the words it uses

and to convey its intent by the use of specifi c terms, courts must apply the

plain meaning of those words if they are unambiguous); and 92-93 (1992).

5

See The Florida Senate Veto Message Bill Analysis for CS/HB 7103,

dated July 12, 2010, and House of Representatives Staff Analysis, CS/HB

7103, dated April 14, 2010, and stating that section 6 of the bill “exempts

farm fences from the Florida Building Code, and exempts farm fences and

nonresidential farm buildings from county or municipal codes and fees,

except for code provisions implementing local, state, or federal fl oodplain

management regulations.”

6

See, e.g., State v. J.M., 824 So. 2d 105, 109 (Fla. 2002); St. Petersburg

Bank & Trust Co. v. Hamm, 414 So. 2d 1071 (Fla. 1982); Barruzza v.

Suddath Van Lines, Inc., 474 So. 2d 861 (Fla. 1st DCA 1985); Philip

Crosby Associates, Inc. v. State Board of Independent Colleges, 506 So. 2d

490 (Fla. 5th DCA 1987).

7

Barruzza and Philip Crosby Associates, Inc., supra.

8

Carawan v. State, 515 So. 2d 161 (Fla. 1987).

9

See s. 320.822, Fla. Stat. (uniform standard code for recreational

vehicles and park trailers), and s. 553.955, Fla. Stat. (providing that the

word “code” is defi ned for purposes of those statutes as the Florida Energy

Effi ciency Code for Building Construction).

10

See Southeast Fisheries Association, Inc. v. Department of Natural

Resources, 453 So. 2d 1351 (Fla. 1984); Millazzo v. State, 377 So. 2d 1161

(Fla. 1979) (when a statute does not specifi cally defi ne words of common

usage, such words are construed in their plain and ordinary sense).

11

Webster’s New Universal Unabridged Dictionary (2003), p. 397.

12

Black’s Law Dictionary (8th ed. 2004), p. 273.

13

Section 163.3164(26), Fla. Stat.

14

Your letter states that “if Section 604.50 is intended to expand the

exemption for nonresidential farm buildings, fences and signs to all

municipal regulations, then Section 823.14, Florida Statutes, would be

superfl uous as to nonresidential farm buildings, fences and signs, since

an exemption from a code means there cannot be duplication of codes.”

However, s. 604.50 and s. 823.14, Fla. Stat., the Florida Right to Farm

Act, can be read in such a manner as to give effect to both. See Ideal

Farms Drainage District et al. v. Certain Lands, 19 So. 2d 234 (Fla. 1944);

Mann v. Goodyear Tire and Rubber Company, 300 So. 2d 666 (Fla. 1974),

for the proposition that when two statutes relate to common things or

have a common or related purpose, they are said to be pari materia, and

BIENNIAL REPORT OF THE ATTORNEY GENERAL

13-02

6

where possible, that construction should be adopted which harmonizes

and reconciles the statutory provisions so as to preserve the force and

effect of each. Section 604.50, Fla. Stat., is the more specifi c statute

and completely exempts nonresidential farm buildings, farm fences, and

farm signs from regulation under the town’s codes. Section 823.14, Fla.

Stat., is intended by the Legislature to “protect reasonable agricultural

activities conducted on farm land from nuisance suits.” The Right to

Farm Act would accommodate other types of land development regulation

undertaken in compliance with the terms of the act, but the more specifi c

subjects of s. 604.50, Fla. Stat., would be excluded from the terms of the

act. Thus, these two statutes, both related to farming, can be read to give

a scope of operation to each.

15

I would note that the Offi ce of General Counsel, Florida Department of

Agriculture and Consumer Services, has submitted a letter on this issue

concluding that “it is the opinion of the Department of Agriculture and

Consumer Services that this legislation applies to all local codes including

land development regulations.” See letter from Carol A. Forthman, Offi ce

of the General Counsel, Florida Department of Agriculture and Consumer

Services, to Mr. Michael D. Cirullo, Jr., dated November 20, 2012.

AGO 13-02 – January 29, 2013

SOUTH FLORIDA REGIONAL TRANSPORTATION

AUTHORITY – MUNICIPALITIES – DUAL OFFICE-HOLDING

CITY COMMISSIONER MAY SERVE AS MEMBER OF

GOVERNING BOARD OF SPECIAL DISTRICT TRANSPORTATION

AUTHORITY

To: Mr. David K. Wolpin, Ms. Laura K. Wendell, City Attorneys for the

City of Aventura

QUESTION:

May a city commissioner simultaneously serve as a member

of the governing board of the South Florida Regional

Transportation Authority without violating the dual office-

holding prohibition in section 5(a), Article II of the Florida

Constitution?

SUMMARY:

A city commissioner may simultaneously serve as a member

of the governing board of the South Florida Regional

Transportation Authority without violating the dual offi ce-

holding prohibition in section (5)(a), Article II of the Florida

Constitution, because the authority is a special district.

BIENNIAL REPORT OF THE ATTORNEY GENERAL

13-02

7

Article II, section 5(a), Florida Constitution, provides in part that

“[n]o person shall hold at the same time more than one offi ce under

the government of the state and the counties and municipalities

therein . . . .” While the constitutional provision does not defi ne the

term “offi ce” or “offi cer,” the Supreme Court of Florida has stated that

an “offi ce” implies a delegation of a portion of the sovereign power to,

and the possession of it by, the person fi lling the offi ce.

1

The constitutional dual offi ce-holding prohibition, however, refers

only to state, county, and municipal offi ces. There is no reference in

the constitutional prohibition to special district offi ces, such that both

the courts and this offi ce have therefore concluded that the dual offi ce-

holding prohibition does not apply to the offi cers of an independent

special district. In Advisory Opinion to the Governor--Dual Offi ce-

Holding,

2

the Supreme Court of Florida reiterated that special district

offi cers are not included within the dual offi ce-holding prohibition,

concluding that a member of a community college district board of

trustees is not included within the dual offi ce-holding prohibition. This

offi ce in Attorney General Opinion 94-83 stated that membership on the

Panama City-Bay County Airport Authority, created as an independent

special district, did not constitute an offi ce for purposes of Article II,

section 5(a), Florida Constitution. The authority was created by law to

perform a limited function and its members were appointed by a diverse

group of governmental agencies that had no oversight or control over

the functions or actions of the authority.

This offi ce has cautioned that care must be taken in determining the

nature and character of a district or authority to determine whether the

governmental entity is an agency of the state, county, or municipality

such that its offi cers may be considered state, county, or municipal

offi cers for purposes of dual offi ce-holding. For example, in Attorney

General Opinion 84-90, this offi ce considered whether a member of

the Volusia County Health Facilities Authority was an offi cer of the

county. While the authority was created and organized under Part III,

Chapter 154, Florida Statutes, as a public body corporate and politic, it

was created by the county by passage of an ordinance or a resolution.

The governing body of the county appointed the authority members,

was empowered to remove the members, and was authorized to abolish

the authority at any time. This offi ce, therefore, concluded that the

authority was an instrumentality of the county and its offi cers were

county offi cers. Thus, the constitutional prohibition against dual offi ce-

holding prohibited a mayor from also serving on the governing body of

the county health facilities authority.

Similarly, in Attorney General Opinion 91-79, this offi ce concluded

that the Fort Walton Beach Area Bridge Authority, created as a

dependent special district within the county, was an instrumentality

of the county for dual offi ce-holding purposes. Under the act creating

the district, the county commission was charged with approving the

BIENNIAL REPORT OF THE ATTORNEY GENERAL

13-02

8

authority’s annual budget and for fi lling vacancies on the authority.

3

There is no question that a city commissioner is an offi cer of the city

for purposes of the dual offi ce-holding prohibition. However, to the

extent the South Florida Regional Transportation Authority (authority)

is a special district, a member of its governing board is not subject to the

constitutional dual offi ce-holding prohibition.

The authority is created as “a body politic and corporate, an agency of

the state” in section 343.53(1), Florida Statutes. Pursuant to its enabling

legislation, the authority has the right to own, operate, maintain, and

manage a transit system in the tri-county area of Broward, Miami-

Dade, and Palm Beach counties.

4

Its governing board is appointed

as follows: each of its member counties selects one of its county

commissioners; the secretary of the Department of Transportation

selects one of the district secretaries (or his or her designee) from the

districts within the authority’s service area “who shall serve ex offi cio as

a voting member[;]” and the Governor appoints three members who are

residents and qualifi ed electors in the service area, but not residents of

the same county.

5

The authority is authorized to “plan, develop, own,

purchase, lease, or otherwise acquire, demolish, construct, improve,

relocate, equip, repair, maintain, operate, and manage a transit system

and transit facilities.” Moreover, the Legislature states its intent that

the authority “shall have overall authority to coordinate, develop, and

operate a regional transportation system within the area served.”

6

While the enabling legislation describes the authority as an “agency

of the state,” the authority is designated as an independent special

district by the Department of Economic Opportunity,

7

operates within

a limited geographical area, and is specifi cally authorized to perform

a limited governmental activity to fulfi ll its purpose. The nature and

purpose of the authority would appear more closely aligned with that

of a special district carrying out its limited powers. Membership on the

authority’s governing board, therefore, is more in the nature of a district

offi ce which is not subject to the constitutional prohibition against dual

offi ce-holding.

Accordingly, it is my opinion that a city commissioner may serve

as a member of the governing board of the South Florida Regional

Transportation Authority without violating the dual offi ce-holding

prohibition in section 5(a), Article II of the Florida Constitution, since

the authority is a special district.

1

State ex rel. Holloway v. Sheats, 83 So. 508, 509 (Fla. 1919); see also

State ex rel. Clyatt v. Hocker, 22 So. 721 (Fla. 1897).

2

630 So. 2d 1055, 1058 (Fla. 1994).

BIENNIAL REPORT OF THE ATTORNEY GENERAL

13-03

9

3

Cf. Op. Att’y Gen. Fla. 90-91 (1990), concluding that the Hillsborough

County Hospital Authority, created by special act with all powers of a body

corporate, whose members are appointed by the Hillsborough County

Commission which possesses the power to fi ll vacancies on the authority,

remove members for misfeasance, malfeasance or willful neglect of duty,

and approve the authority’s budget, was a county agency. And see Op.

Att’y Gen. Fla. 01-28 (2001), in which this offi ce determined that regional

planning council member was a public offi cer subject to the dual offi ce-

holding prohibition, based on Orange County v. Gillespie, 239 So. 2d 132

(Fla. 4th DCA 1970), cert. denied, 239 So. 2d 825 (Fla. 1970) (planning

council member was subject to Florida’s Resign-to-Run Law which at that

time only applied to state, county or municipal offi ces, as councils act

on behalf of the state in implementing state policies regarding growth

management). The AGO notes, however, that regional planning councils

were not (and are still not) listed as special districts by the Department

of Community Affairs (now Department of Economic Opportunity).

Questions regarding the resign-to-run law should be addressed to the

Division of Elections, Florida Department of State.

4

Section 343.54(1)(a), Fla. Stat.

5

Section 343.53(2), Fla. Stat.

6

Section 343.54(1)(b), Fla. Stat.

7

See http://dca.deo.myfl orida.com/fhcd/sdip/Offi cialListdeo/report.cfm.

AGO 13-03 – January 30, 2013

PUBLIC RECORDS – ELECTRONIC RECORDS – COPIES –

E-MAIL

CHARGES FOR PROVIDING COPIES OF PUBLIC RECORDS BY

E-MAIL

To: Ms. Sonja K. Dickens, City of Miami Gardens Attorney

QUESTION:

May the City of Miami Gardens impose a fee when documents

are downloaded and submitted by electronic mail, in lieu of

photocopying, to the requestor?

SUMMARY:

The City of Miami Gardens may charge the “actual costs

of duplication” for electronic mail forwarded to a public

records requestor in lieu of photocopying those records. When

calculating the “actual costs of duplication,” charges may not

BIENNIAL REPORT OF THE ATTORNEY GENERAL

13-03

10

be made for labor costs or associated overhead costs. However,

section 119.07(4)(d), Florida Statutes, provides that if the

nature or volume of public records to be inspected or copied

requires the extensive use of information technology resources

or extensive clerical or supervisory assistance, or both, the City

of Miami Gardens may charge a reasonable service charge based

on the cost actually incurred by the agency for such extensive

use of information technology resources or personnel. The fact

that the request involves the use of information technology

resources is not suffi cient to incur the imposition of the special

service charge.

According to your letter, a public records request was made to the

records custodian for the City of Miami Gardens for data which the city

compiles and maintains in an electronic format. A further request was

made to deliver the records by electronic mail to avoid the payment of

copying costs. The requestor objected to the payment of any fees for

costs associated with transmitting the documents by way of electronic

mail.

Section 119.01(2)(f), Florida Statutes, requires:

Each agency that maintains a public record in an electronic

recordkeeping system shall provide to any person, pursuant to

this chapter, a copy of any public record in that system which

is not exempted by law from public disclosure. An agency

must provide a copy of the record in the medium requested

if the agency maintains the record in that medium, and the

agency may charge a fee in accordance with this chapter. For

the purpose of satisfying a public records request, the fee

to be charged by an agency if it elects to provide a copy of a

public record in a medium not routinely used by the agency,

or if it elects to compile information not routinely developed or

maintained by the agency or that requires a substantial amount

of manipulation or programming, must be in accordance with s.

119.07(4). (e.s.)

The statute clearly provides that if an agency maintains a record in

a particular medium and that medium is requested for the copy, the

agency “must provide a copy of the record in the medium requested[.]”

1

The statute also provides that “the agency may charge a fee in accordance

with this chapter.”

Section 119.07, Florida Statutes, provides for the inspection and

copying of records and for the fees which may be charged for inspecting

and copying. Subsection (4) makes general provision for fees for copying

when not otherwise prescribed by law:

(4) The custodian of public records shall furnish a copy or a

BIENNIAL REPORT OF THE ATTORNEY GENERAL

13-03

11

certifi ed copy of the record upon payment of the fee prescribed

by law. If a fee is not prescribed by law, the following fees are

authorized:

(a)1.Up to 15 cents per one sided copy for duplicated copies of

not more than 14 inches by 81/2 inches;

2. No more than an additional 5 cents for each two sided copy;

and

3. For all other copies, the actual cost of duplication of the

public record.

(b) The charge for copies of county maps or aerial photographs

supplied by county constitutional offi cers may also include a

reasonable charge for the labor and overhead associated with

their duplication.

(c) An agency may charge up to $1 per copy for a certifi ed copy

of a public record.

(d) If the nature or volume of public records requested to be

inspected or copied pursuant to this subsection is such as to

require extensive use of information technology resources or

extensive clerical or supervisory assistance by personnel of the

agency involved, or both, the agency may charge, in addition to

the actual cost of duplication, a special service charge, which

shall be reasonable and shall be based on the cost incurred for

such extensive use of information technology resources or the

labor cost of the personnel providing the service that is actually

incurred by the agency or attributable to the agency for the

clerical and supervisory assistance required, or both.

(e)1. Where provision of another room or place is necessary to

photograph public records, the expense of providing the same

shall be paid by the person desiring to photograph the public

records.

2. The custodian of public records may charge the person

making the photographs for supervision services at a rate of

compensation to be agreed upon by the person desiring to make

the photographs and the custodian of public records. If they

fail to agree as to the appropriate charge, the charge shall be

determined by the custodian of public records. (e.s.)

As no charge has been established by law for providing copies by

electronic mail in lieu of photocopying, section 119.07(4)(a)3., Florida

Statutes, authorizes “the actual cost of duplication of the public

record” to be charged. “Actual cost of duplication” is defi ned in section

BIENNIAL REPORT OF THE ATTORNEY GENERAL

13-03

12

119.011(1), Florida Statutes, to mean “the cost of the material and

supplies used to duplicate the public record, but does not include labor

cost or overhead cost associated with such duplication.” You have not

advised me of and I am not aware of any “actual costs of duplication”

involved in forwarding copies of electronic mail in lieu of photocopying

and the defi nition does not allow for the imposition of labor costs or

associated overhead costs.

Section 119.07(4)(d), Florida Statutes, does provide that if the nature

or volume of public records to be inspected or copied requires the

extensive use of information technology resources or extensive clerical

or supervisory assistance, or both, the agency may charge a reasonable

service charge based on the cost actually incurred by the agency for

such extensive use of information technology resources or personnel.

When the special service charge is warranted, it applies to requests for

both the inspection of and copies made of public records.

2

For purposes

of the Public Records Law, “[i]nformation technology resources” means

“data processing hardware and software and services, communications,

supplies, personnel, facility resources, maintenance, and training.”

3

The fact that the request involves the use of information technology

resources is not suffi cient to incur the imposition of the special service

charge; rather, an extensive use of such resources is required before the

special service charge is authorized.

4

The statute does not identify the Legislature’s intent as to what

may constitute “extensive use” and provides no defi nition of the term.

5

However, in light of the lack of clear direction in the statute as to

the meaning of the term “extensive,” this offi ce has suggested that

agencies implement the service charge authorization in a manner that

refl ects the purpose and intent of the Public Records Act and does not

represent an unreasonable infringement upon the public’s statutory

and constitutional right of access to public records. While you have not

advised me whether the City of Miami Gardens has adopted a public

records procedure which includes provisions for imposing the special

service charge, this offi ce would strongly encourage the adoption of such

a policy for accommodating public records requests.

Your letter suggests that a request for the production of public records

by electronic mail may appear to be time saving and cost effective for

both the requestor and the city. However, you are concerned that an

individual could make several requests a day for the production of

public records by electronic mail and, in responding to each request, the

city could be required to utilize an exorbitant amount of staff time to

respond to such public records requests. While this offi ce acknowledges

your concerns, these are issues which arise regardless of the format

in which public records are maintained or produced. Providing access

to public records is a statutory duty imposed by the Legislature on

all records custodians and must be accomplished in a manner that is

consistent with the purpose and intent of the Public Records Law and

BIENNIAL REPORT OF THE ATTORNEY GENERAL

13-03

13

that does not unreasonably infringe upon the public’s statutory and

constitutional right of access to public records.

Subsequent conversations with your offi ce indicate that the City of

Miami Gardens is currently contracting with a private entity for the

storage and maintenance of certain public records, requests for proposal

(RFP’s) in this instance, and has been requiring that copies of the city’s

RFP’s be obtained from the private company at a price established by

that company. A request has been received by the city for copies of

these public records at the price established in the Public Records Law

for public records. This is the fact situation which has prompted your

question. This offi ce has opined, in Attorney General Opinion 2002-37,

that an agency may not abdicate its duty to produce public records for

inspection and copying by requiring those seeking public records to do

so only through its designee and then paying whatever fee that company

may establish for its services. Rather, the agency is the custodian of

its public records and, upon request, must produce such records for

inspection and copy such records at the statutorily prescribed fee.

6

In sum, it is my opinion that the City of Miami Gardens may charge

the “actual costs of duplication” for electronic mail forwarded to a

public records requestor in lieu of photocopying those records. When

calculating the “actual costs of duplication,” charges may not be

made for labor costs or associated overhead costs. However, section

119.07(4)(d), Florida Statutes, provides that if the nature or volume of

public records to be inspected or copied requires the extensive use of

information technology resources or extensive clerical or supervisory

assistance, or both, the City of Miami Gardens may charge a reasonable

service charge based on the cost actually incurred by the agency for such

extensive use of information technology resources or personnel. The fact

that the request involves the use of information technology resources is

not suffi cient to incur the imposition of the special service charge.

1

And see Op. Att’y Gen. Fla. 91-61 (1991) (custodian of public records

must, if asked for a copy of a computer software disk used by an agency,

provide a copy of the disk in its original format; a typed transcript of the

disk would not satisfy the requirements of the Public Records Law).

2

See Board of County Commissioners of Highlands County v. Colby, 976

So. 2d 31 (Fla. 2d DCA 2008).

3

Section 119.011(9), Fla. Stat.

4

See Op. Att’y Gen. Fla. 99-41 (1999).

5

However, Florida courts have approved a local government’s formula

for calculating its special service charge based on a determination that

it would take more than 15 minutes to locate, review for confi dential

information, copy, and refi le the requested material. See Florida

BIENNIAL REPORT OF THE ATTORNEY GENERAL

13-04

14

Institutional Legal Services, Inc. v. Florida Department of Corrections,

579 So. 2d 267 (Fla. 1st DCA 1991), review denied, 592 So. 2d 680 (Fla.

1991) (court upheld hearing offi cer’s order rejecting inmates’ challenge

to Department of Correction’s rule defi ning “extensive” for purposes of

special service charge to mean it would take more than 15 minutes to

locate, review, copy, and refi le requested material); and Op. Att’y Gen.

Fla. 99-41 (1999).

6

And see Op. Att’y Gen. Fla. 05-34 (2005) (while the property appraiser

may provide public records, excluding exempt or confi dential information,

to a private company, the property appraiser may receive only those fees

that are authorized by statute and may not, in the absence of statutory

authority, enter into an agreement with the private company where

the property appraiser provides such records in exchange for either in-

kind services or a share of the profi ts or proceeds from the sale of the

information by the private company).

AGO 13-04 – March 21, 2013

VIRTUAL CHARTER SCHOOLS – PUBLIC EDUCATION –

SCHOOL DISTRICTS

PAYMENT OF COSTS OF STATE-WIDE ASSESSMENTS OF

VIRTUAL CHARTER SCHOOL STUDENTS INCLUDED WITHIN

ADMINISTRATIVE FEE RETAINED BY SCHOOL DISTRICT

To: Mr. Brady J. Cobb, South Florida Virtual Charter School Board,

Inc., and Florida Virtual Academy at Palm Beach

QUESTION:

Must a virtual charter school pay for access to school district

testing facilities and the technology for taking state-wide

assessment tests for students enrolled in the virtual charter

school which the school district has sponsored?

SUMMARY:

The school district sponsoring a virtual charter school is

required to provide certain administrative services to the school,

including test administration services, which includes payment

of the costs of state-required or district-required student

assessments. The school district may withhold a fee of up to

5 percent of the funding from the Florida Education Finance

Program and the General Appropriations Act to be received by

a virtual charter school to cover the cost of the administrative

services provided to the charter school, including the cost of

virtual charter school students’ access to and use of district

BIENNIAL REPORT OF THE ATTORNEY GENERAL

13-04

15

testing facilities.

Initially, it should be acknowledged that this offi ce has previously

issued a legal opinion to a charter school. In Attorney General Opinion

2004-67, this offi ce determined that charter schools are part of the

state’s program of public education and shall be funded “the same as”

other schools in the public school system. In light of the subject matter

of your request, this offi ce sought, received, and considered the views

of the School District of Palm Beach County on the question presented

here.

Section 1002.33(1), Florida Statutes, authorizes a charter school to

operate as a virtual charter school. The sponsor of a charter school

is required to provide certain administrative and educational services

to a charter school, including “test administration services, including

payment of the costs of state-required or district-required student

assessments[.]”

1

Each student enrolled in a virtual charter school

must “[t]ake state assessment tests within the school district in which

such student resides, which must provide the student with access to the

district’s testing facilities.”

2

(e.s.)

The sponsor of a virtual charter school is authorized to withhold a

fee of up to 5 percent, which “shall be used to cover the cost of services

provided under [section 1002.33(20),] subparagraph 1 . . . or other

technological tools that are required to access electronic and digital

instructional materials.”

3

This plain language requires no further

interpretation in its directive that a school district, as the sponsor of a

virtual charter school, may retain up to 5 percent of the funds payable

to a virtual charter school and that such funds cover the provision of

testing facilities for state-wide assessments. Where the Legislature

has prescribed the manner in which something is to be accomplished,

it in effect operates as a prohibition against its being done in any other

manner.

4

Accordingly, it is my opinion that the administrative services

required to be provided by a school district sponsoring a virtual charter

school include the payment of the costs of state-required or district-

required student assessments, including the cost of virtual charter

school students’ access to and use of district testing facilities, and that

such costs are contained within the fee of up to 5 percent retained by

the school district.

1

Section 1002.33(20)(a)1., Fla. Stat.

2

Section 1002.45(6), Fla. Stat.

3

Section 1002.33(20)(a)8., Fla. Stat.

4

See Alsop v. Pierce, 19 So. 2d 799, 805 (Fla. 1944) (where Legislature

BIENNIAL REPORT OF THE ATTORNEY GENERAL

13-05

16

prescribes the mode, that mode must be observed).

AGO 13-05 – April 1, 2013

MUNICIPALITIES – CHARTERS – ELECTIONS – TERMS OF

OFFICE – QUALIFICATIONS – REFERENDUM

AMENDMENT OF CHARTER TO CHANGE ELECTION DATES

AND TERMS OF OFFICE

To: Mr. Thomas J. Wohl, City Attorney for the City of Arcadia

QUESTIONS:

1. May the Arcadia City Council, pursuant to sections

100.3605 and 166.021(4), Florida Statutes, amend the Arcadia

City Charter by ordinance to move the dates of city elections

from the first Tuesday after the third Monday of September

of each odd year to the first Tuesday after the first Monday of

November of each even year to coincide with federal, state, and

county elections, and to extend the terms of the sitting municipal

officers resulting from said date change?

2. May the Arcadia City Council, pursuant to section

166.021(4), Florida Statutes, amend the Arcadia City Charter

by ordinance to include term limits to the qualifications to be

eligible to hold office on the Arcadia City Council?

SUMMARY:

1. The Arcadia City Council, acting pursuant to sections

100.3605 and 166.021(4), Florida Statutes, may amend the

Arcadia City Charter by ordinance and without referendum for

the purpose of changing municipal election dates and qualifying

periods for candidates and for the adjustment of terms of offi ce

necessitated by such date changes.

2. The Arcadia City Council, may not, pursuant to section

166.021(4), Florida Statutes, amend the Arcadia City Charter

by ordinance to include term limits to the qualifi cations for

eligibility for holding offi ce on the city council as such a change

constitutes a change in the municipal charter which would affect

“the terms of elected offi cers[,]” and, as provided in the statute,

must be accomplished by approval by referendum pursuant to

section 166.031, Florida Statutes.

QUESTION 1.

BIENNIAL REPORT OF THE ATTORNEY GENERAL

13-05

17

According to your letter, the Charter of the City of Arcadia, Florida,

was adopted by Chapter 5080, Laws of Florida 1901, and has not been

readopted. The Arcadia City Council is considering amending the city

charter by ordinance to move the dates of city elections from September

of each odd year to November of each even year to coincide with federal,

state, and county elections to avoid the expense of a special election and

to take advantage of increased voter turnout for those elections. You

are aware that this offi ce has issued a number of opinions on sections

100.3605 and 166.021(4), Florida Statutes, advising that such a change

is authorized, but are particularly concerned that the proposed change

in the Arcadia City Charter would have the effect of extending the terms

of sitting municipal offi cers by more than one year.

Section 166.031, Florida Statutes, sets forth the procedures to be

followed in amending municipal charters and requires that a proposed

amendment shall be subject to referendum approval by the voters. For

charters adopted prior to July 1, 1973, and not subsequently readopted,

section 166.021, Florida Statutes, repealed or changed into ordinances

many of the limitations contained in such charters.

1

Subsection (4) of

the statute, however, provided that nothing in Chapter 166, Florida

Statutes, the Municipal Home Rule Powers Act, was to be construed

as permitting any changes in a special law or municipal charter that

affected certain subject matters set forth therein, including “the terms

of elected offi cers,” without referendum approval as provided in section

166.031, Florida Statutes.

Thus, for charters adopted after July 1, 1973, and for charter

provisions relating to the terms of elected offi cers adopted prior to

that date and not subsequently readopted, any amendment of those

provisions would be subject to the procedures in section 166.031,

Florida Statutes. Accordingly, this offi ce concluded in Attorney General

Opinion 94-31 that the city commission of the City of Tallahassee could

not amend its charter by ordinance to provide for a change in the date

on which municipal elections would occur and extend the terms of the

sitting offi cers affected by the change.

However, in response to this opinion, the Florida Legislature, during

the 1995 legislative session, introduced legislation to amend section

166.021, Florida Statutes. Section 1 of Chapter 95-178, Laws of Florida,

amended section 166.021(4) to read in pertinent part:

[N]othing in this act shall be construed to permit any changes

in a special law or municipal charter which affect . . . the terms

of elected offi cers and the manner of their election except for the

selection of election dates and qualifying periods for candidates

and for changes in terms of offi ce necessitated by such changes

in election dates, . . . without approval by referendum of the

electors as provided in s. 166.031. . . . (e.s.)

BIENNIAL REPORT OF THE ATTORNEY GENERAL

13-05

18

In addition, Chapter 95-178, supra, created section 100.3605, Florida

Statutes, relating to the conduct of municipal elections.

2

Subsection (2)

of section 100.3605 provides:

The governing body of a municipality may, by ordinance,

change the dates for qualifying and for the election of members

of the governing body of the municipality and provide for the

orderly transition of offi ce resulting from such date changes.

3

Accordingly, this offi ce in Attorney General Opinion 2000-61 concluded

that a city may amend its city charter by ordinance to move the dates of

city elections from April to November to coincide with federal, state, and

county elections, and to extend the terms of the sitting commissioners

to November.

4

Thus, as discussed above, prior to the 1995 amendment to section

166.021(4), Florida Statutes, and the creation of section 100.3065,

Florida Statutes, a change in the charter prescribing the qualifying

and election dates for municipal offi cers, and the resulting change in

the term of offi ce for sitting offi cers, required amendment according

to the provisions of section 166.031, Florida Statutes, regardless of

when such provisions were adopted. The legislative history of the 1995

legislation amending section 166.021(4) and creating section 100.3065,

however, indicates an intent that municipalities are authorized to

amend their charters, whether those charters were adopted before or

after July 1, 1973, to change the election dates and qualifying periods

for candidates, including any changes in terms of offi ce necessitated by

such amendment, without a referendum. Nothing in these statutes or

in the legislative history related to their enactment places a restriction

on this authority based on the increase in term required for the “orderly

transition of offi ce” affected by the ordinance.

Accordingly, I am of the opinion that pursuant to sections 166.021(4)

and 100.3605, Florida Statutes, the Arcadia City Council may amend

its city charter by ordinance to move the dates of city elections from the

fi rst Tuesday after the third Monday of September of each odd year to

the fi rst Tuesday after the fi rst Monday of November of each even year

to coincide with federal, state, and county elections, and to extend the

terms of the sitting municipal offi cers resulting from this date change

without voter approval by referendum. The date upon which the city